Tag: savings

-

“Mastering Expense Tracking: The Key to Financial Success for Alternative School Students”

Expense tracking is an essential skill that can benefit individuals of all ages, including students in alternative schooling and education. By keeping track of your expenses, you can gain a better understanding of where your money goes and make informed decisions about saving, budgeting, and spending. In this article, we will explore the importance of…

-

“Protecting Your Finances: Strategies to Beat Inflation and Stretch Your Dollar”

Have you ever wondered why the cost of living seems to keep rising every year? Or why your paycheck never seems to stretch as far as it used to? The answer lies in a concept called inflation. Inflation refers to the general increase in prices over time, resulting in a decrease in the purchasing power…

-

“Secure Your Future: Building an Emergency Fund for Financial Peace of Mind”

Building an Emergency Fund Interviewer: Thank you for joining us today. We have a very important topic to discuss – building an emergency fund. Can you start by explaining what exactly is an emergency fund and why it is important? Expert: Absolutely! An emergency fund refers to a designated amount of money set aside specifically…

-

Building an Emergency Fund: The Key to Financial Preparedness

Building an Emergency Fund: A Key Aspect of Financial Preparedness Introduction In today’s uncertain times, it is more important than ever to have a safety net in place for unexpected expenses and emergencies. One way to achieve financial stability is by building an emergency fund. An emergency fund acts as a cushion to protect you…

-

“Unlocking the Power of Interest Rates: The Key to Growing Savings and Tackling Debt”

Understanding Interest Rates and Compounding Effects on Savings or Debt Interest rates play a significant role in our financial lives, whether we are saving money or carrying debt. They have the power to either work for us by growing our savings or against us by increasing our debt burden. Therefore, it is crucial to comprehend…

-

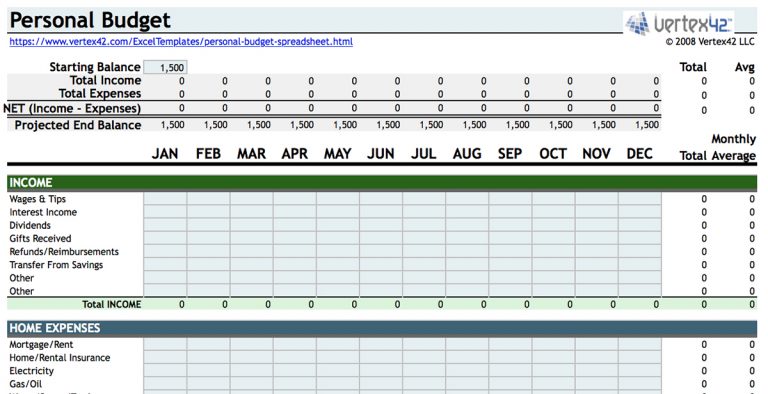

Master Your Finances: The Ultimate Guide to Budgeting Success

Budgeting 101: A Comprehensive Guide to Mastering Your Finances Introduction: In today’s fast-paced world, financial stability is crucial for a stress-free life. However, many people struggle with managing their money effectively. The good news is that budgeting can help you take control of your finances and achieve your financial goals. Whether you’re a student or…

-

“Building Financial Resilience: 10 Essential Steps to Create an Emergency Fund”

Building an Emergency Fund: 10 Essential Steps 1. Assess Your Finances Before you start building an emergency fund, it’s crucial to evaluate your current financial situation. Take a close look at your income, expenses, debts, and savings. This will give you a clear picture of where you stand financially. 2. Set a Realistic Goal Determine…

-

“Secure Your Future: The Ultimate DIY Guide to Building an Emergency Fund”

Building an Emergency Fund: A DIY Guide to Financial Security Introduction: In today’s unpredictable world, having a solid financial safety net is crucial. An emergency fund acts as a buffer during unexpected situations like job loss, medical emergencies, or unforeseen expenses. Building an emergency fund provides peace of mind and helps you navigate through tough…

-

“Secure Your Future: Building an Emergency Fund for Alternative Schooling and Education”

Building an Emergency Fund: A Crucial Step in Alternative Schooling and Education In the world of alternative schooling and education, we often focus on unconventional approaches to learning, personal growth, and self-sufficiency. However, one important aspect that is often overlooked is financial stability. While it may not be the most exciting topic to discuss, building…

-

“Mastering Financial Goal Setting: Techniques to Achieve Your Dreams”

Financial Goal Setting Techniques Achieving financial goals is one of the most important aspects of personal and professional growth. Financial goals can help you achieve your dreams, pay off debts, save for retirement, buy a house or car, and much more. However, setting financial goals can be daunting if you don’t know how to go…