In today’s world, a college education is becoming increasingly important for securing a successful future. However, the rising costs of higher education can be overwhelming for many families. As such, it is crucial to start saving for your child’s college education as early as possible to ease the financial burden when the time comes.

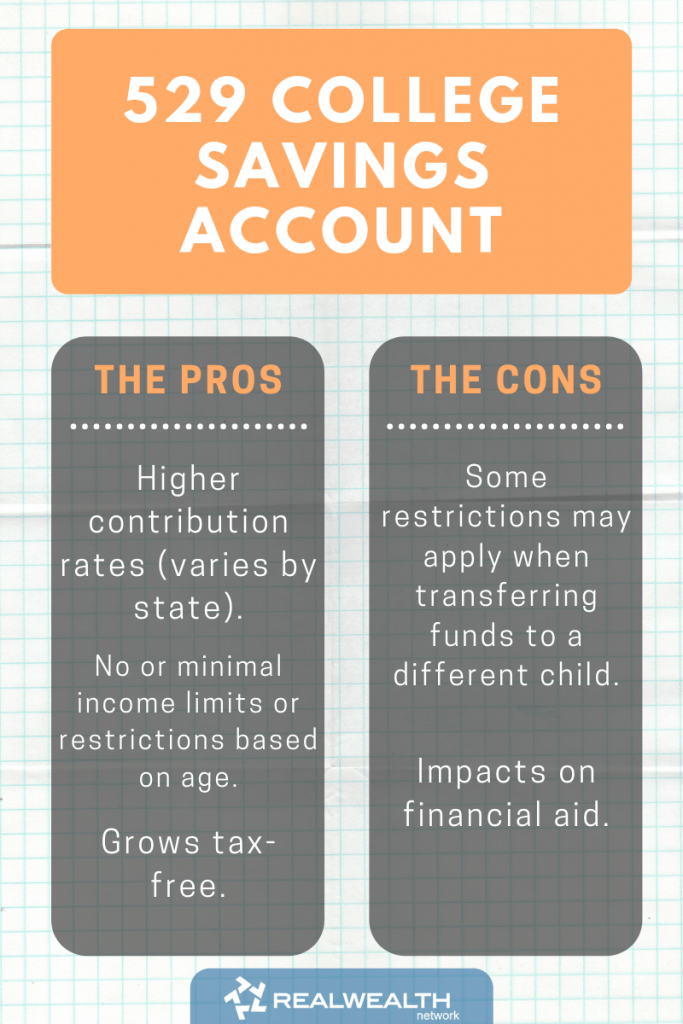

One popular way to save for college is through a 529 savings plan. These state-sponsored plans offer tax advantages and allow your contributions to grow over time through investments. The funds in a 529 plan can be used for tuition, fees, books, and room and board at eligible educational institutions. It’s essential to research and compare different 529 plans to find one that best suits your needs and financial goals.

Another option for saving for college is setting up a custodial account under the Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA). These accounts allow you to make financial gifts to your child that are invested on their behalf until they reach adulthood. While these accounts offer flexibility in how the funds can be used, keep in mind that once the child reaches legal age (usually 18 or 21), they gain full control over the assets.

For parents who want more control over how their college savings are invested, opening a Coverdell Education Savings Account (ESA) may be a suitable choice. ESAs have contribution limits but offer more investment options compared to 529 plans. The funds in an ESA can be used not only for college expenses but also for K-12 education costs. Additionally, withdrawals from an ESA are tax-free if they are used for qualified educational expenses.

It’s also worth considering other strategies like scholarships, grants, work-study programs, and student loans as part of your overall plan for funding your child’s education. Encouraging your child to excel academically and participate in extracurricular activities can increase their chances of receiving merit-based scholarships or grants. Work-study programs provide valuable work experience while helping offset some educational costs.

Lastly, having open conversations with your child about the importance of higher education and involving them in discussions about saving money for college can instill good financial habits early on. By starting early and exploring various savings options available, you can better prepare yourself financially to support your child’s academic journey without sacrificing your own financial stability.

Leave a comment