Tax planning is a crucial aspect of financial management that can have a significant impact on an individual’s or organization’s bottom line. By strategically managing your taxes, you can minimize the amount of tax you owe while maximizing your potential for savings and investments. In this guide, we will delve into the importance of tax planning, key strategies to consider, and how alternative schooling and education can play a role in enhancing your understanding of taxation.

Importance of Tax Planning

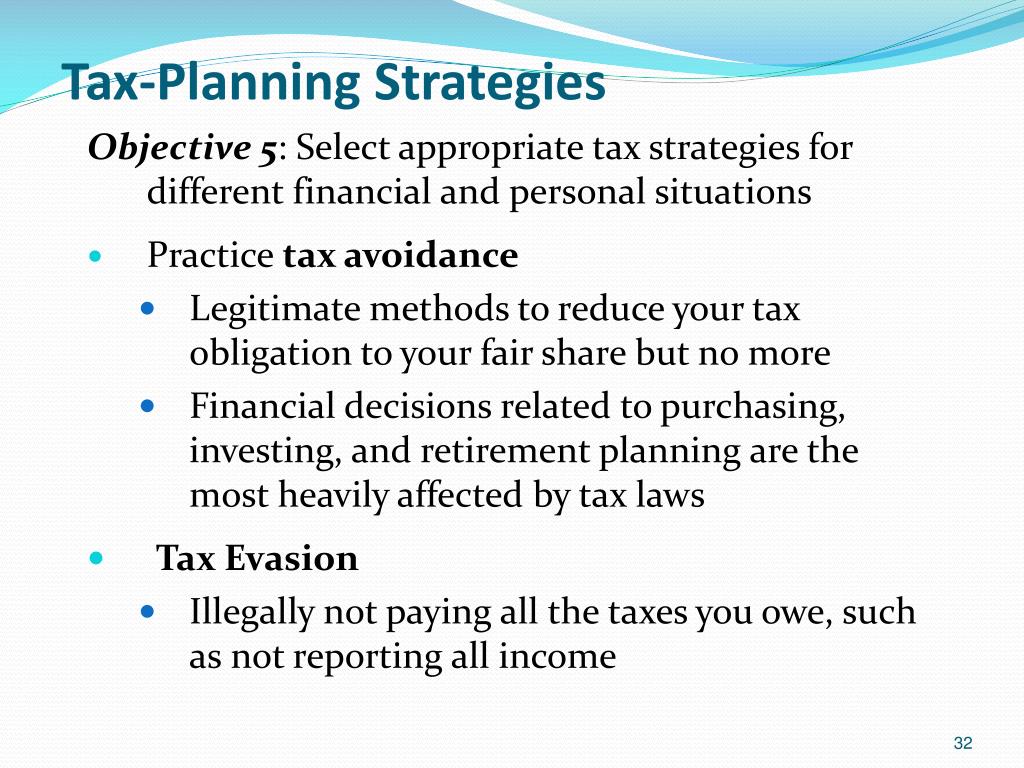

Tax planning involves analyzing your financial situation from a tax perspective to ensure that you are taking advantage of all available opportunities to reduce your tax liability. Effective tax planning allows individuals and businesses to optimize their finances by legally minimizing their tax obligations, ultimately leading to increased savings and wealth accumulation.

One key benefit of tax planning is the ability to take advantage of various deductions, credits, exemptions, and other incentives offered by the government. By carefully examining these options and structuring your finances accordingly, you can lower your taxable income and potentially qualify for significant savings on your overall tax bill.

Furthermore, strategic tax planning enables individuals and businesses to plan for future expenses or investments while considering the tax implications associated with those decisions. By forecasting potential tax liabilities ahead of time, you can make informed choices about when to make purchases or investments in order to maximize potential deductions or credits.

Key Strategies for Tax Planning

There are several strategies that individuals and businesses can employ as part of their overall tax planning efforts:

1. Utilize Retirement Accounts: Contributing money to retirement accounts such as IRAs or 401(k) plans not only helps you save for the future but also offers valuable tax benefits. Contributions made to these accounts are often deductible from taxable income, reducing your current-year taxes while allowing your investments to grow on a tax-deferred basis.

2. Consider Income Shifting: For families with multiple earners or business owners with flexibility in their income sources, income shifting can be a powerful strategy for lowering overall taxes. By redistributing income among family members or allocating earnings between different entities (such as partnerships or corporations), you may be able to take advantage of lower marginal tax rates for certain individuals or entities.

3. Take Advantage of Tax Credits: Tax credits provide a dollar-for-dollar reduction in your total tax bill and can significantly impact your bottom line. Be sure to explore available credits such as the Earned Income Tax Credit (EITC), Child Tax Credit, education-related credits like the Lifetime Learning Credit, energy-efficient home improvements credits, and others that may apply based on your circumstances.

4. Plan Charitable Giving: Donating money or assets to qualified charitable organizations not only supports causes you care about but also offers potential deductions on your taxes. By itemizing deductions on Schedule A of Form 1040 (for U.S taxpayers), you may be able to deduct charitable contributions up…

5…to specified limits based on the type of donation made.

6.Maximize Health Savings Accounts (HSAs): If eligible under high-deductible health insurance plans,HSA contributions are deductible from taxable income while offering triple-tax advantages – contributions are pre-tax,distributions used towards qualified medical expenses are exempt from taxes,and any growth within HSAs accumulate without being taxed.

Alternative Education & Taxation Understanding

While traditional educational institutions typically offer courses on accounting,taxation,and financial management,some alternative schooling options could also provide valuable insights into effective taxation practices.Some online platforms,course providers,and community colleges offer specialized courses in personal finance,tax preparation,business accounting,and related subjects.These courses equip learners with practical knowledge regarding taxation rules,strategies,guidelines,making them better equipped at handling their own finances optimally.Additionally,some alternative schools,focused programs might integrate real-world scenarios,simulations,hands-on projects involving practical application oft…

axes,income calculations,deductions,maximizing refunds,personalized budgeting tailored towards specific cases.They foster critical thinking skills,self-sufficiency,and empower students by helping them navigate complex financial landscapes confidently.Furthermore,the interactive nature oft…

hese educational models encourages collaboration,critical analysis,research skills development fostering an engaging learning experience.Conclusively,integrating alternative education approaches alongside conventional methods enhances comprehensive understanding around taxation principles,promoting lifelong financial literacy,self-reliance among learners irrespective oft…

heir backgrounds,enabling them manage personal/business finances efficiently,navigate through evolving economic conditions adeptly.

In conclusion,tax planning plays an integral role in achieving financial stability,long-term prosperity.However,it requires careful consideration,strategic approach navigating myriad laws,rules surrounding taxation.To enhance one’s proficiency around this intricate topic,it’s imperative leverage diverse resources,strategies discussed above.Seek professional advice if needed,but remember,you hold primary responsibility ensuring compliance,optimal outcomes regarding own taxes.Educational avenues including alternative schooling offerings,further enrich one’s understanding promoting sound decision-making autonomy moving forward.Taking proactive steps today reap benefits tomorrow,start exploring possibilities today!

Leave a comment