Credit Scores and Reports: Unraveling the Mystery

In today’s society, credit scores and reports play a significant role in our financial lives. They are used by lenders, landlords, insurance companies, and even employers to determine our creditworthiness. But what exactly are these credit scores and reports? How do they affect us? And most importantly, how can we improve them?

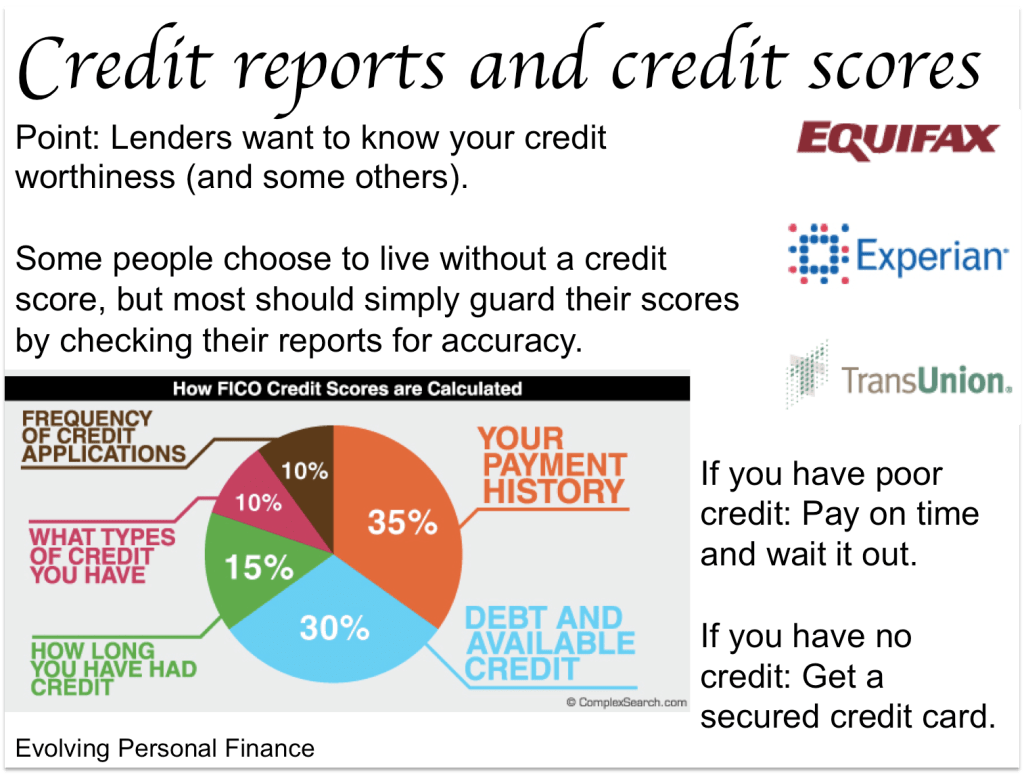

A credit score is a three-digit number that represents an individual’s creditworthiness. It serves as a snapshot of their financial history and predicts the likelihood of them repaying debts responsibly. The most commonly used scoring model is the FICO score, which ranges from 300 to 850. The higher the score, the better your chances of securing favorable interest rates on loans or getting approved for rental agreements.

To understand your creditworthiness fully, it’s crucial to examine your credit report. A credit report is a detailed record of your financial behavior compiled by one or more major credit bureaus—Equifax, Experian, and TransUnion. It includes information such as personal details (name, address), account history (credit cards, loans), payment history (missed payments), public records (bankruptcies), and inquiries made by potential creditors.

Your payment history has the most significant impact on your overall credit score – approximately 35%. Consistently making timely payments shows responsible borrowing behavior while missed or late payments can significantly damage your score over time. Other factors influencing your score include amounts owed (30%), length of credit history (15%), new accounts opened (10%), and types of credits used (10%).

Improving one’s credit score may seem like an intimidating task but rest assured; it can be done with dedication and patience. Start by obtaining copies of all three major reports annually from AnnualCreditReport.com—a free service offered by federal law—so you can review them for any errors or discrepancies.

If there are inaccuracies, you have the right to dispute them with the credit bureaus. Once any discrepancies are rectified, focus on making timely payments and reducing outstanding debts. Paying bills on time is crucial as late or missed payments can stay on your report for up to seven years.

Another way to improve your credit score is by maintaining a low credit utilization ratio. This ratio represents how much of your available credit you are utilizing at any given time. Keeping this ratio below 30% demonstrates responsible borrowing behavior and can positively impact your score.

Building positive credit history also involves keeping old accounts open, even if they’re not actively used. The length of your credit history plays a role in determining your overall score, so closing older accounts may negatively affect it.

Lastly, be cautious about opening new lines of credit frequently as this can indicate financial instability to lenders and potentially harm your score. Instead, focus on diversifying the types of credits you have—such as having both installment loans and revolving lines of credit—to show that you can handle different types of debt responsibly.

Understanding the importance of credit scores and reports empowers individuals to take control over their financial lives. By ensuring accuracy in reports, making timely payments, managing debts responsibly, and being mindful about opening new accounts or closing old ones unnecessarily – anyone can improve their chances for better rates on loans or rental agreements while gaining peace of mind in their financial journey.

Leave a comment