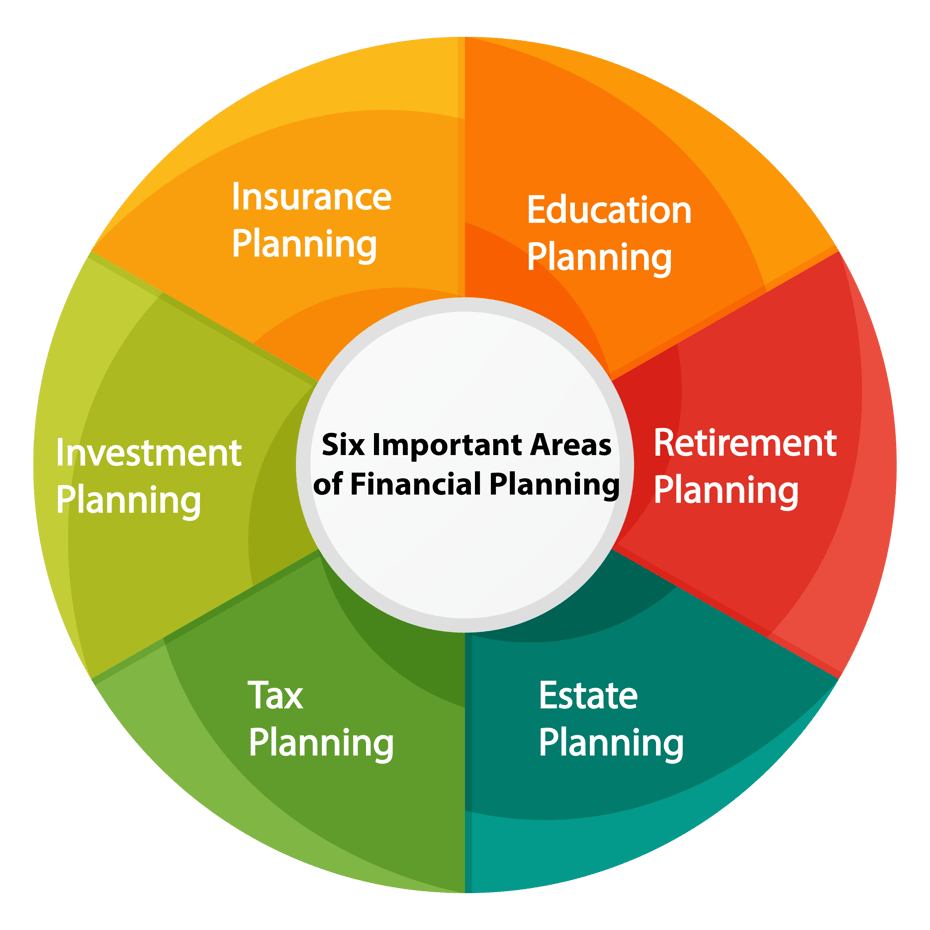

Financial planning is a crucial aspect of preparing for the future, and it’s never too early to start thinking about it. Whether you’re a student in an alternative schooling program or a parent helping your child navigate their educational journey, understanding the basics of financial planning can set you up for long-term success. Here are some key tips to consider when planning for your financial future:

1. Set Clear Goals: The first step in any financial plan is setting clear and achievable goals. These goals could include saving for college tuition, starting a business, buying a home, or building an emergency fund. By identifying your objectives early on, you can create a roadmap to guide your financial decisions.

2. Create a Budget: A budget is essentially a spending plan that outlines how much money you have coming in and where it goes out each month. Start by tracking your expenses and income to get an idea of your current financial situation. Then allocate funds towards essentials like housing, food, utilities, transportation, and savings before considering discretionary spending on things like entertainment or dining out.

3. Save Regularly: Building savings is essential for meeting both short-term and long-term financial goals. Consider setting up automatic transfers from your checking account to a savings account each month to ensure consistent contributions towards your goal.

4. Invest Wisely: Investing is another way to grow wealth over time but requires careful consideration and risk assessment. Explore different investment options such as stocks, bonds, mutual funds, real estate investment trusts (REITs), or retirement accounts like IRAs or 401(k)s based on your risk tolerance and investment timeline.

5. Manage Debt: Student loans, credit card debt, car loans – managing debt is crucial when planning for the future as excessive debt can hinder progress towards achieving financial goals. Develop strategies such as prioritizing high-interest debts first or consolidating multiple debts into one manageable payment plan.

6. Plan for Education Costs: If you’re pursuing alternative education pathways like online courses or vocational training programs after high school rather than traditional college routes, estimating the associated costs will help you plan accordingly.

7.Insure Your Future: Life insurance policies provide protection against unexpected events that could derail your finances such as disability or death while health insurance safeguards against costly medical bills due to illness or injury.

8.Establish an Emergency Fund : An emergency fund acts as a safety net during unforeseen circumstances like job loss or medical emergencies by providing immediate access to funds without having to rely on credit cards or loans.

9.Plan Retirement Savings Early On : Even if retirement seems far off when you’re young ,starting early with small contributions can make significant growth over time thanks due compound interest .Consider employer-sponsored plans , IRAs ,or even investing in index funds .

10.Seek Professional Advice : Financial planners , advisors ,or counselors possess expertise in guiding individuals through various aspects of finance including investments,taxes,budgeting,and more .Consulting with them can provide valuable insights tailored specifically for needs whether they be short term commitments funding education,career transitions ,or long term retirement strategies

11.Review & Adjust Your Plans : As life evolves so should our approach towards finance .Regularly evaluate progress made toward established targets adjust budgets,savings rates,rebalancing portfolios ensuring alignment between current actions desired outcomes

In conclusion establishing sound financial habits at any stage in life serves well not just financially but also emotionally reducing stress providing security leading fulfilling lives whether embarking upon alternative educational paths navigating career changes preparing eventual retirements comprehensive approach enables us face uncertain futures confidence readiness .Start today laying groundwork brighter tomorrow !

Leave a comment