Tag: financial literacy

-

Mastering the Art of Saving: Financial Tips for Alternative Schooling Families

Saving money is a valuable skill that everyone should learn, regardless of age or background. This holds especially true for students and families pursuing alternative schooling and education paths, as they often face unique financial challenges. Whether you are a homeschooling family, an unschooler, or attending a non-traditional educational program, finding ways to save money…

-

Empowering Financial Literacy Workshops: Building Confidence and Independence

Financial literacy is a crucial life skill that empowers individuals to make informed decisions about their money and achieve financial stability. In recent years, there has been a growing recognition of the importance of incorporating financial education into school curricula and community programs to equip people with the knowledge and skills necessary to manage their…

-

Mastering Money: Budgeting Tips for Alternative Schooling Students

Budgeting is an essential life skill that everyone should learn, regardless of their educational path. For students in alternative schooling and education programs, understanding budgeting can be especially important as they navigate unique learning environments. Here are some tips to help alternative schooling students effectively manage their finances: 1. **Track Your Expenses**: Start by tracking…

-

Mastering Budgeting: The Key to Financial Success

Budgeting is an essential skill that everyone should learn, regardless of their age or financial situation. It involves creating a plan for how you will spend your money based on your income and expenses, with the goal of achieving financial stability and reaching your financial goals. In this roundup post, we will explore the importance…

-

Don’t Let Alternative Education Hold You Back: Tips for Securing Your Retirement

Retirement planning is a crucial aspect of adult life that often gets overlooked, especially for those who have pursued alternative schooling and education paths. While traditional educational routes may offer more structured guidance on financial planning for retirement, individuals who have taken non-traditional paths can still achieve a secure retirement with some careful consideration and…

-

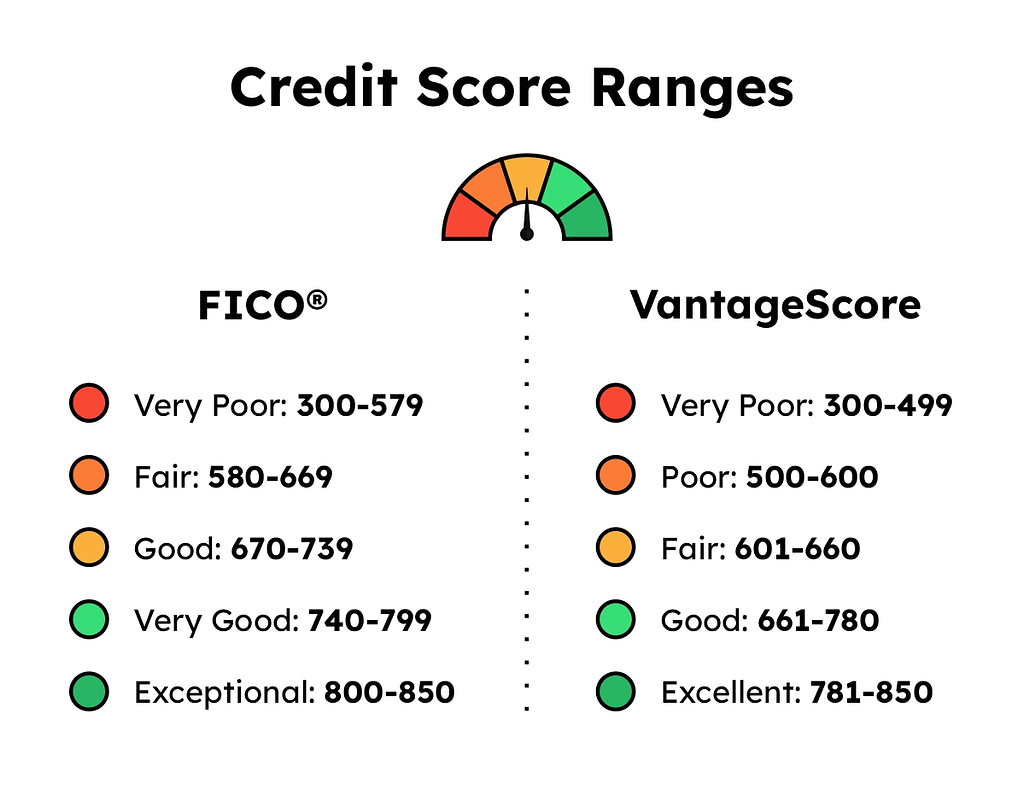

Empowering Youth through Credit Score Education in Alternative Schools

Credit scores are an essential part of financial well-being in today’s society. They provide a snapshot of an individual’s creditworthiness and can impact their ability to secure loans, apartments, jobs, and more. Despite their importance, credit scores are often not adequately covered in traditional education settings. Alternative schooling and education programs have the opportunity to…

