Financial planning is a crucial aspect of managing a household, especially when children are involved. Parents have the responsibility to ensure that their family’s financial well-being is secure not only in the present but also for the future. When it comes to families with children, there are unique considerations and challenges that need to be addressed in financial planning.

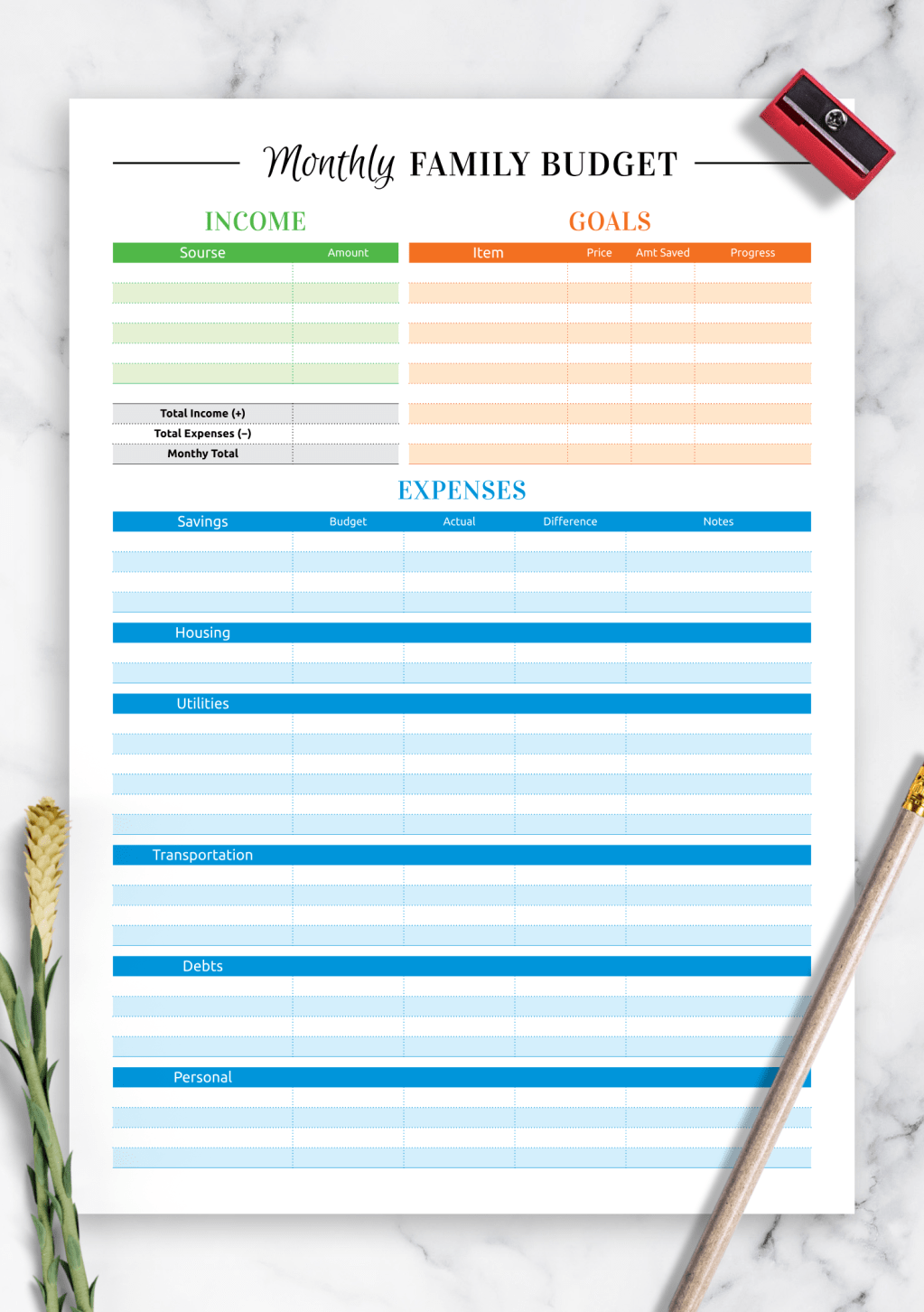

One of the first steps in financial planning for families with children is creating a budget. Establishing a budget allows parents to track their income and expenses accurately and identify areas where they can save money or cut costs. When creating a budget, it’s important to account for all sources of income, including salaries, bonuses, investments, and any other financial resources available to the family. On the expense side, parents should list all regular monthly expenses such as mortgage or rent payments, utilities, groceries, childcare costs, insurance premiums, transportation expenses, and any other recurring bills.

In addition to regular monthly expenses, parents should also plan for irregular or unexpected expenses that may arise when raising children. These can include medical emergencies, school-related costs such as tuition fees or extracurricular activities fees, home repairs or renovations needed due to wear and tear caused by kids’ activities.

Setting up an emergency fund is another critical component of financial planning for families with children. An emergency fund serves as a safety net in case of unexpected events such as job loss or medical emergencies that could disrupt the family’s finances. Financial experts recommend saving at least three to six months’ worth of living expenses in an emergency fund.

Parents should also consider investing in life insurance policies to protect their family’s financial future in case something happens to one or both parents. Life insurance provides a death benefit payout that can help cover living expenses and future needs such as college tuition for the children if one parent passes away unexpectedly.

Saving for education is another key aspect of financial planning for families with children. College tuition costs continue to rise each year making it essential for parents to start saving early on behalf of their kids’ higher education goals. One popular option for saving for education is setting up a 529 savings plan which offers tax advantages while allowing funds saved specifically designated toward educational purposes.

Teaching children about money management from an early age is crucial in helping them develop good financial habits later on in life. Parents can involve their kids in discussions about budgeting decisions and explain basic concepts like saving and investing through age-appropriate activities like setting up piggy banks or opening junior savings accounts at local credit unions.

When it comes to estate planning specifically tailored towards families with young children; drafting wills naming guardians who would care for minor-aged dependents if something were ever happened becomes paramount given unpredictable situations despite best intentions made otherwise beforehand.

Overall ensuring proper risk management through various forms insurances (health-life-disability), tight control over spending patterns by sticking strictly budgets created time-sensitive manner alongside proactive investment strategies hold keys unlocking brighter futures younger generations improved quality lives ahead!

Leave a comment