Credit scores may not be a topic commonly discussed in traditional educational settings, but they are a crucial aspect of financial literacy that young adults should be familiar with as they navigate the world of personal finance. Understanding credit scores and their impact on various aspects of our lives can empower individuals to make informed decisions and take control of their financial futures.

A credit score is a three-digit number that represents an individual’s creditworthiness based on their borrowing and repayment history. It is used by lenders, landlords, insurance companies, and even potential employers to assess an individual’s risk level when it comes to extending credit or offering services.

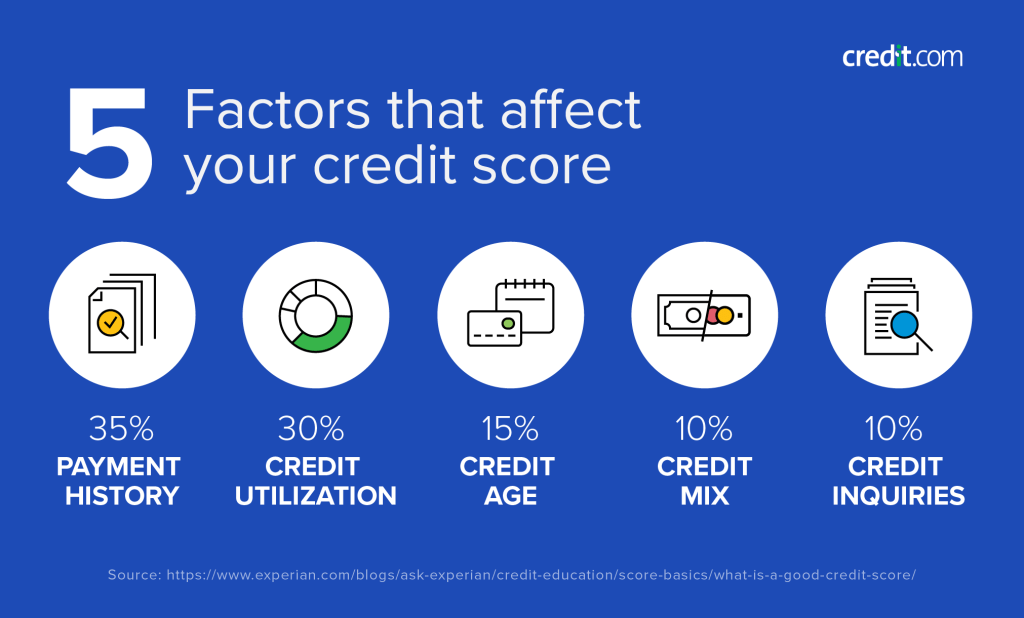

There are several factors that contribute to determining a person’s credit score. The most common scoring model used in the United States is the FICO score, which ranges from 300 to 850. Factors that influence your FICO score include:

1. Payment history (35%): This is one of the most critical factors impacting your credit score. Lenders want to see consistent, on-time payments for loans and credit cards.

2. Amounts owed (30%): This factor looks at how much debt you have compared to your available credit limits.

3. Length of credit history (15%): The longer you’ve had accounts open, the better it reflects on your ability to manage credit responsibly.

4. Credit mix (10%): Having a mix of different types of accounts such as revolving credit (credit cards) and installment loans (mortgages or auto loans) can positively impact your score.

5. New credit (10%): Opening multiple new accounts in a short period can signal risk if not managed carefully.

Having a good credit score opens up opportunities for favorable interest rates on loans, access to higher lines of credits, lower insurance premiums, easier approval for rental applications or mortgages, among other benefits.

For students in alternative schooling environments who may not receive traditional financial education in school curriculums, understanding how to build and maintain good credit can set them up for success as they transition into adulthood.

Here are some tips for students looking to establish a positive credit history:

1. Start early: Even before turning 18, young adults can start building their credit by becoming an authorized user on a parent or guardian’s account or applying for a student card with low limits.

2. Make timely payments: Paying bills on time is crucial for maintaining good credit health.

3. Keep balances low: Aim to use no more than 30% of your available credit limit at any given time.

4. Monitor your credit report: Regularly check your report for errors or signs of identity theft that could negatively impact your score.

5. Avoid opening unnecessary accounts: While having diverse types of accounts can be beneficial down the line, avoid opening too many new accounts at once.

It’s important for students in alternative schooling programs to understand that financial literacy goes beyond just budgeting and saving money—it also includes mastering concepts like managing debt responsibly and leveraging tools like good credi…

Leave a comment