Tag: income sources

-

Navigating Tax Season: Tips to Streamline Your Preparation

Tax season can be a stressful time for many individuals, especially those who are not well-versed in tax preparation. However, with the right tools and knowledge, navigating through the process can become much more manageable. Here are some helpful tips to streamline your tax preparation: 1. Keep organized records: One of the most important aspects…

-

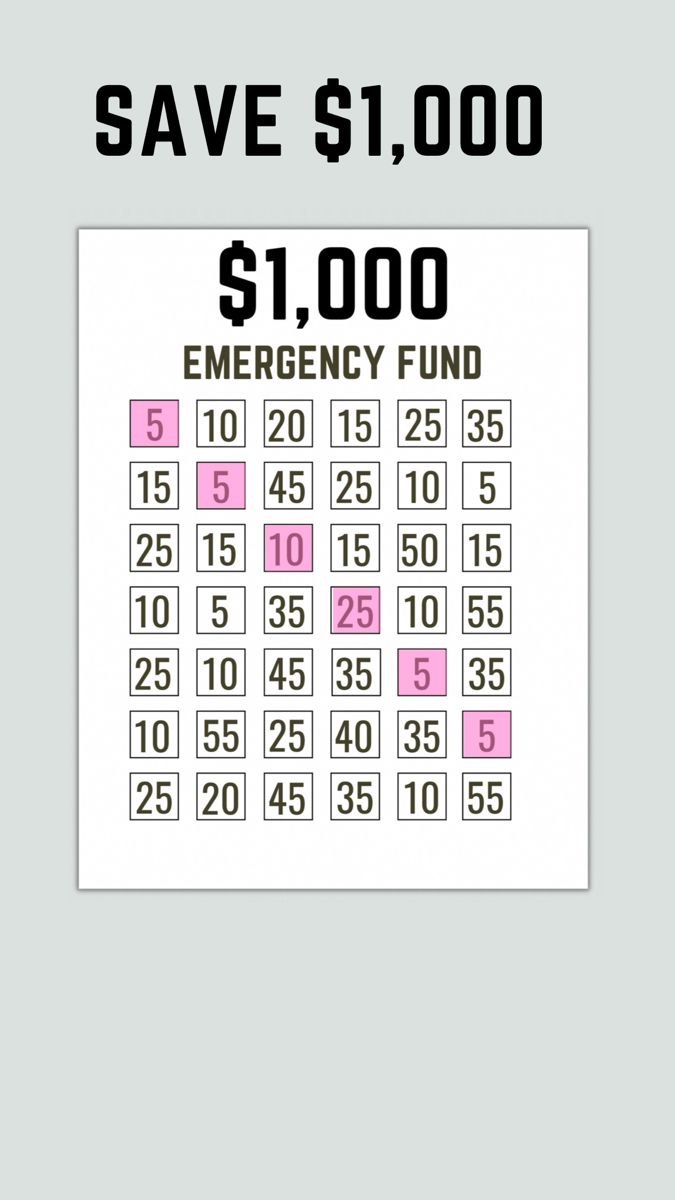

Don’t Get Caught Unprepared: The Crucial Guide to Building Your Emergency Fund

Emergency funds are a crucial aspect of financial planning that often gets overlooked. Whether you’re a student, a parent, or someone pursuing alternative schooling and education, having an emergency fund in place can provide peace of mind and security during unexpected situations. In this article, we will explore the importance of emergency funds and provide…

-

“Financially Empowering Unschooled Teens: 10 Essential Lessons for Future Success”

Financial Literacy for Unschooled Teenagers: 10 Essential Lessons Introduction: In today’s fast-paced world, financial literacy has become more critical than ever. However, traditional schooling often falls short in teaching young people about money management and personal finance. For unschooled teenagers, who have chosen alternative education paths, acquiring essential financial skills becomes even more important. In…

-

Mastering the Art of Budgeting: A Key Skill for Alternative Schoolers

Budgeting: A Key Skill for Alternative Schoolers Introduction: In today’s fast-paced world, financial literacy is a crucial life skill that everyone should possess. This applies to alternative schoolers as well, who often have unique educational experiences and may need to navigate different financial circumstances. Learning how to budget effectively can empower alternative schoolers to take…

-

Maximize Your Tax Benefits with Comprehensive Tax Planning for Alternative Schooling and Education

Tax Planning: A Comprehensive Guide for Alternative Schooling and Education Introduction Tax planning is a crucial aspect of managing personal finances, especially for individuals involved in alternative schooling and education. Whether you are an independent homeschooler, part of a cooperative learning group, or running an alternative education institution, understanding tax laws and implementing effective strategies…

-

“Securing Your Future: Building an Emergency Fund During Apprenticeship Training”

Building an Emergency Fund During Apprenticeship Training Introduction: Apprenticeship training is a valuable opportunity to gain practical skills and knowledge in various fields. However, it is important to recognize that apprentices often face financial challenges during their training period. To mitigate these challenges and ensure financial stability, building an emergency fund becomes essential. In this…

-

Mastering the Art of Budgeting: A Key Skill for Alternative Schooling and Education

Budgeting: A Key Skill for Alternative Schooling and Education Introduction: Alternative schooling and education is a rapidly growing movement that seeks to provide students with non-traditional learning experiences. Alongside the unique educational approaches, it is crucial to equip students with essential life skills that will set them up for success in the real world. One…

-

Budgeting: The Key to Financial Success for Alternative Schoolers and Educators

Budgeting: A Key Skill for Alternative Schoolers and Educators As an alternative schooler or educator, budgeting is a crucial skill that can help you manage your finances effectively. Budgeting involves creating a plan for how you will spend your money, taking into account all of your income and expenses. By doing this, you can ensure…