Financial literacy is a crucial life skill that all students should strive to learn and understand. In today’s world, it is more important than ever for young people to be equipped with the knowledge and tools necessary to make informed decisions about their finances. By developing a strong foundation in financial literacy, students can set themselves up for success and avoid common pitfalls that many adults face when it comes to managing money.

One of the first steps in becoming financially literate is understanding the basics of budgeting. Creating a budget allows individuals to track their income and expenses, helping them prioritize spending and save for future goals. Students can start by listing all sources of income, such as allowance or part-time job earnings, and then identifying regular expenses like school supplies or transportation costs. By tracking these numbers on a regular basis, students can gain insight into where their money is going and adjust their spending habits accordingly.

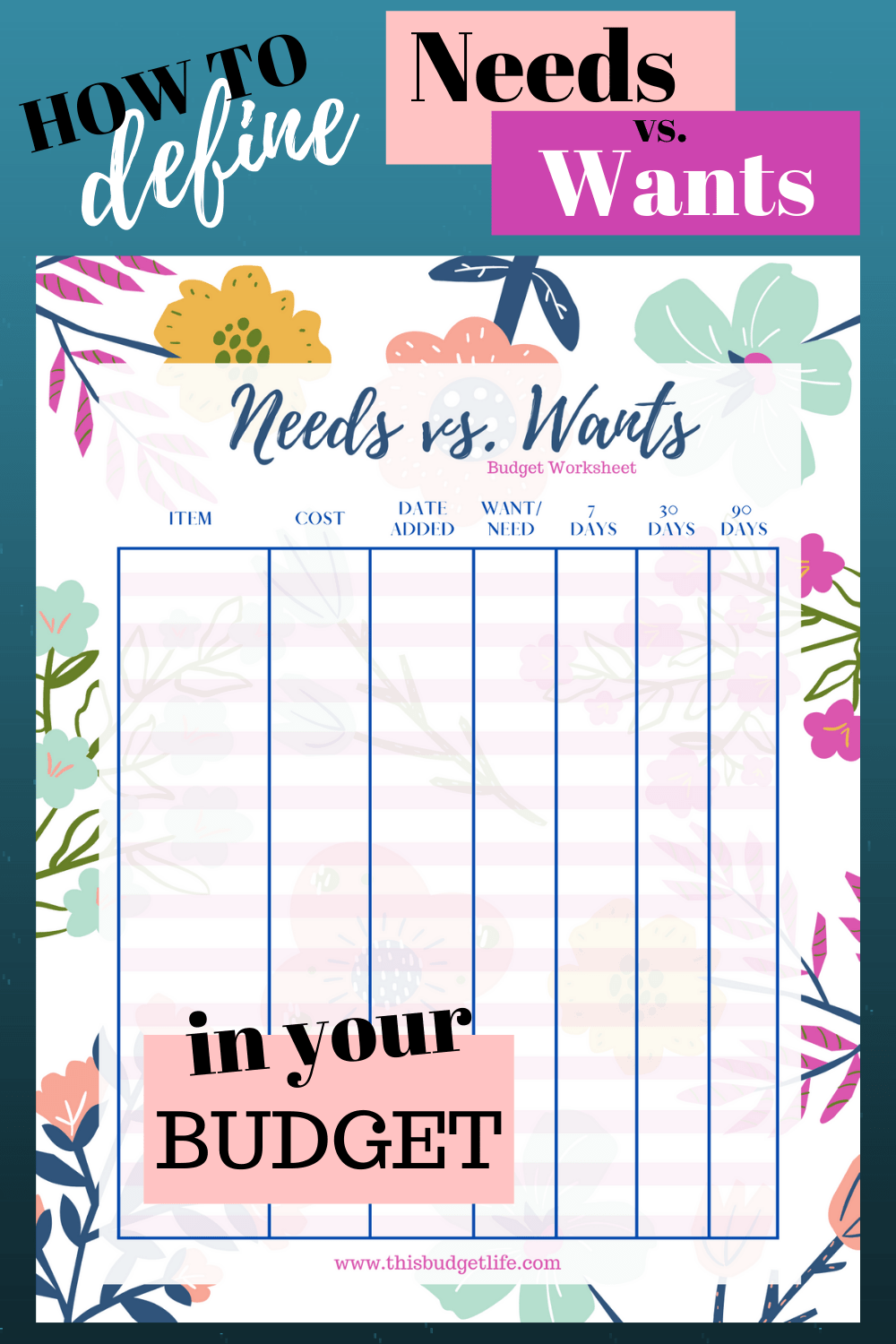

Another important aspect of financial literacy is learning how to differentiate between needs and wants. This distinction helps individuals make smarter choices about how they allocate their resources. Students can practice this skill by asking themselves if a purchase is essential for daily living or simply something they desire but could live without. By prioritizing needs over wants, students can avoid overspending on unnecessary items and focus on saving for more meaningful goals.

