Tag: record keeping

-

The Importance of Proper Accounting Practices in Alternative Education

As an educational institution, keeping track of finances and maintaining accurate accounting records is crucial for effective management and decision-making. In the realm of alternative schooling and education, where resources may be limited or come from diverse sources, proper accounting practices are even more essential to ensure transparency, accountability, and sustainability. One key aspect of…

-

Maximizing Your Money: The Importance of Strategic Tax Planning

Tax planning is a crucial aspect of financial management that individuals and businesses need to consider in order to optimize their tax liabilities. Whether you are self-employed, a small business owner, or an employee, understanding the basics of tax planning can help you make informed decisions that can potentially save you money and reduce your…

-

Empowering Consumers: The Key to a Safer Marketplace

Consumer Awareness and Protection: Empowering Individuals in the Marketplace Introduction: In today’s fast-paced world, consumers are faced with an overwhelming number of choices when it comes to purchasing goods and services. With advancements in technology and the rise of online shopping, the marketplace has become more accessible than ever before. However, along with this convenience…

-

Tax Breaks and Savings: Navigating Taxes for Alternative Schooling and Education

Tax Considerations for Alternative Schooling and Education Alternative schooling and education have become increasingly popular choices for parents who want to provide their children with a unique learning experience. Whether it’s homeschooling, unschooling, or enrolling in alternative schools, such as Montessori or Waldorf, there are several tax considerations that parents should be aware of. 1.…

-

Maximize Your Tax Benefits with Comprehensive Tax Planning for Alternative Schooling and Education

Tax Planning: A Comprehensive Guide for Alternative Schooling and Education Introduction Tax planning is a crucial aspect of managing personal finances, especially for individuals involved in alternative schooling and education. Whether you are an independent homeschooler, part of a cooperative learning group, or running an alternative education institution, understanding tax laws and implementing effective strategies…

-

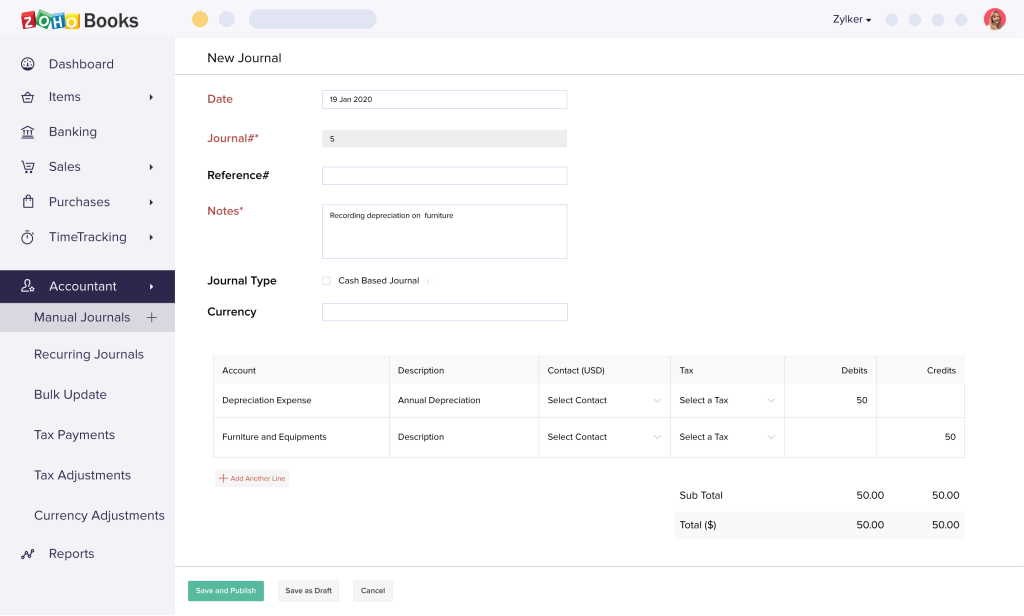

Interview with Bookkeeping Expert Reveals Common Mistakes and Importance of Accurate Records for Small Businesses

Interview with a Bookkeeping Expert Bookkeeping is an essential part of running any business. It involves the recording and organizing of financial transactions to ensure that a company’s finances are accurate and up-to-date. To learn more about bookkeeping, we interviewed Jane Smith, a bookkeeping expert who has been in the industry for over 10 years.…

-

Navigating Homeschooling Laws: What You Need to Know

Homeschooling Laws and Regulations: What You Need to Know Homeschooling has become an increasingly popular alternative to traditional schooling in recent years. According to the National Center for Education Statistics, there were approximately 1.7 million homeschooled students in the United States in 2016. With this increase in popularity comes a greater need for understanding homeschooling…

-

“Maximizing Your Money: Effective Tax Planning Strategies for a Stronger Financial Future”

As the saying goes, there are only two things that are certain in life: death and taxes. While we cannot control our ultimate fate, we can take steps to minimize the impact of taxes on our lives. Tax planning is a crucial part of personal finance that helps us manage our tax liabilities while maximizing…