Tag: personal finance

-

Empowering Alternative School Students Through Financial Literacy

Financial literacy is an essential skill that empowers individuals to make informed decisions about their money, investments, and financial future. It encompasses the knowledge and understanding of various financial topics such as budgeting, saving, investing, debt management, retirement planning, and more. In today’s complex world of finance and economics, having a strong foundation in financial…

-

Achieving Financial Success: The Power of Setting Clear Goals

Financial goals are crucial in achieving financial success and stability. Whether you are a student, a parent, or an educator at an alternative school, setting clear and achievable financial goals can help you better manage your money and work towards a secure financial future. In this guide, we will explore the importance of setting financial…

-

“Mastering Taxes: 10 Key Points for Financial Empowerment”

Understanding taxes is an essential life skill that everyone should have a basic knowledge of. Whether you are a student just entering the workforce or an adult managing your finances, knowing how taxes work can help you make informed financial decisions and avoid potential pitfalls. Here are ten key points to help you better understand…

-

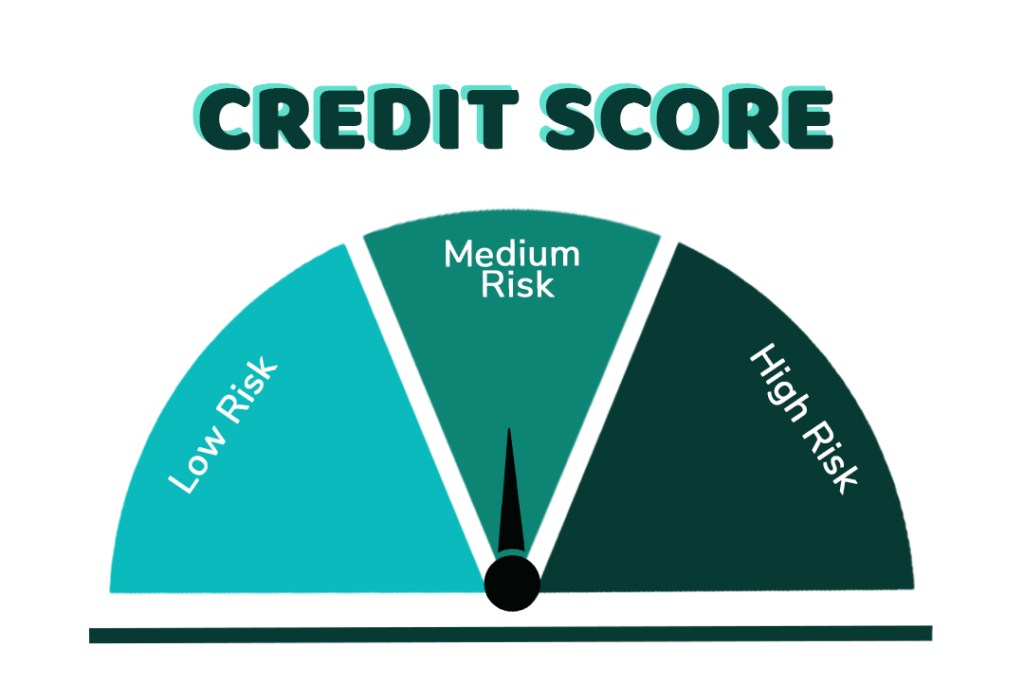

The Power of Credit Scores: Key to Financial Success

Credit scores are a crucial aspect of personal finance that can greatly impact an individual’s financial well-being. Understanding credit scores and how they work is important for anyone looking to manage their finances effectively. First off, it’s essential to know what a credit score is. A credit score is a numerical representation of an individual’s…

-

Mastering Banking Basics: Your Key to Financial Empowerment

Banking is a fundamental aspect of managing personal finances and understanding its basics can greatly empower individuals to make informed financial decisions. In today’s world, where everything is becoming increasingly digital, having a good grasp of banking principles is more important than ever before. Whether you’re a student starting your first job or an adult…

-

Revolutionize Your Finances: Top Budgeting Apps and Tools to Take Control Today

Are you tired of constantly feeling overwhelmed by your finances? Do you wish there was an easier way to manage your money and stick to a budget? Well, look no further than budgeting apps and tools! In today’s digital age, there are countless options available to help you track your spending, set financial goals, and…

-

Mastering Credit Scores: The Key to Financial Success

Understanding credit scores is crucial for anyone looking to make informed financial decisions. Your credit score is a numerical representation of your creditworthiness and plays a significant role in determining whether you can qualify for loans, mortgages, or even rent an apartment. In this article, we will break down the basics of credit scores and…

-

Mastering Interest Rates: The Key to Financial Success

Interest rates play a crucial role in the world of finance, influencing everything from mortgages to credit card payments. Understanding how interest rates work is essential for making informed financial decisions and managing your money effectively. Whether you’re a student learning about economics or an adult looking to improve your financial literacy, grasping the concept…

-

Empowering Teens: The Importance of Learning Personal Finance Early

Personal finance is an essential aspect of life that everyone, including teens, should start learning about early on. Here are some commonly asked questions about personal finance for teenagers: Q: Why is it important for teens to learn about personal finance? A: Learning about personal finance at a young age can set a solid foundation…

-

The Importance of Emergency Funds: Building Financial Resilience for Young Adults and Students

Emergency funds are a crucial aspect of financial planning that often gets overlooked, especially among young adults and students. In this panel discussion, we will delve into the importance of emergency funds, how to build and maintain one, as well as strategies for utilizing it effectively. Firstly, let’s address why having an emergency fund is…