Understanding the concept of interest rates is also essential for financial literacy. Whether it’s on savings accounts or credit cards, interest rates play a significant role in determining how much money individuals earn or owe over time. Students can explore how different interest rates impact savings growth or debt repayment through real-life examples or simulations. This hands-on approach helps students grasp the importance of making informed decisions based on interest rates when managing their finances.

Learning about credit scores and reports is another valuable component of financial literacy education for students. Credit scores reflect an individual’s creditworthiness based on factors like payment history, amount owed, length of credit history, new credit inquiries, and types of credit used. Understanding how these factors influence one’s credit score empowers students to build healthy credit habits early on. They can learn about responsible borrowing practices, such as making timely payments and keeping balances low relative to available credit limits.

Teaching students about setting financial goals encourages them to think long-term about their aspirations and priorities. Whether it’s saving for college tuition, starting a business, buying a car, or traveling the world, having clear objectives motivates individuals to manage their money wisely in pursuit of those goals. Through goal-setting exercises and action plans tailored to each student’s ambitions, educators can help instill the importance of planning ahead financially.

Incorporating lessons on investing introduces students to the concept of growing wealth over time through strategic asset allocation strategies like stocks, bonds, mutual funds, real estate properties, or retirement accounts like IRAs or 401(k)s.

By exploring basic investment principles such as risk tolerance levels,

portfolio diversification techniques,

and compounding returns,

students gain exposure

to valuable wealth-building opportunities that extend beyond traditional savings methods.

Educators may use

simulations,

virtual trading platforms,

or guest speakers from finance-related professions

to enhance student understanding

of investment concepts

in an engaging manner.

Discussing topics related

to taxes forms another critical component

of financial literacy education

for students.

Understanding tax implications associated with various sources

of income

allows individuals

to comply with legal requirements

and optimize tax benefits effectively.

Students may learn

about different types

of taxes (income tax,

sales tax),

tax deductions/credits,

filing deadlines,

and ways

to minimize tax liabilities legally.

Engaging activities like role-playing scenarios where

students simulate filing taxes using hypothetical incomes prompt critical thinking skills while demystifying complex taxation processes.

Exploring concepts related

to insurance coverage offers insight into protecting assets

and mitigating risks effectively.

Whether discussing health insurance policies’ benefits,

auto insurance claims procedures,and homeowners’ insurance coverage details,discussion enablesstudents understandthe value insuranceto providefinancial security during unexpected eventslike illnessesaccidents natural disasters.Facilitating discussions aroundinsurance premiums,policy terms conditions,and claim settlement processespreparestudentsto make informedchoiceswhenselecting adequatecoverage options.

Encouraging dialogue around philanthropy imparts values-based education alongside practicalfinancial managementlessons.Studentslearnhowdonatingtime,moneyorresourcescanbenefitcommunityorganizationswhilesupportingsocialcausesimportantthem.Byparticipating charitable initiativeslike fundraisersvolunteer programs,youngpeopledevelopempathy compassionwhilecultivatinglifelonghabits giving back society.

In conclusion,fosteringa cultureoffinancial literacyamongstudentsprovidesfoundational skillssetsmake soundmoneymanagementdecisions nowfuture.Educatorsplay pivotal roledeliveringcomprehensiveeducationcurriculumsthatcoverbudgeting,savinginvesting,bankingcredit,taxesinsurancephilanthropy.Throughinteractive activitiesreal-world applicationssuchasbudget challengesinvestment simulationsrole-play exercises,studenstengagedlearnpracticalskillsapplicabletheir everyday lives.Bystartingearlyinstillingvalueoffinancial responsibilityyounggenerationpositionedbuildsecurefinancial futuresachieve personalprofessionalgoalswith confidenceandindependence

Leave a comment