Financial goal setting is a crucial aspect of personal and professional development. Whether you are a student, an educator, or a parent involved in alternative schooling and education, having clear financial goals can help you achieve financial stability and success in the long run. In this article, we will discuss the top 15 financial goals that individuals in alternative schooling and education settings should consider setting to secure their financial future.

1. **Create a Budget:** The first step towards achieving your financial goals is to create a budget. A budget helps you track your income and expenses, allowing you to identify areas where you can save money and allocate funds towards your goals.

2. **Establish an Emergency Fund:** An emergency fund is essential for unexpected expenses such as medical emergencies or job loss. Aim to save at least three to six months’ worth of living expenses in your emergency fund.

3. **Pay Off Debt:** Prioritize paying off high-interest debt such as credit card debt or student loans. Create a repayment plan and allocate extra funds towards reducing your debt burden.

4. **Save for Retirement:** It’s never too early to start saving for retirement. Consider opening a retirement account such as a 401(k) or IRA and contribute regularly towards it.

5. **Invest Wisely:** Explore different investment options such as stocks, bonds, mutual funds, or real estate to grow your wealth over time. Consult with a financial advisor to determine the best investment strategy for your financial goals.

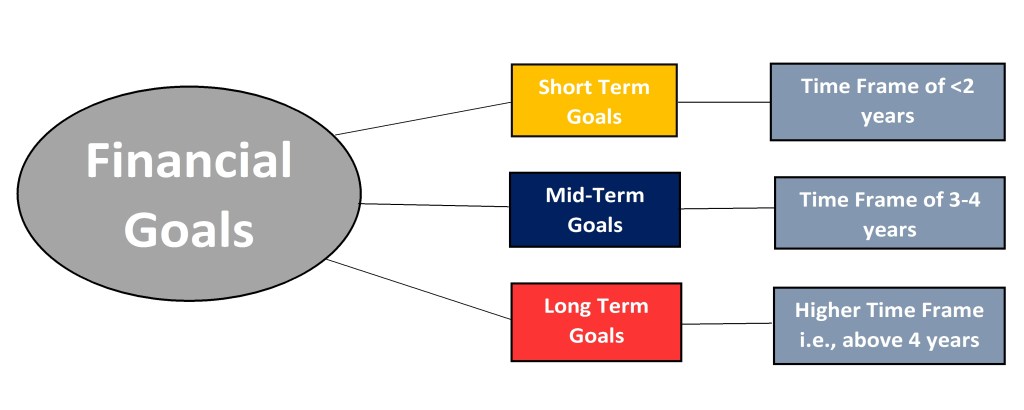

6. **Set Short-Term Goals:** Define short-term financial goals that can be achieved within one year, such as saving for a vacation, purchasing new equipment for homeschooling, or attending educational workshops.

7. **Set Long-Term Goals:** Identify long-term financial goals that may take several years to accomplish, such as buying a home, starting a business, funding higher education, or retiring early.

8. **Track Your Progress:** Regularly monitor your finances to track progress towards your goals. Use tools like spreadsheets or budgeting apps to stay organized and motivated on your financial journey.

9. **Increase Income Streams:** Explore opportunities to increase your income through part-time work, freelance gigs, online businesses, or passive income streams like rental properties or investments.

10 .**Educate Yourself About Personal Finance:** Take courses on personal finance management or attend workshops/seminars on investing strategies and money management techniques tailored specifically for educators in alternative schooling settings

11 .**Teach Financial Literacy**: Educators play a vital role in teaching students about money management skills at an early age; therefore incorporating lessons on savings habits,budgeting,and investing can help students develop good money habits from an early age

12 .**Automate Savings**: Set up automatic transfers from checking account into savings/investment accounts so that you consistently put away money without having the chance spend it elsewhere

13 .**Shop Smart**: Look out for discounts,coupons,sales when making purchases; also consider buying second-hand items which are often cheaper than brand-new products

14 .**Review Your Finances Regularly**: Conduct periodic reviews of spending patterns,savings rates,money leaks etc.to identify areas needing improvement

15 .**Seek Professional Advice**: If uncertain about managing finances seek advice from certified finance professionals who specialize in working with educators.

In conclusion,having clear-cut achievable finacial objectives can pave way toward securing steady economic footing; hence by following these mentioned points individuals engaged in alternative schooling scenarios could build sound monetary strategies ensuring stable fiscal future ahead!

Leave a comment