Budgeting is an essential skill that everyone should learn, regardless of their age or background. It involves creating a plan for how you will spend and save your money to ensure financial stability and achieve your long-term goals. While budgeting may seem intimidating at first, it is actually a straightforward process that can have a significant impact on your life.

For students attending alternative schooling programs, budgeting is especially important as they often have unique financial circumstances compared to traditional students. Whether you are pursuing homeschooling, online courses, or other non-traditional forms of education, learning how to manage your finances effectively can help alleviate stress and set you up for success in both your academic and personal life.

To start budgeting effectively as a student in an alternative schooling program, follow these steps:

1. **Assess Your Income**: The first step in creating a budget is to determine how much money you have coming in each month. This could include income from part-time work, allowances from parents or guardians, scholarships, or any other sources of funds available to you.

2. **Track Your Expenses**: Next, track all of your expenses over the course of a month. This includes everything from tuition fees and school supplies to daily expenses like food, transportation, and entertainment. Keeping a detailed record of where your money goes will help you identify areas where you can cut back and save.

3. **Set Financial Goals**: Determine what you want to achieve with your money in the short term (e.g., saving for a new laptop) and the long term (e.g., funding further education). Having clear goals will give purpose to your budgeting efforts and motivate you to stick to your plan.

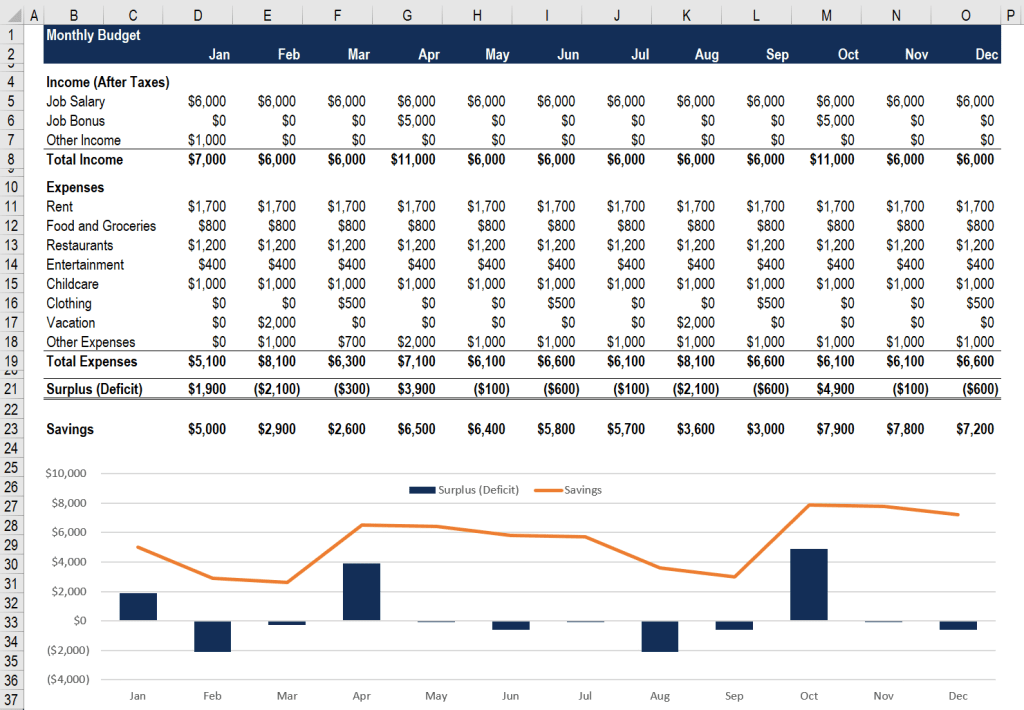

4. **Create a Budget Spreadsheet**: Use tools like Excel or Google Sheets to create a monthly budget spreadsheet that outlines your income sources and expenses. Allocate specific amounts for different categories such as rent/utilities, groceries, entertainment, savings etc., making sure not to overspend in any area.

5. **Differentiate Between Needs vs Wants**: When allocating funds in your budget spreadsheet be sure to differentiate between essential needs (such as housing costs) versus wants (like eating out frequently). Prioritize spending on needs first before indulging in wants.

6. **Build an Emergency Fund**: Set aside some money each month into an emergency fund that can cover unexpected expenses such as medical bills or car repairs without derailing your entire budget.

7. **Look for Ways To Save Money**: Explore opportunities for saving money wherever possible – this could include using student discounts on software subscriptions or public transport fares; buying second-hand textbooks instead of new ones; cooking meals at home instead of dining out etc..

8. **Review Your Budget Regularly**: Your financial situation may change over time so it’s important to review and adjust your budget regularly based on fluctuations in income or expenses.

Remember that creating a realistic budget takes time and practice – don’t get discouraged if things don’t go perfectly at first! Keep refining your approach based on what works best for you personally.

By mastering the art of budgeting early on during alternative schooling programs not only will students develop good financial habits but also gain valuable skills that will serve them well throughout their lives.

Leave a comment