Financial aid is a crucial component for many individuals seeking alternative schooling and education. Whether pursuing an online degree, attending a vocational school, or enrolling in a specialized program, the cost of education can be a significant barrier for some students. Fortunately, there are various financial aid options available to help make alternative education more accessible and affordable.

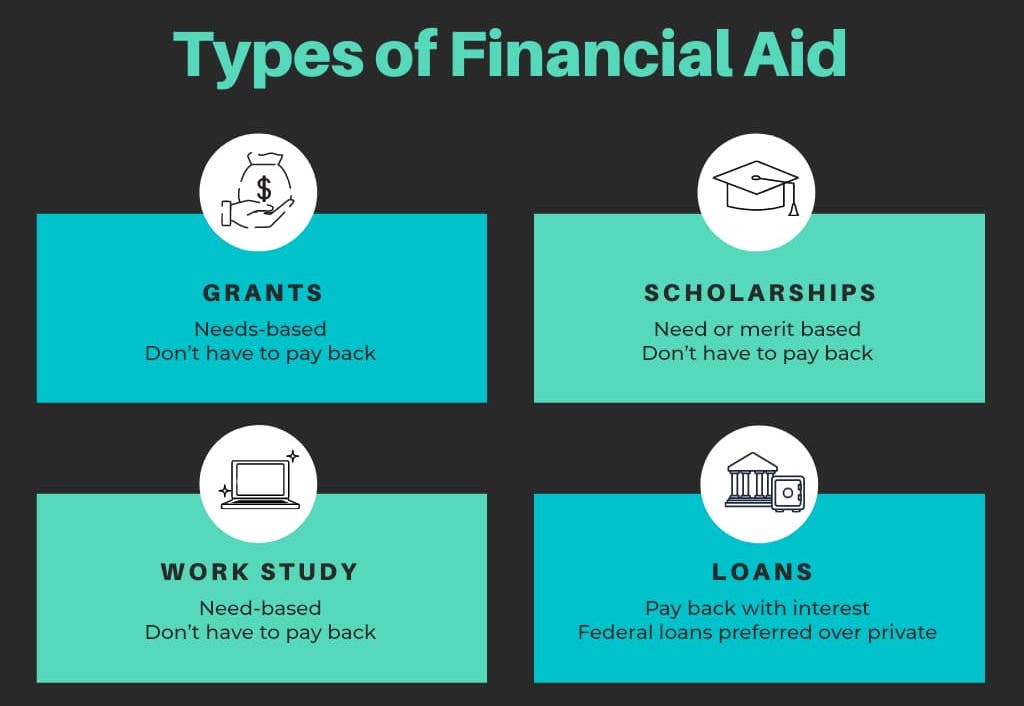

In this article, we will explore different types of financial aid that students can utilize to fund their alternative educational pursuits. From scholarships and grants to loans and work-study programs, understanding these options can empower students to make informed decisions about how to finance their education.

1. **Scholarships**:

Scholarships are one of the best ways to fund your education without accumulating debt. They are typically awarded based on merit or specific criteria such as academic achievement, athletic ability, artistic talent, leadership qualities, or community involvement. Many organizations offer scholarships specifically tailored to students pursuing alternative forms of education.

To find relevant scholarships, students can start by researching online databases like Fastweb or Scholarships.com. Additionally, they should check with their prospective schools’ financial aid offices and departmental offices for information on scholarship opportunities.

2. **Grants**:

Grants are another form of financial aid that does not need to be repaid. They are usually awarded based on financial need and may come from various sources such as federal or state governments, private organizations, or colleges and universities themselves.

The Federal Pell Grant is one of the most well-known grant programs available to undergraduate students with exceptional financial need pursuing any form of higher education. To apply for federal grants like the Pell Grant, students must complete the Free Application for Federal Student Aid (FAFSA).

3. **Loans**:

Student loans are borrowed funds that must be repaid with interest over time after graduation or when no longer enrolled in school at least half-time status. While loans should generally be considered as a last resort due to potential debt burden post-graduation, they can still be valuable in financing an alternative educational path.

Federal student loans tend to offer more favorable terms compared to private loans – lower interest rates and flexible repayment options being key advantages here. Students should carefully review loan terms before borrowing money and consider factors like interest rates and repayment schedules before making any commitments.

4. **Work-Study Programs**:

Work-study programs provide part-time employment opportunities for students with demonstrated financial need while they attend school part-time or full-time. These jobs are often located on campus or within the local community and may align with a student’s field of study whenever possible.

Participating in work-study not only helps offset educational costs but also provides valuable work experience that could enhance a student’s resume upon graduation.

5 . **Employer Tuition Assistance**:

Many employers offer tuition assistance benefits as part of their employee compensation packages which employees can use towards furthering their education through alternative schooling options such as vocational training courses,

Employees interested in taking advantage of employer tuition assistance should inquire about eligibility requirements directly from their HR departments so they have all necessary information regarding what expenses will be covered under these programs.

6 . **Crowdfunding & Fundraising:**

Crowdfunding platforms like GoFundMe provide an opportunity for individuals seeking support from friends,family members,and even strangers who believe in investing in someone’s future success story.These platforms allow users set up campaigns detailing why support is needed,e.g.,funding for professional certification course fees,laptop purchase etc.,and share them across social media channels,personal networks,and communities where potential donors might reside.

7 . **Tax Credits & Deductions:**

Students pursuing alternate forms Education may qualify tax credits deductions related expenses incurred during concurrent period e.g.,tuition fees,textbooks,supplies required coursework.Unlike deductions reduce taxable income dollar-for-dollar amount claimed whereas credits directly reduce owed IRS dollar amount owed.Investigating eligibility availing these tax incentives consult professional accountant maximize benefits minimize potential taxation impact post-education journey completion.

In conclusion,Finding funding sources pursue Alternative Schooling Education paths requires thorough research strategic planning determine best mix resources individual circumstances.Consider exploring multiple avenues including scholarships grants,tuition assistance,crowdfunding,and tax incentives create robust plan meet funding needs sustain successful progress towards personal academic goals.Educational institutions Financial Aid Offices trained professionals guide process ensure aware supported every step way don’t hesitate reach out questions concerns arise navigating complex world financing higher learning experiences!

Leave a comment