Credit scores are an essential part of financial well-being in today’s society. They provide a snapshot of an individual’s creditworthiness and can impact their ability to secure loans, apartments, jobs, and more. Despite their importance, credit scores are often not adequately covered in traditional education settings. Alternative schooling and education programs have the opportunity to address this gap by incorporating lessons on credit scores into their curricula.

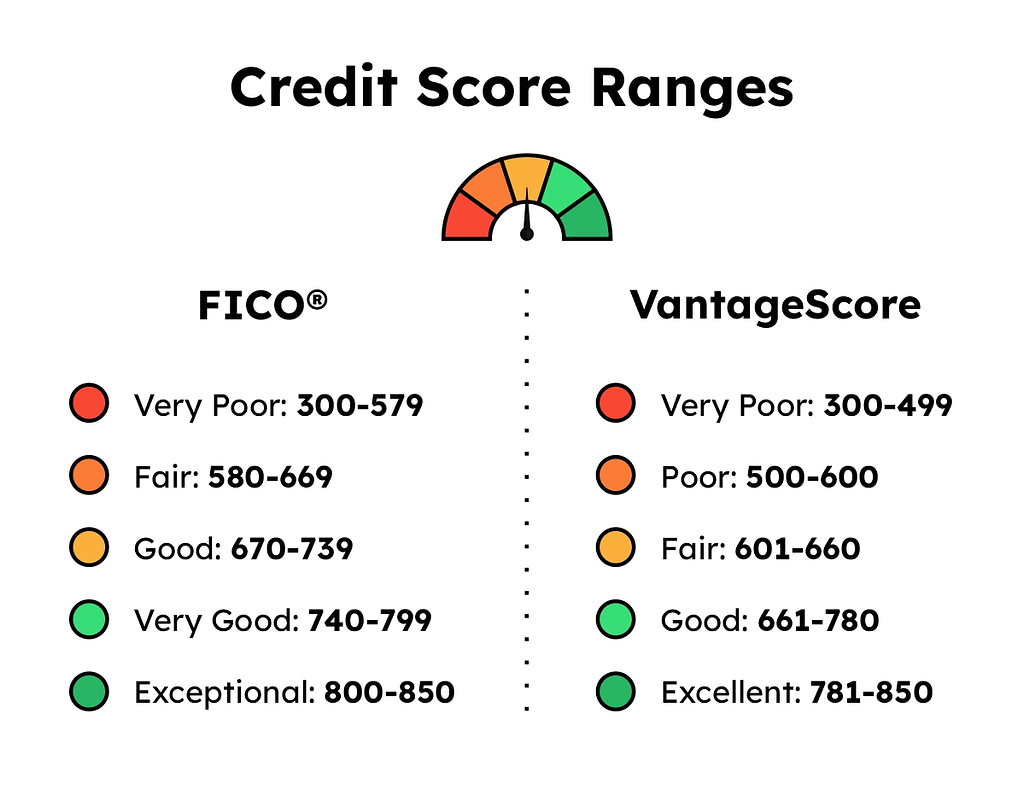

Understanding how credit scores work is crucial for young adults as they navigate the complexities of the financial world. A credit score is a three-digit number that ranges from 300 to 850 and is calculated based on one’s credit history. Factors such as payment history, amounts owed, length of credit history, new credit accounts, and types of credit used all play a role in determining an individual’s score. By learning about these components early on, students can take steps to build and maintain good credit habits.

One way alternative schooling programs can educate students about credit scores is by explaining the importance of maintaining a good score. A high credit score demonstrates responsible financial behavior and can lead to lower interest rates on loans and better terms on rental agreements. On the other hand, a low credit score can result in higher interest rates or even denials for loans or housing opportunities. By emphasizing these consequences, educators can motivate students to prioritize building healthy credit habits.

Furthermore, alternative education institutions can teach practical strategies for improving one’s credit score. This includes making timely payments on bills and debts, keeping balances low on revolving credit accounts like credit cards, avoiding opening multiple new accounts at once, and regularly monitoring one’s credit report for errors or fraudulent activity. By empowering students with this knowledge early on, they can proactively manage their finances and work towards achieving their long-term goals.

In addition to discussing how to improve one’s score, alternative schools could also delve into the implications of different types of debt on one’s overall financial health. For example, student loans are often necessary for pursuing higher education but can significantly impact one’s finances post-graduation if not managed wisely. Educating students about the long-term effects of various forms of debt allows them to make informed decisions when borrowing money.

Moreover, integrating real-world examples into lessons about credit scores can make the content more relatable and engaging for students. Sharing personal anecdotes or case studies illustrating how individuals have overcome challenges related to poor credit or leveraged good credit to achieve their goals can foster deeper understanding among learners. Additionally, interactive activities such as budgeting simulations or mock loan applications can help reinforce key concepts while providing hands-on experience.

Alternative schooling programs also have the opportunity to invite guest speakers from financial institutions or organizations specializing in consumer advocacy to share insights on managing finances responsibly. These experts can offer valuable perspectives beyond traditional classroom teachings and provide up-to-date information on industry trends or regulations that may affect students’ financial decisions.

Ultimately,the inclusion of lessons oncredit scoresin alternative educational settings has far-reaching benefits.By equippingstudentswith knowledgeto navigatethecomplexitiesofcreditandfinancial management,youthis empoweredto makewell-informeddecisionsabouttheirfinanceswhileworkingtowardsa securefinancial future.Learningaboutcredit scorsisnotjustanexerciseinfiscalresponsibilitybutalsoapowerfultoolfor personal empowermentandlong-term successinthe moderneconomy.

Leave a comment