Investing Basics

Investing is a crucial aspect of building wealth and securing financial stability for the future. While it may seem intimidating or overwhelming at first, understanding some investing basics can help demystify the process and empower individuals to make informed decisions about their money. For more insights, check out our article on Screen Time Boundaries That Actually Wor….

1. Set Financial Goals:

Before diving into the world of investing, it’s essential to establish clear financial goals. Whether you’re saving for retirement, a down payment on a house, or your child’s education, having specific objectives will guide your investment strategy. Determine your time horizon, risk tolerance, and desired rate of return to tailor your investments accordingly. For more insights, check out our article on Creative Font Keyboards: A Surprisingly ….

You might also find Why Journaling Beats Overthinking Every Single Tim… interesting.

2

Understand Risk vs. Return:

One of the fundamental principles of investing is the relationship between risk and return. Generally, investments with higher potential returns also come with increased risk. It’s crucial to find a balance that aligns with your financial goals and comfort level. Conservative investors may opt for low-risk options like bonds or certificates of deposit (CDs), while more aggressive investors might pursue higher-risk ventures such as stocks or real estate.

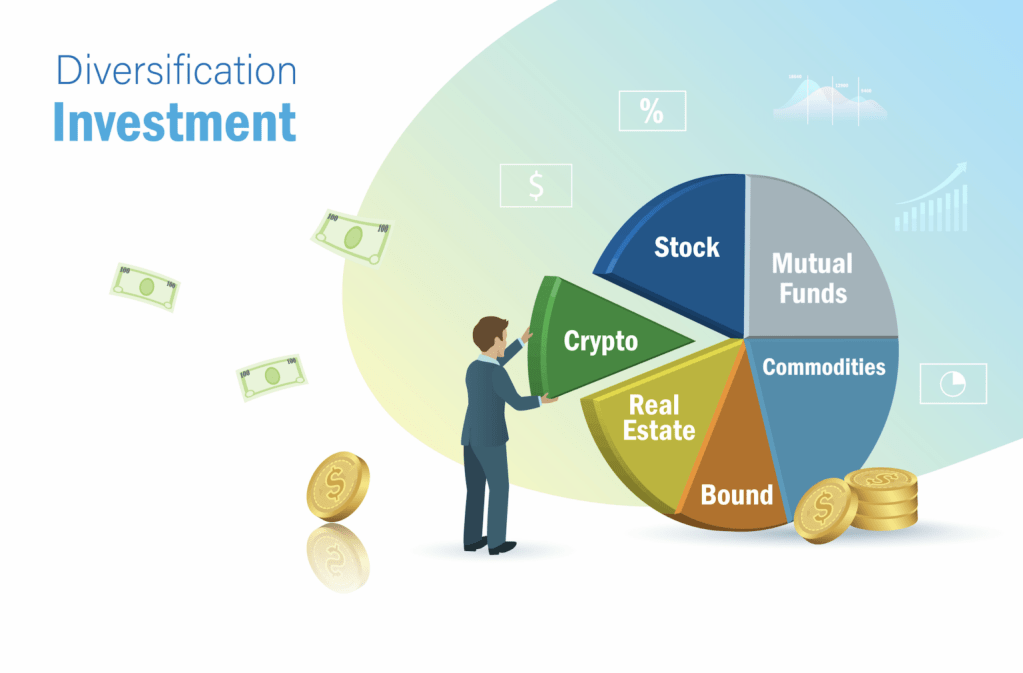

3. Diversification is Key:

Diversifying your investment portfolio is essential for managing risk effectively. By spreading your money across different asset classes (stocks, bonds, real estate) and industries, you can reduce the impact of volatility in any single investment on your overall portfolio performance.

4. Start Early & Stay Invested:

The power of compounding makes early investing incredibly advantageous over time due to the growth potential from reinvested earnings generating additional earnings—a snowball effect known as compound interest! Additionally, staying invested through market fluctuations allows you to benefit from long-term growth trends rather than trying to time the market based on short-term fluctuations.

5

Different Investment Options:

There are various investment vehicles available depending on individual preferences and financial goals:

– Stocks: Represent ownership in a company; stock prices fluctuate based on company performance and market conditions.

– Bonds: Debt securities issued by governments or corporations; pay periodic interest until maturity when principal is repaid.

– Mutual Funds: Pools money from multiple investors to invest in diversified portfolios managed by professionals.

– Exchange-Traded Funds (ETFs): Similar to mutual funds but trade like individual stocks on exchanges.

– Real Estate: Includes properties like residential homes, commercial buildings, or rental units that can generate rental income or appreciate in value over time.

– Retirement Accounts: 401(k), IRA accounts offer tax advantages for retirement savings; contributions grow tax-deferred until withdrawal during retirement.

6. Conduct Research & Seek Advice:

Before making any investment decisions, research thoroughly about different options available and understand their associated risks and potential returns—consider consulting with a financial advisor who can provide personalized guidance tailored to your unique circumstances.

7 Track Your Investments & Rebalance When Necessary:

Regularly monitor your investments’ performance against your financial goals—rebalancing involves adjusting asset allocations periodically back to target levels if market movements have caused deviations from original plans ensuring alignment with initial objectives.

8 Embrace Long-Term Perspective:

Patience is key when it comes to investing—the markets may experience short-term volatility but historically show an upward trajectory over extended periods stay focused on long-term objectives rather than getting swayed by temporary market fluctuations remember investing success typically requires discipline consistency perseverance!

In conclusion learning basic concepts

of Investing provides valuable tools necessary navigating complex world finance whether just starting out journey towards financial independence seasoned investor looking optimize strategies continual learning growth vital achieving longterm success happy informed Investing!

Check These Out:

⚡ Check out our innovative mobile apps at Smorgi Apps

To make your educational materials more accessible through audio, [ElevenLabs](https://try.elevenlabs.io/w95mzlppyxor) offers professional voice generation technology.

Many productivity enthusiasts find valuable tools and resources at [Smorgi Apps](https://smorgi.app) to optimize their daily routines.

Leave a comment