Building a diversified investment portfolio is crucial for long-term financial success and security. By spreading your investments across different asset classes, you can reduce risk and increase the likelihood of achieving your financial goals. In this guide, we will explore the key principles of diversification and provide practical tips on how to build a well-rounded investment portfolio.

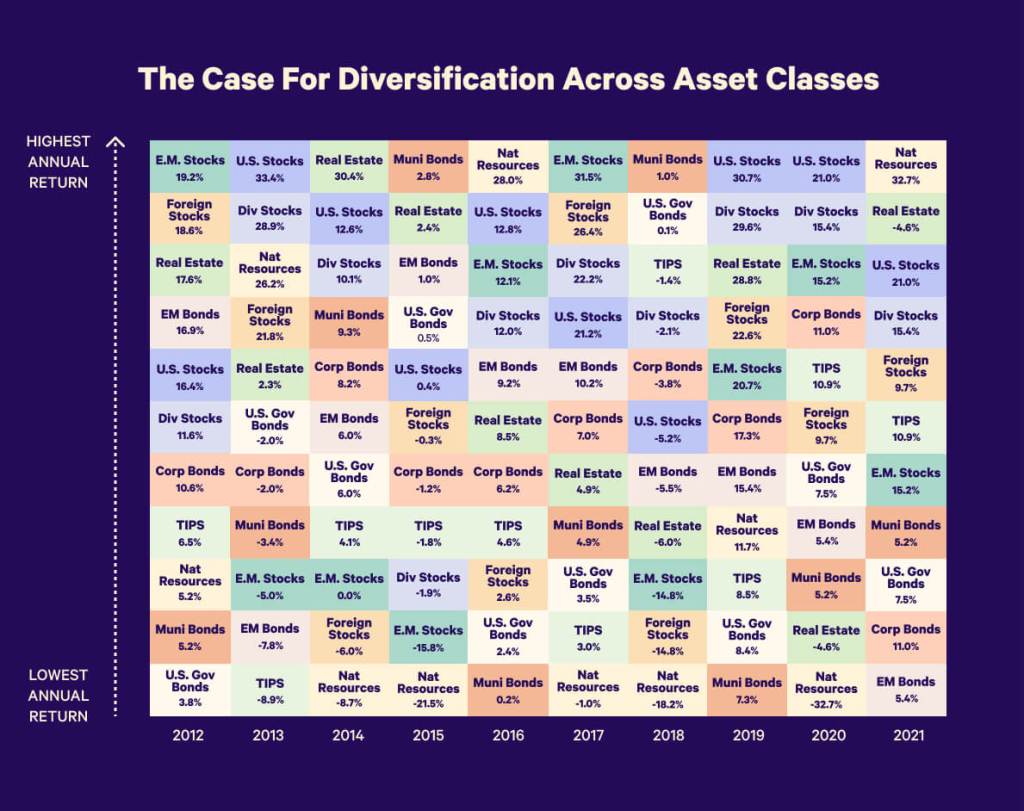

Diversification is the practice of investing in a variety of assets that are not closely correlated with each other. This means that when one asset class performs poorly, others may perform better, helping to balance out your overall investment returns. The goal of diversification is to minimize the impact of market volatility on your portfolio while still capturing growth opportunities.

👉 Check it out: Shop Health Supplements on Amazon

One way to achieve diversification is by allocating your investments across different asset classes such as stocks, bonds, real estate, and commodities. Each asset class has its own risk-return profile, so by combining them in a portfolio, you can potentially enhance returns while reducing overall risk.

👉 Check it out: Shop Fitness Tracker on Amazon

Within each asset class, it’s also important to further diversify by investing in different industries or sectors. For example, instead of just investing in technology stocks, consider spreading your investments across various sectors like healthcare, consumer goods, and energy. This helps protect against sector-specific risks that could impact a single industry.

Another key aspect of diversification is geographic diversification. Investing in assets from different regions or countries can help protect against country-specific risks such as political instability or economic downturns. Consider including international stocks or funds in your portfolio to capture global growth opportunities.

When building a diversified investment portfolio, it’s essential to consider your risk tolerance and investment goals. Younger investors with a longer time horizon may be able to take on more risk and allocate a higher percentage of their portfolio to equities for potential growth. On the other hand, older investors nearing retirement may prioritize capital preservation and income generation through bonds or dividend-paying stocks.

Rebalancing your portfolio regularly is also critical for maintaining proper diversification levels. As some assets outperform others over time, your initial allocation may become skewed towards certain holdings. By rebalancing periodically – typically annually or semi-annually – you can ensure that your portfolio remains aligned with your desired risk-return profile.

In addition to traditional assets like stocks and bonds, alternative investments can also play a role in building a diversified portfolio. Alternative investments include hedge funds, private equity funds, real estate partnerships, commodity futures contracts,and more exotic strategies like cryptocurrency or peer-to-peer lending platforms.These alternative assets often have low correlation with traditional marketsand can provide additional sourcesof diversification withinyourportfolio.Butit’simportanttoconductthoroughresearchandconsultwithafinancialadvisorbeforeventuringintosuchinvestmentsduetotheircomplexityandriskprofile.

Overall,a diversifiedinvestmentportfoliocanhelpyoumanageriskwhilepositioningyourselfforlong-termfinancialsuccess.Byallocatingyourassetsacrossdifferentassetclassesandgeographies,rebalancingregularly,andconsideringalternativeinvestments,youcanbuildaportfoliothatiswell-positionedtoweathermarketvolatilityandachieveyourfinancialgoals.

🛒 Recommended Products

As an Amazon Associate, we earn from qualifying purchases.

Disclosure: This post contains Amazon affiliate links. As an Amazon Associate, we earn from qualifying purchases at no additional cost to you.

Leave a comment