Tag: interest rates

-

Credit Unions: The Financial Alternative for Students and Educators

Credit Unions: A Financial Alternative for Students and Educators When it comes to financial institutions, credit unions are often overlooked in favor of traditional banks. However, credit unions offer unique benefits that make them a great option for students and educators. Firstly, credit unions are member-owned cooperatives. This means that the members have a say…

-

Maximizing Credit Card Rewards: Tips and Tricks for Earning the Most Points, Miles, and Cashback

Q: What are credit card rewards programs? A: Credit card rewards programs offer incentives to customers who use their credit cards to make purchases. These incentives can come in the form of cashback, points or miles that can be redeemed for merchandise, travel, and other rewards. Q: How do these programs work? A: When you…

-

“Mastering Loans and Debt: A Student’s Ultimate Guide to Financial Success”

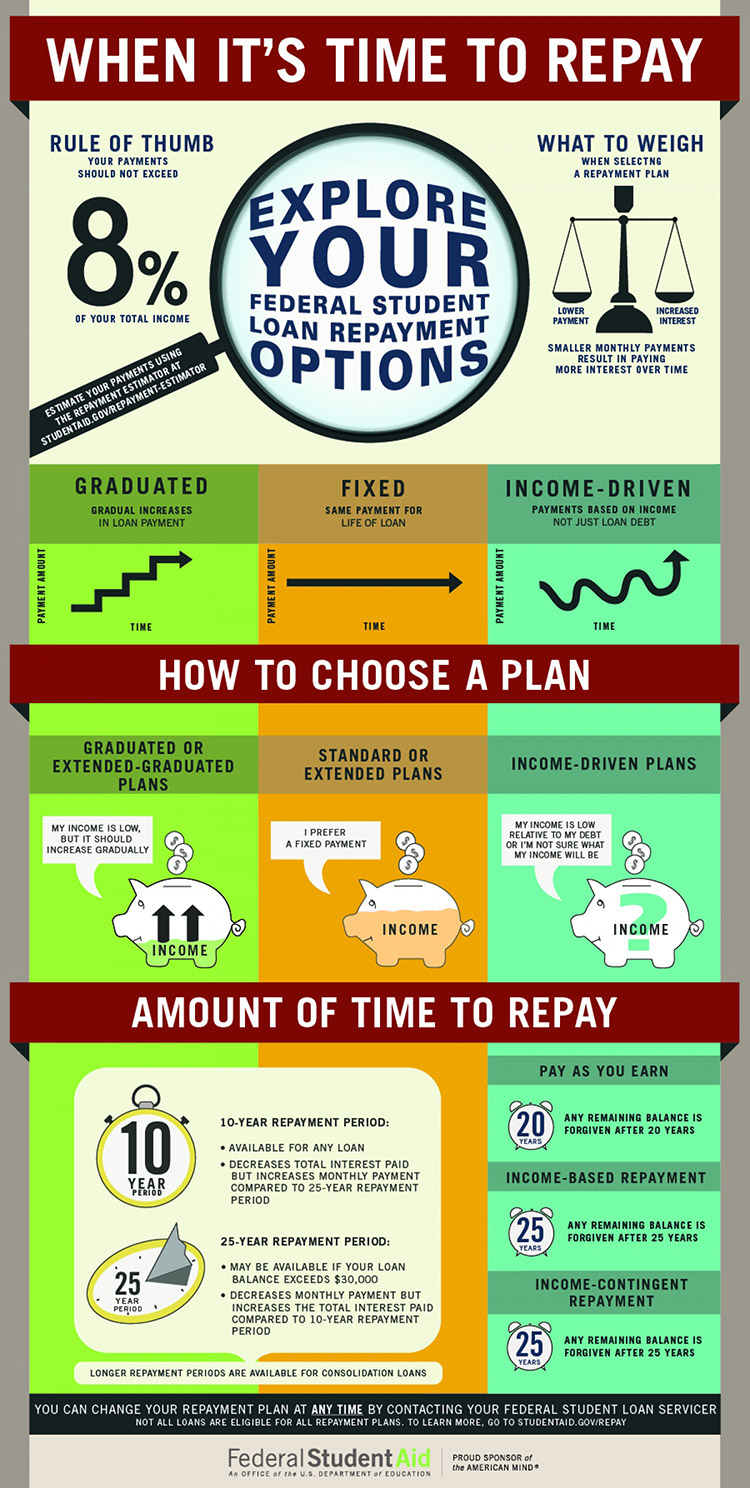

Loans and Debt Management: A Guide for Students As a student, managing your finances can be challenging. You have to balance your tuition fees, textbooks, rent, food expenses and other miscellaneous costs. Sometimes you may fall short of funds and require financial assistance in the form of loans. However, taking out loans can result in…

-

Debt Management: Unlocking the Path to Financial Freedom

Debt Management: A Path to Financial Freedom Many people are burdened with debt, and it can be overwhelming. However, by managing debt effectively, you can take control of your finances and work towards financial freedom. The first step in effective debt management is to assess your current situation. Make a list of all debts including…

-

“Mastering Debt Management: Take Control of Your Finances Today!”

Q: What is debt management? A: Debt management refers to the process of managing and paying off debts in a responsible and efficient manner. This involves creating a plan to pay down your debts while minimizing interest charges and fees, negotiating with creditors for better terms or repayment schedules, and making changes to your spending…

-

Cracking the Credit Score Code: Insights from Financial Experts

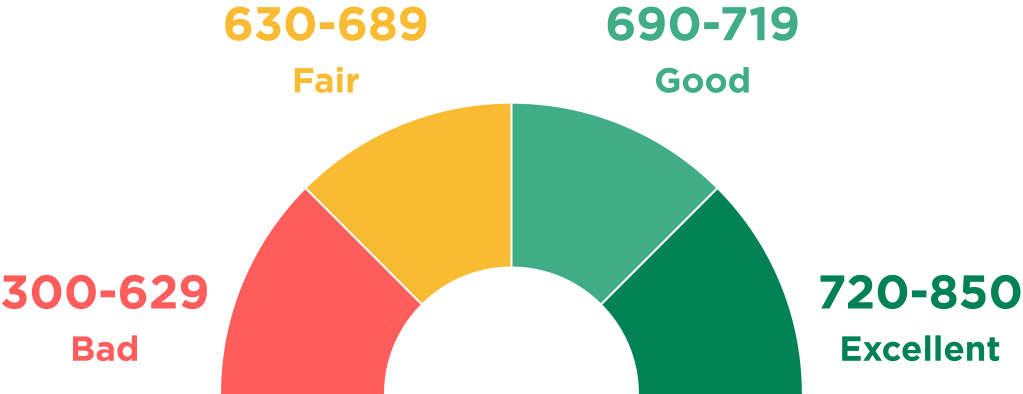

Panel Discussion: Understanding Credit Scores Credit scores are an essential part of our financial lives. Whether you’re looking to buy a house, rent an apartment, or get a loan, your credit score is used by lenders and landlords to evaluate your creditworthiness. In this panel discussion, we’ll explore the ins and outs of credit scores…

-

Master Your Finances: The Ultimate Guide to Debt Management

Debt Management: A Comprehensive Guide In today’s economy, managing debt is becoming increasingly challenging for many individuals and families. With the rising cost of living and stagnating wages, it is easy to fall into debt traps that can quickly spiral out of control. Fortunately, there are several strategies that you can use to help manage…