Investing is a crucial aspect of financial planning that allows individuals to grow their wealth over time. While traditional schooling often overlooks this important topic, alternative education pathways can provide a unique opportunity to educate students about the importance of investing and equip them with the necessary skills to make informed financial decisions.

Understanding the Basics of Investing

Before delving into the world of investing, it’s essential to grasp some fundamental concepts. One key principle is the concept of risk and return. In general, investments with higher potential returns tend to come with greater risks. It’s vital for investors to assess their risk tolerance and investment goals before committing funds to any asset class.

Diversification is another critical concept in investing. By spreading investments across different asset classes such as stocks, bonds, real estate, and commodities, investors can reduce their overall risk exposure. Diversification helps mitigate losses in one area by potentially gaining in another, thereby creating a more stable investment portfolio.

Types of Investments

There are various types of investments available to individuals looking to grow their wealth:

1. Stocks: When you buy shares of a company’s stock, you essentially own a small portion of that company. Stocks have historically provided high returns over the long term but also come with higher volatility.

2. Bonds: Bonds are debt securities issued by governments or corporations. They typically offer lower returns than stocks but are considered less risky due to their fixed interest payments.

3. Real Estate: Investing in real estate involves purchasing properties with the goal of generating rental income or capital appreciation over time.

4. Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of assets managed by professional fund managers.

5. Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks.

6. Commodities: Investing in commodities such as gold, silver, oil, or agricultural products can provide diversification benefits and act as a hedge against inflation.

Developing an Investment Strategy

Creating an investment strategy is crucial for long-term success in building wealth through investing:

1. Set Clear Goals: Define your financial goals, whether it’s saving for retirement, buying a home, or funding your children’s education.

2. Determine Your Risk Tolerance: Understand how much risk you’re willing and able to take based on factors like age, income level, and investment timeline.

3. Asset Allocation: Allocate your investment portfolio across different asset classes based on your risk tolerance and goals.

4.Rebalance Regularly – As market conditions change or certain assets outperform others within your portfolio rebalancing ensures that your allocation stays aligned with your objectives while managing risk levels effectively.

5.Diversify Wisely – Spreading out investments across different sectors reduces vulnerability during economic downturns providing stability through market fluctuations

6.Educate Yourself – Continue learning about investing strategies trends & staying updated on current events affecting global markets will help make informed decisions when managing portfolios

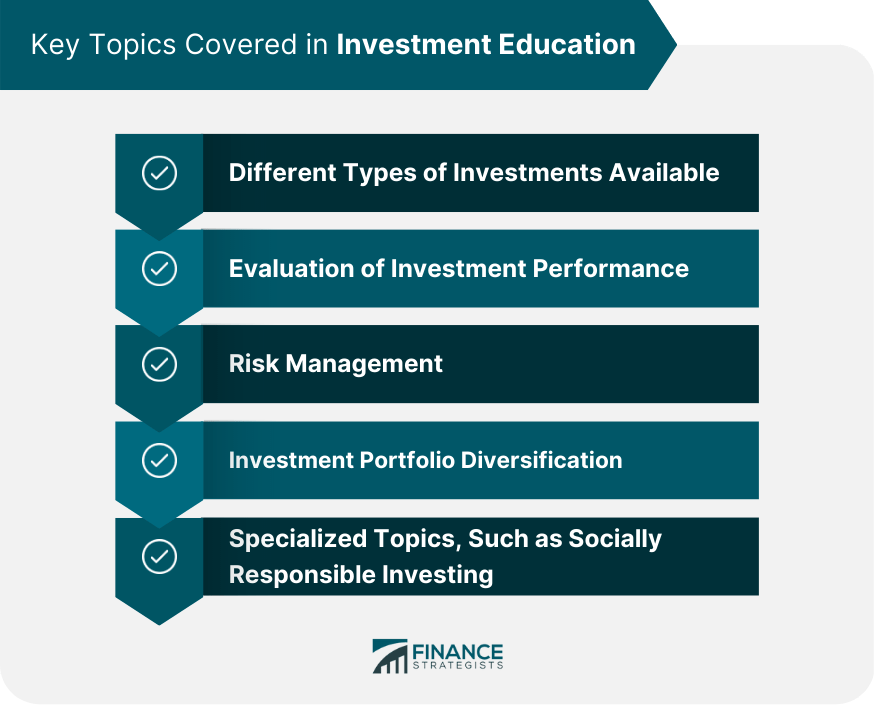

Educational Initiatives Focusing on Investing

Alternative schooling methods can play an essential role in educating students about investing principles at an early age:

1.Financial Literacy Programs – Offering courses focused on personal finance management including budgeting savings credit & basic investment principles provides foundational knowledge

2.Investment Clubs – Encouraging students interested in finance join clubs where they can learn together practice simulated trading scenarios share ideas & gain real-world experience

3.Guest Speakers & Workshops – Inviting industry professionals economists analysts from financial institutions host workshops seminars discussions broadens perspectives enhances understanding complex topics surrounding markets

4.Virtual Trading Platforms – Utilizing online platforms that simulate actual trading environments allows students test strategies experiment without risking actual capital developing practical skills

By integrating these initiatives into alternative education curricula students can develop valuable skills knowledge required navigate complex world finance set themselves up for future financial success

Leave a comment