Tag: portfolio diversification

-

Unlocking the Potential: Real Estate Investing for Passive Income and Long-Term Wealth

Real estate investing can be a lucrative and fulfilling endeavor for those looking to diversify their income streams or build long-term wealth. With the right knowledge and strategy, real estate can offer significant returns on investment. One of the key benefits of real estate investing is its potential for passive income. Rental properties can provide…

-

Investing Basics: Unlocking the Path to Wealth

Investing Basics: A Guide to Building Wealth Introduction: In today’s fast-paced world, it is crucial to understand the basics of investing in order to secure your financial future. Investing is not just for the wealthy; it is a tool that can be utilized by anyone willing to take the time to learn and make informed…

-

Demystifying the Stock Market: Grasp the Basics for Financial Growth

When it comes to understanding the stock market, it can seem like a complex and intimidating world. However, with the right knowledge and guidance, anyone can grasp the basics of how it works. So let’s dive into some key concepts. Firstly, what is a stock? Stocks represent shares of ownership in a company. When you…

-

The Risks and Rewards of Market Timing: 10 Key Considerations

Market timing is a strategy used by investors to try and predict the direction of the stock market. It involves buying or selling stocks based on anticipated future market movements, with the aim of maximizing profits. However, this approach can be risky and often requires a significant amount of knowledge and experience to execute successfully.…

-

Unveiling the Beta Coefficient: Unlocking Insights into Alternative Education’s Risks and Rewards

The Beta coefficient is a statistical measure widely used in finance and investment analysis. It helps investors understand the risk associated with a particular stock or portfolio by comparing its price movements to those of the broader market. In the realm of alternative schooling and education, understanding beta can provide valuable insights into the potential…

-

Investment Styles: Which Approach Fits Your Financial Goals?

Investment styles refer to the various approaches that investors use when making investment decisions. The different investment styles are often categorized based on the level of risk and reward they offer. One popular investment style is value investing, which involves identifying stocks that are undervalued by the market and have a potential for growth. This…

-

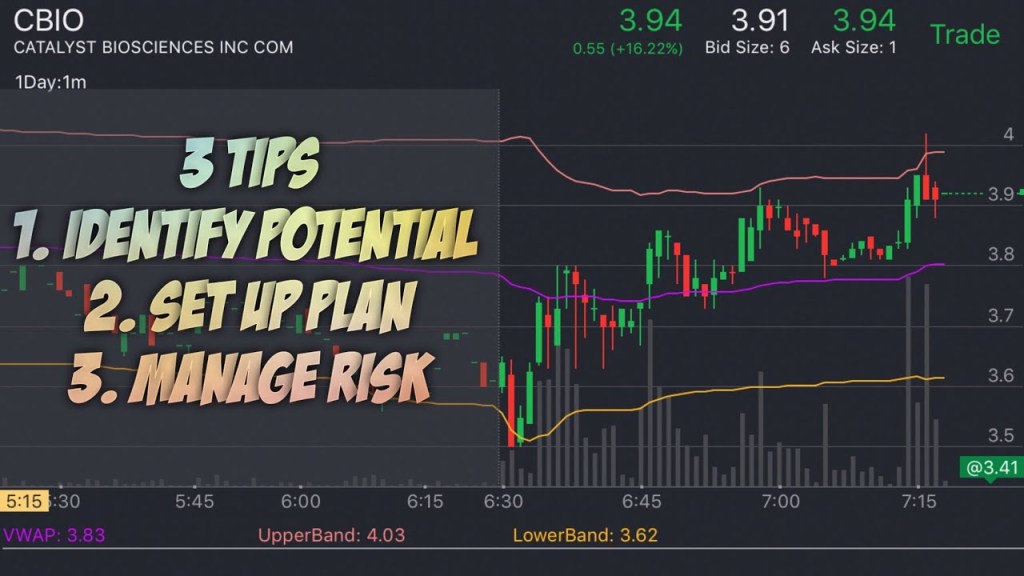

10 Essential Tips for New Stock Traders to Get Started and Succeed

Stock trading is an exciting and potentially lucrative way to invest your money. However, it can also be intimidating for those who are new to the world of investing. In this post, we will cover ten essential tips to help you get started with stock trading. 1. Set Goals: Before you start trading, it’s important…

-

“Unlocking the Secrets of Cryptocurrency Investing: A Beginner’s Guide”

Cryptocurrency Investing: A Beginner’s Guide Cryptocurrency is a digital or virtual currency that uses cryptography for security. It operates independently of a central bank and can be transferred directly between individuals without the need for intermediaries like banks. Investing in cryptocurrency can seem intimidating, but with proper research and caution, it can be a profitable…