Tag: savings accounts

-

Banking Basics Unveiled: Navigating Finances with Humor and Common Sense

Banking basics are an essential part of adulting, yet many people feel overwhelmed by the complexities of the financial world. Fear not, for we are here to guide you through some fundamental banking concepts in a satirical and light-hearted manner. Let’s start with the most basic aspect: opening a bank account. It’s like choosing a…

-

Mastering Banking Basics: Your Key to Financial Empowerment

Banking is a fundamental aspect of managing personal finances and understanding its basics can greatly empower individuals to make informed financial decisions. In today’s world, where everything is becoming increasingly digital, having a good grasp of banking principles is more important than ever before. Whether you’re a student starting your first job or an adult…

-

Decoding the Banking Maze: Understanding Different Types of Bank Accounts

Understanding Different Types of Bank Accounts Introduction: Bank accounts are essential financial tools that help individuals manage their money, make transactions, and save for the future. However, with so many different types of bank accounts available, it can be confusing to determine which one is right for your specific needs. In this article, we will…

-

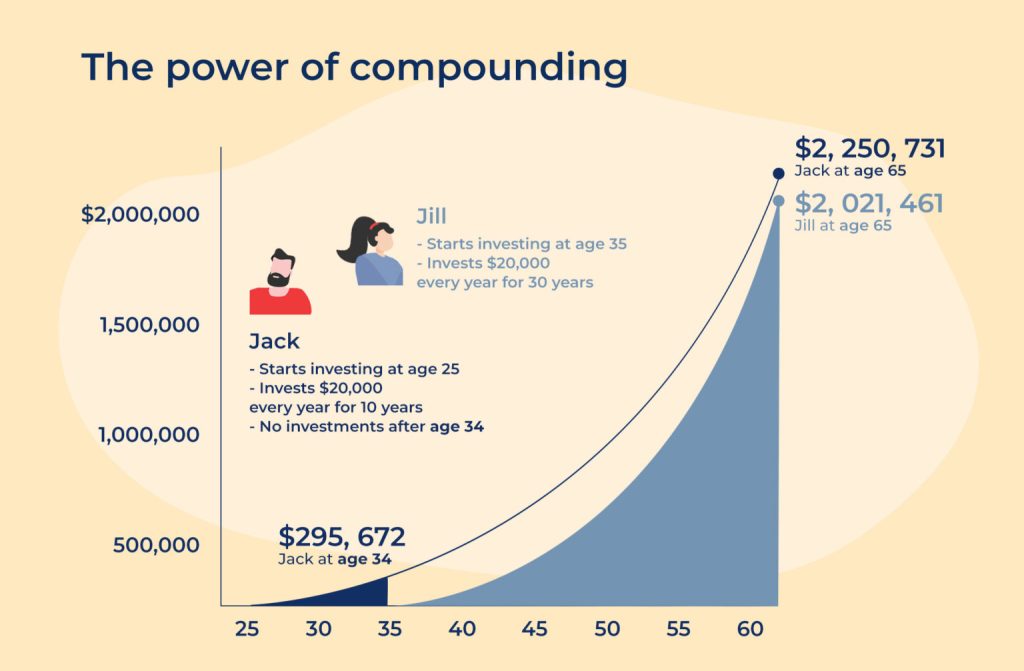

Unleashing the Power of Compound Interest: A Guide to Understanding Interest Rates

Understanding Interest Rates and Compound Interest Introduction Interest rates and compound interest are important concepts that play a significant role in our financial lives. Whether you’re taking out a loan, investing in stocks or bonds, or saving money in a bank account, understanding how interest rates work is crucial. In this article, we will delve…

-

Banking Basics: Empowering Financial Literacy for a Brighter Future

Banking Basics: A Case Study in Financial Literacy Introduction: In today’s world, understanding the basics of banking is crucial for financial well-being. Whether you’re a student entering adulthood or an adult looking to enhance your knowledge, having a solid foundation in banking can empower you to make informed financial decisions. In this case study, we…

-

Unlocking Financial Success: Mastering the Power of Interest Rates

Understanding interest rates is essential in today’s financial landscape. Whether you are applying for a loan, investing in stocks, or even saving money in a bank account, interest rates play a crucial role in determining your financial outcomes. Here are 15 key points to help you comprehend and navigate the world of interest rates: 1.…

-

Unlocking the Power of Compound Interest: A Comprehensive Guide to Teaching Financial Literacy

Teaching About Compound Interest: A Comprehensive Guide Introduction: In today’s complex financial landscape, it is crucial for students to develop a solid understanding of concepts like compound interest. This knowledge can empower them to make informed decisions about saving, investing, and managing their finances effectively. However, traditional education systems often overlook this important topic. That’s…

-

Retirement Planning 101: Answers to Your Most Pressing Questions!

Retirement planning is an essential aspect of personal finance that requires careful consideration and preparation. It involves setting long-term financial goals, creating a realistic budget, investing wisely, and managing risks to ensure a comfortable retirement. In this Q&A style post, we will explore some common questions about retirement planning. Q: When should I start planning…

-

“Mastering Financial Planning: The Key to Long-Term Stability and Effective Money Management”

Financial planning is an essential skill that everyone must learn to manage their finances effectively. It is a process of setting financial goals, creating strategies to achieve them, and continuously monitoring the progress towards those goals. With proper financial planning, one can make informed decisions about their money and ensure long-term stability. Financial planning begins…