Tag: debt management

-

Empowering Students Through Financial Literacy in Alternative Education

Financial literacy is a crucial skill that empowers individuals to make informed decisions about their finances. In the context of alternative schooling and education, teaching financial literacy is especially important in preparing students for the real world. Historically, financial literacy was not always prioritized in traditional educational systems. However, as society has become increasingly complex…

-

Navigating the Path to Financial Success: Credit Scores Unveiled

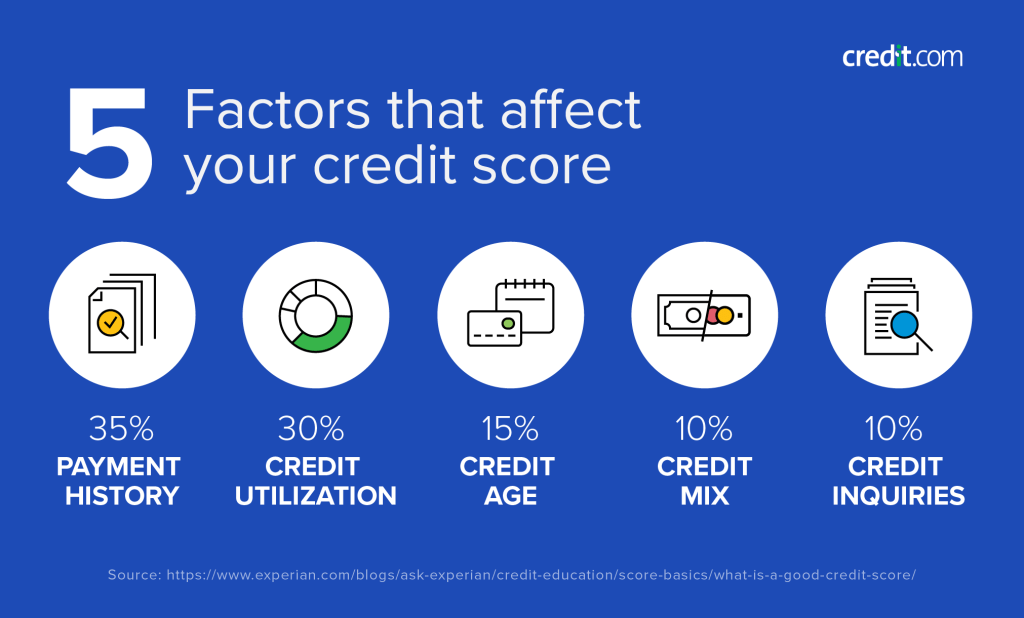

Credit Scores: A Case Study Introduction In today’s society, credit scores play a significant role in individuals’ financial lives. Whether you are applying for a loan, renting an apartment, or even seeking employment, your credit score is often one of the key factors that determines your financial standing. Many people may not fully understand how…

-

Mastering Debt: Essential Financial Skills for a Secure Future

Debt management is a crucial life skill that many individuals do not learn in traditional schooling settings. Understanding how to effectively manage debt can lead to financial stability and security in the long run. In alternative schooling and education programs, teaching students about debt management can provide them with essential knowledge for their future financial…

-

Mastering Personal Finance: Essential Tips for All, Including Alternative Learners

Creating a personal finance plan is an essential skill that everyone should develop, regardless of their background or education. In today’s society, where financial literacy is not often taught in traditional schooling systems, it becomes even more important for individuals to take charge of their own financial well-being. This is especially true for those who…

-

Empowering Students Through Financial Planning Integration in Alternative Education Systems

Financial planning is a critical aspect of overall well-being that often gets overlooked, especially in traditional education systems. However, alternative schooling and education models have the unique opportunity to integrate financial literacy and planning into their curricula to equip students with essential skills for navigating the complexities of personal finance in today’s world. Understanding the…

-

Unlocking the Power of Credit Scores: A Must for Young Adults in Alternative Education

Credit scores may not be a topic commonly discussed in traditional educational settings, but they are a crucial aspect of financial literacy that young adults should be familiar with as they navigate the world of personal finance. Understanding credit scores and their impact on various aspects of our lives can empower individuals to make informed…

-

Empowering Alternative School Students Through Financial Literacy

Financial literacy is an essential skill that empowers individuals to make informed decisions about their money, investments, and financial future. It encompasses the knowledge and understanding of various financial topics such as budgeting, saving, investing, debt management, retirement planning, and more. In today’s complex world of finance and economics, having a strong foundation in financial…

-

Mastering Debt Management: A Crucial Skill for Students in Alternative Schools

Debt management is a crucial skill that all individuals should learn to navigate their financial well-being, especially in the current economic climate. For students attending alternative schooling and education programs, understanding how to manage debt can be particularly important as they transition into adulthood. One key aspect of debt management is creating a budget and…

-

Mastering Credit Scores: The Key to Financial Success

Understanding credit scores is crucial for anyone looking to make informed financial decisions. Your credit score is a numerical representation of your creditworthiness and plays a significant role in determining whether you can qualify for loans, mortgages, or even rent an apartment. In this article, we will break down the basics of credit scores and…