Tag: responsible borrowing

-

Mastering Debt: Essential Financial Skills for a Secure Future

Debt management is a crucial life skill that many individuals do not learn in traditional schooling settings. Understanding how to effectively manage debt can lead to financial stability and security in the long run. In alternative schooling and education programs, teaching students about debt management can provide them with essential knowledge for their future financial…

-

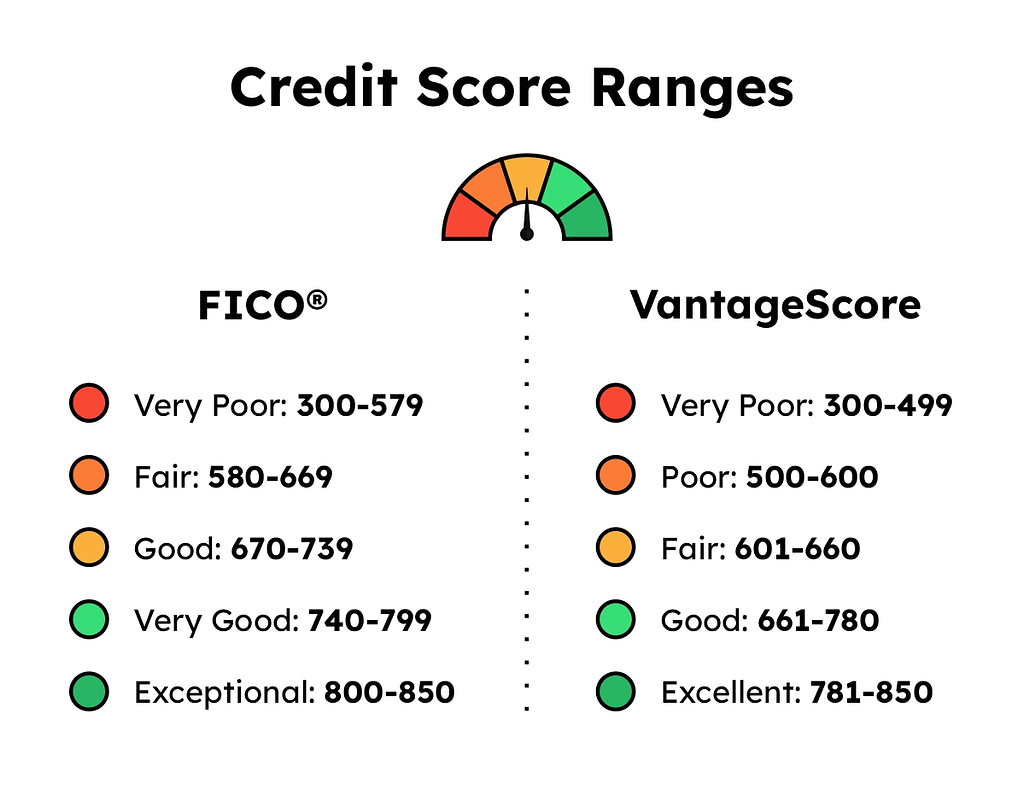

Unlocking the Power of Credit Scores: Why They Matter and How to Improve Yours

Credit scores are crucial financial tools that can greatly impact various aspects of our lives. While they may not be traditionally taught in schools, understanding credit scores and how they work is essential for navigating the modern financial landscape. Credit scores are numerical representations of an individual’s creditworthiness, based on their credit history and behavior.…

-

Empowering Students Through Debt Management Education

Debt management is a crucial skill that everyone should learn, regardless of their background or educational path. While traditional schooling often overlooks this important aspect of personal finance, alternative education settings have the unique opportunity to integrate debt management into their curriculum and empower students with the knowledge and tools they need to navigate the…

-

Building Credit: The Key to Financial Health and Stability

Building credit history is an essential aspect of financial health and stability. While traditional schooling may not always teach students about the importance of credit, it is crucial for individuals to understand how to build and maintain a positive credit history. One way to start building credit is by opening a secured credit card. Secured…

-

Top 10 Must-Know Facts About Credit Scores

Credit scores are a crucial aspect of personal finance that can greatly impact an individual’s financial well-being. Understanding how credit scores work and knowing how to manage them effectively is essential for anyone looking to build a strong financial foundation. In this article, we will explore the top 10 things you need to know about…

-

Empowering Youth through Credit Score Education in Alternative Schools

Credit scores are an essential part of financial well-being in today’s society. They provide a snapshot of an individual’s creditworthiness and can impact their ability to secure loans, apartments, jobs, and more. Despite their importance, credit scores are often not adequately covered in traditional education settings. Alternative schooling and education programs have the opportunity to…

-

“Mastering Credit Cards and Debt: Navigating Alternative Schooling with Financial Savvy”

Credit Cards and Debt Management: A Guide for Alternative Schooling and Education 1. Understand the Basics Before delving into credit card usage, it’s crucial to comprehend the fundamentals. Credit cards are a form of borrowing money from financial institutions that allow you to make purchases on credit. However, it’s important to remember that this borrowed…

-

Teaching Kids About Credit and Debt: Building Financial Foundations for Life

Teaching Kids About Credit and Debt: A Crucial Life Skill In today’s society, financial literacy is more important than ever. As parents and educators, it is our responsibility to prepare children for the real world by equipping them with the necessary skills to navigate their personal finances successfully. One crucial aspect of financial literacy that…

-

Mastering Credit Management: The Key to Financial Success

In today’s society, managing credit has become an essential skill for individuals of all ages. With easy access to credit cards and loans, it is crucial to understand the importance of responsible borrowing and effective credit management. To shed light on this topic, we reached out to financial expert John Smith, who has spent decades…