Tag: tax credits

-

Maximizing Wealth Through Strategic Tax Planning & Alternative Education

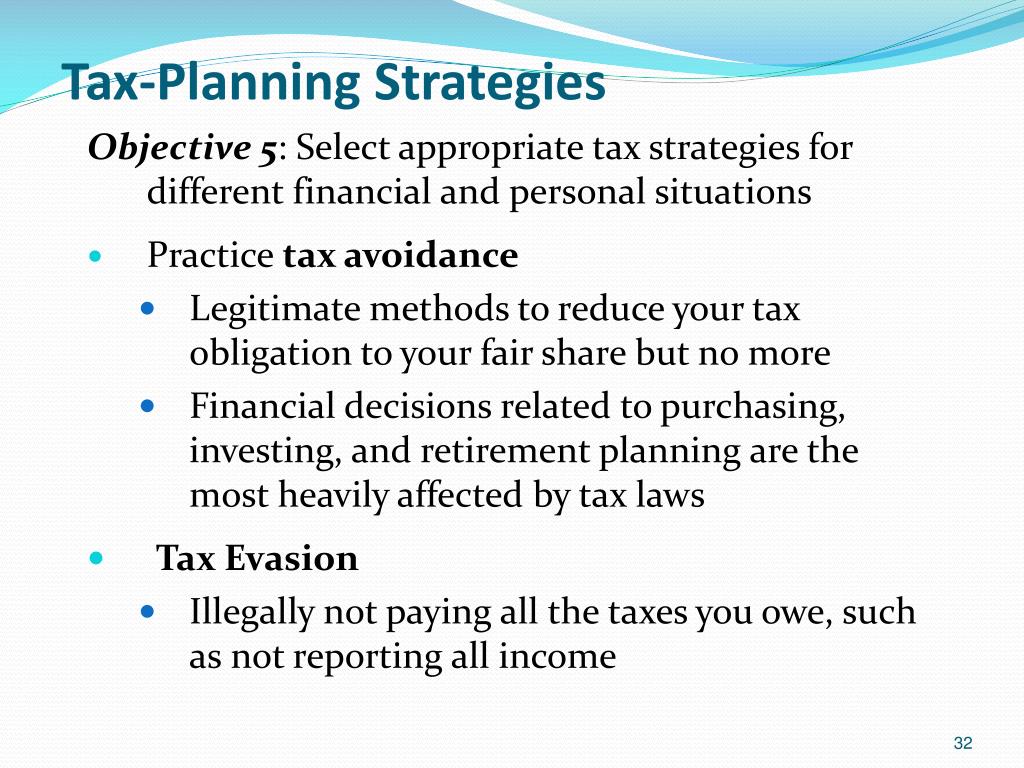

Tax planning is a crucial aspect of financial management that can have a significant impact on an individual’s or organization’s bottom line. By strategically managing your taxes, you can minimize the amount of tax you owe while maximizing your potential for savings and investments. In this guide, we will delve into the importance of tax…

-

“Mastering Taxes: 10 Key Points for Financial Empowerment”

Understanding taxes is an essential life skill that everyone should have a basic knowledge of. Whether you are a student just entering the workforce or an adult managing your finances, knowing how taxes work can help you make informed financial decisions and avoid potential pitfalls. Here are ten key points to help you better understand…