-

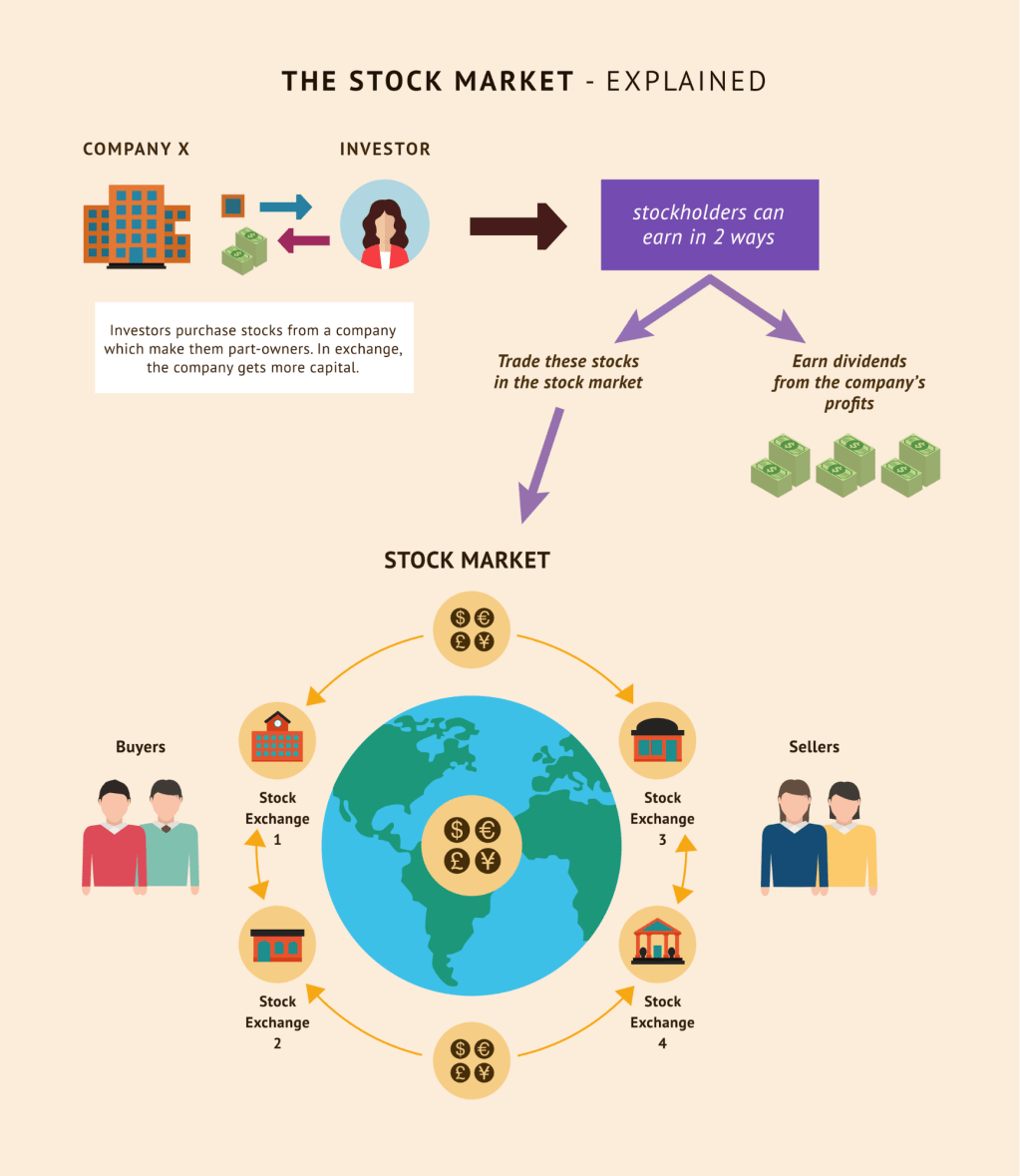

Mastering Stock Market Basics: A Key Skill for Alternative Education Paths

When it comes to alternative schooling and education, understanding the basics of the stock market can be a valuable skill to have. The stock market is a platform where individuals and institutions can buy and sell shares of publicly traded companies. It serves as a vital component of the global economy, providing companies with capital…

-

Empowering Individuals Through Financial Literacy Education

Financial literacy is a crucial skill that everyone should possess in order to navigate the complex world of personal finance effectively. It encompasses the knowledge and understanding of various financial concepts, such as budgeting, saving, investing, debt management, and retirement planning. Without adequate financial literacy, individuals may struggle with making informed decisions about their money,…