Stock market fundamentals are essential concepts that every investor should understand to make informed decisions when investing in the stock market. These fundamentals provide insights into the financial health and performance of a company, helping investors evaluate its potential for growth and profitability.

One of the key stock market fundamentals is earnings per share (EPS), which indicates a company’s profitability by dividing its net income by the number of outstanding shares. A higher EPS suggests that a company is generating more profit per share, making it an attractive investment option. Investors often compare a company’s current EPS with its historical data or industry peers to assess its performance.

Another important fundamental is the price-to-earnings (P/E) ratio, which compares a company’s stock price to its earnings per share. A lower P/E ratio may indicate that a stock is undervalued, while a higher P/E ratio could suggest overvaluation. Investors use this metric to determine whether a stock is reasonably priced relative to its earnings potential.

Furthermore, understanding dividend yield is crucial for investors seeking income from their investments. Dividend yield measures the annual dividend payout as a percentage of the stock price. Companies with stable dividends and high yields can be appealing to income-focused investors looking for regular cash flow.

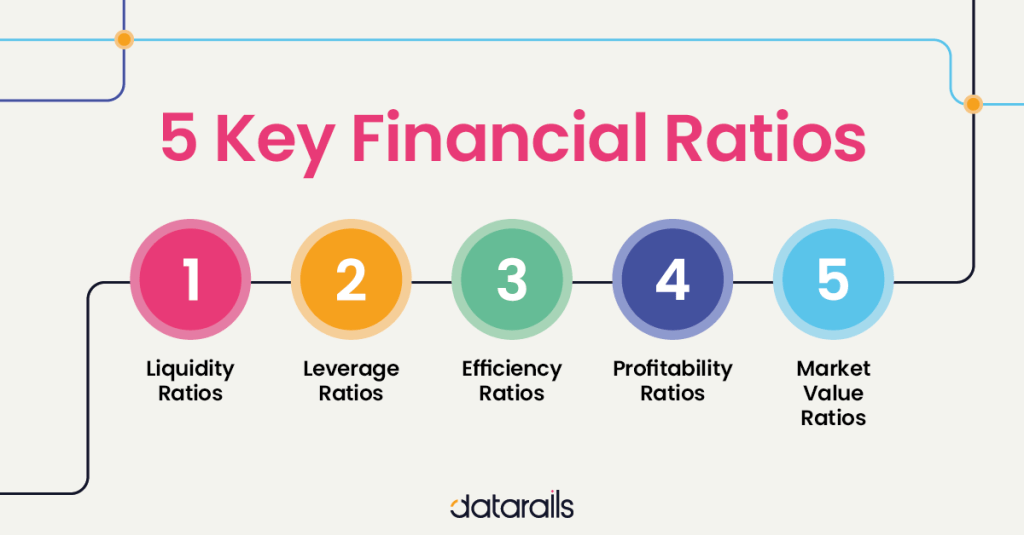

Additionally, analyzing balance sheets and financial statements can provide valuable insights into a company’s assets, liabilities, and overall financial health. By examining metrics such as debt-to-equity ratios and current ratios, investors can assess a company’s ability to meet its financial obligations and manage risks effectively.

It is also essential for investors to stay informed about economic indicators and market trends that could impact their investment decisions. Factors such as interest rates, inflation rates, geopolitical events, and industry-specific developments can influence stock prices and market volatility.

In conclusion, mastering stock market fundamentals empowers investors to make well-informed decisions based on sound analysis rather than speculation or emotions. By understanding these key concepts and regularly monitoring relevant information sources, individuals can navigate the complexities of the stock market with confidence and strategic insight.

Leave a comment