Managing student expenses can be a challenging task for many students, especially those who may not have experience with budgeting or financial planning. However, with some careful planning and smart strategies, it is possible to navigate the costs of education without breaking the bank. Whether you are attending a traditional college or pursuing alternative schooling options, here are some tips to help you manage your expenses effectively.

Q: What are some common expenses that students need to budget for?

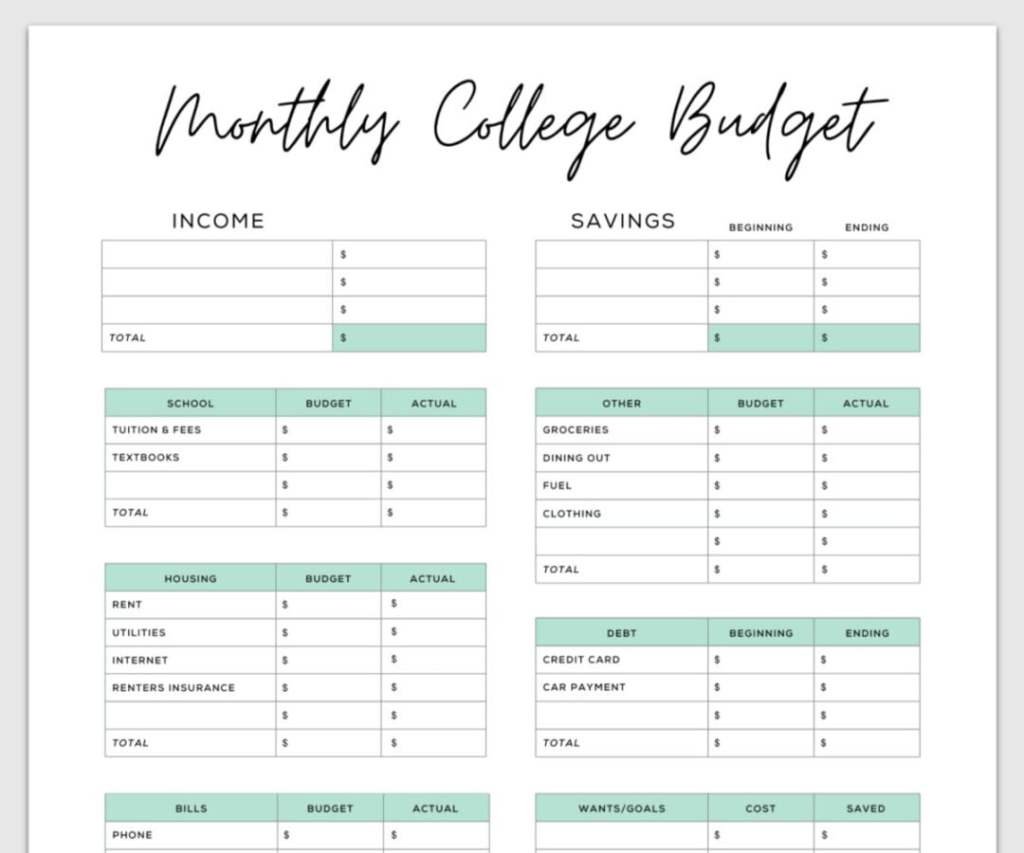

A: Students typically need to budget for tuition fees, textbooks and course materials, housing or rent, food and groceries, transportation costs (such as public transit or gas money), personal expenses (clothing, toiletries), entertainment and social activities. Additionally, there may be miscellaneous fees related to extracurricular activities or academic supplies that should also be considered when creating a budget.

Q: How can students create an effective budget?

A: The first step in creating a budget is to track all sources of income and expenses. This includes any financial aid or scholarships received, part-time job earnings, parental support, etc. Next, list out all anticipated monthly expenses and prioritize them based on necessity. Allocate specific amounts for each category while keeping in mind that unexpected costs may arise. It’s important to review and adjust the budget regularly as circumstances change.

Q: Are there any tools or apps that can help students manage their finances?

A: Yes! There are several apps available that can assist students in managing their finances more efficiently. Some popular ones include Mint, YNAB (You Need A Budget), PocketGuard, and GoodBudget. These apps allow users to track spending habits, set savings goals, categorize expenses easily and even receive alerts for upcoming bills.

Q: How can students save money on textbooks?

A: Textbooks can be a significant expense for many students but there are ways to reduce these costs. Consider buying used textbooks instead of new ones from campus bookstores; check online marketplaces like Amazon or Chegg for better deals; utilize textbook rental services; explore e-book options which are often cheaper than physical copies; borrow books from the library whenever possible; sell back textbooks at the end of the semester if they won’t be needed again.

Q: What are some strategies for saving money on everyday essentials?

A: To cut down on daily living costs as a student – meal planning can help save money on groceries by avoiding unnecessary purchases; using student discounts whenever possible at stores/restaurants; buying generic brands over name brands for household items; taking advantage of free events/activities provided by schools or local communities instead of expensive outings.

Q: How should students approach managing debt such as student loans responsibly?

A: When taking out loans as part of your education funding plan – it’s crucial to understand repayment terms clearly before committing to borrowing any amount. Try minimizing loan amounts by applying for scholarships/grants first; make sure to pay interest accruing during school if possible so it doesn’t capitalize upon graduation; consider working part-time during school breaks if feasible towards paying off interest/principal early.

In conclusion Managing student expenses requires thoughtful planning , discipline ,and utilizing resources wisely .By following these tips ,students will be better equipped financially throughout their educational journey .

Leave a comment