-

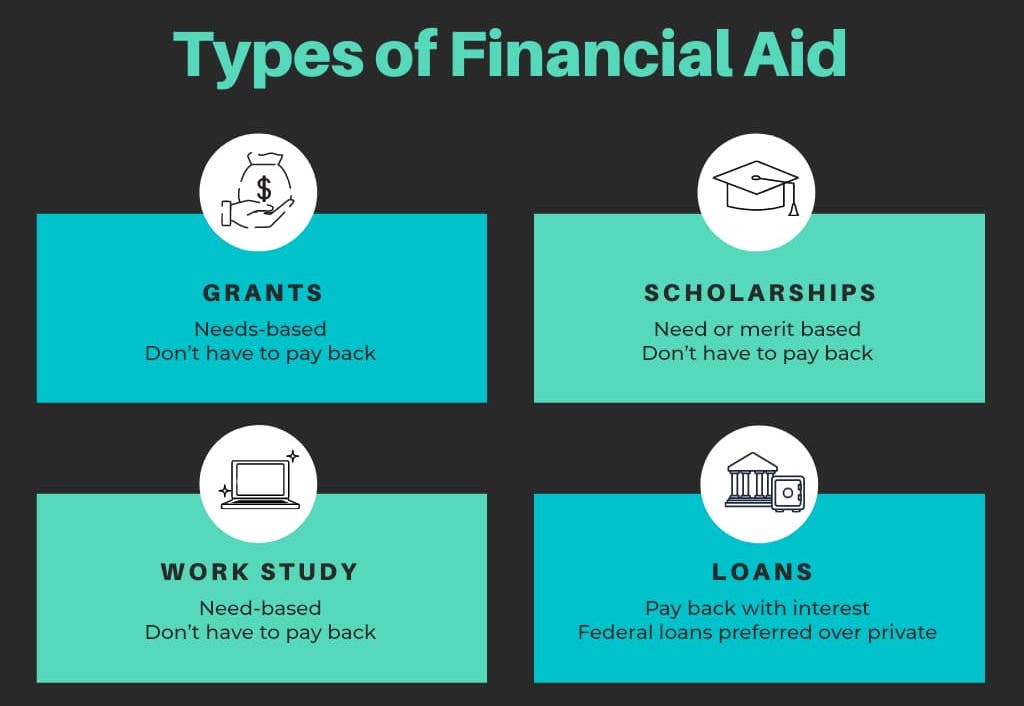

Unlocking the Financial Puzzle: Funding Your Alternative Education Journey

Financial aid is a crucial component for many individuals seeking alternative schooling and education. Whether pursuing an online degree, attending a vocational school, or enrolling in a specialized program, the cost of education can be a significant barrier for some students. Fortunately, there are various financial aid options available to help make alternative education more…

-

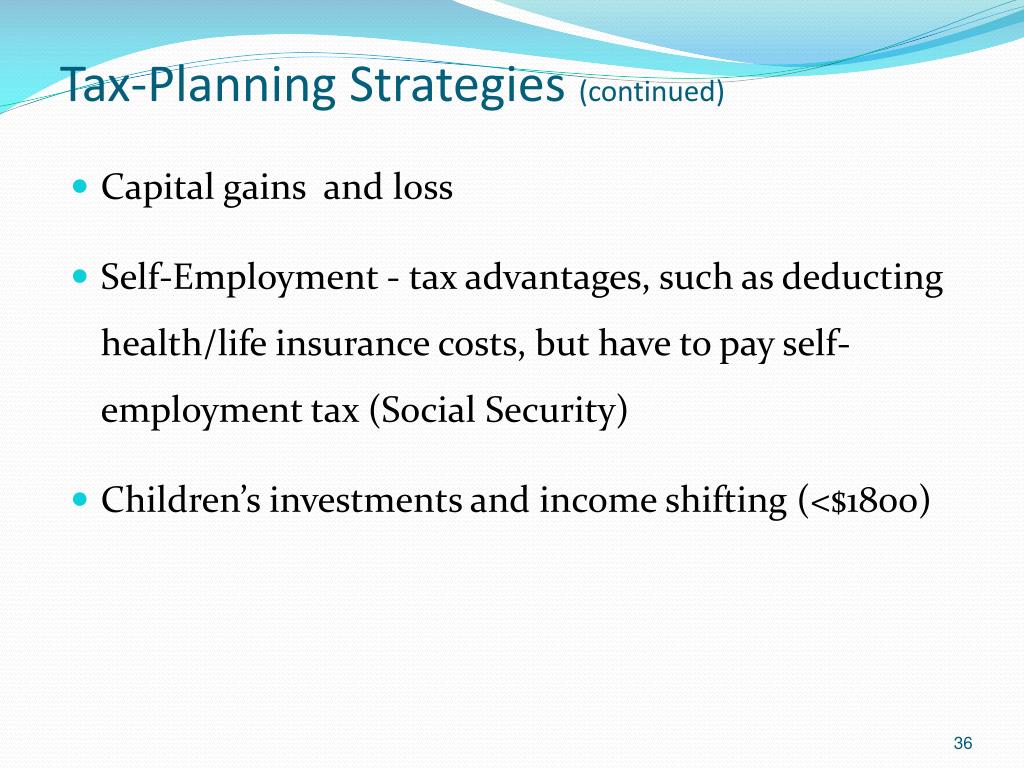

Maximizing Your Money: The Importance of Strategic Tax Planning

Tax planning is a crucial aspect of financial management that individuals and businesses need to consider in order to optimize their tax liabilities. Whether you are self-employed, a small business owner, or an employee, understanding the basics of tax planning can help you make informed decisions that can potentially save you money and reduce your…

-

Tax Breaks and Savings: Navigating Taxes for Alternative Schooling and Education

Tax Considerations for Alternative Schooling and Education Alternative schooling and education have become increasingly popular choices for parents who want to provide their children with a unique learning experience. Whether it’s homeschooling, unschooling, or enrolling in alternative schools, such as Montessori or Waldorf, there are several tax considerations that parents should be aware of. 1.…

-

“Maximize Your Savings with Strategic Tax Planning”

Tax Planning: A Guide to Maximizing Your Savings Introduction: Tax planning is a crucial aspect of managing your finances effectively. By understanding the tax laws and regulations, you can strategically organize your income, expenses, and investments to minimize the amount of tax you owe. This guide aims to provide an overview of tax planning strategies…

-

Unlocking the Benefits of Bilingual Education with Tax Credits

Bilingual Education Tax Credits: An Overview Bilingual education is becoming increasingly popular in the United States as more and more parents are realizing the benefits of raising bilingual children. However, private schools that offer bilingual education can be quite expensive, making them inaccessible to many families. Fortunately, some states have introduced tax credits for bilingual…

-

Taxation: The Necessary Evil That Keeps Us Going

Taxation: The Necessary Evil That Keeps Us Going Ah, Tax season! That time of the year when we get to calculate our earnings, expenses and try to balance them out with the government’s demands. It’s a joyous occasion that puts smiles on everyone’s faces, right? Of course not! But let’s face it – taxation is…