Sector rotation is a popular investment strategy that involves shifting investments from one sector of the economy to another in order to take advantage of changing market conditions. This approach aims to capitalize on sectors that are expected to outperform while avoiding those that may underperform.

The concept behind sector rotation is based on the idea that different sectors of the economy perform better or worse at different stages of the economic cycle. As such, investors can potentially enhance their returns by reallocating their investments between sectors accordingly.

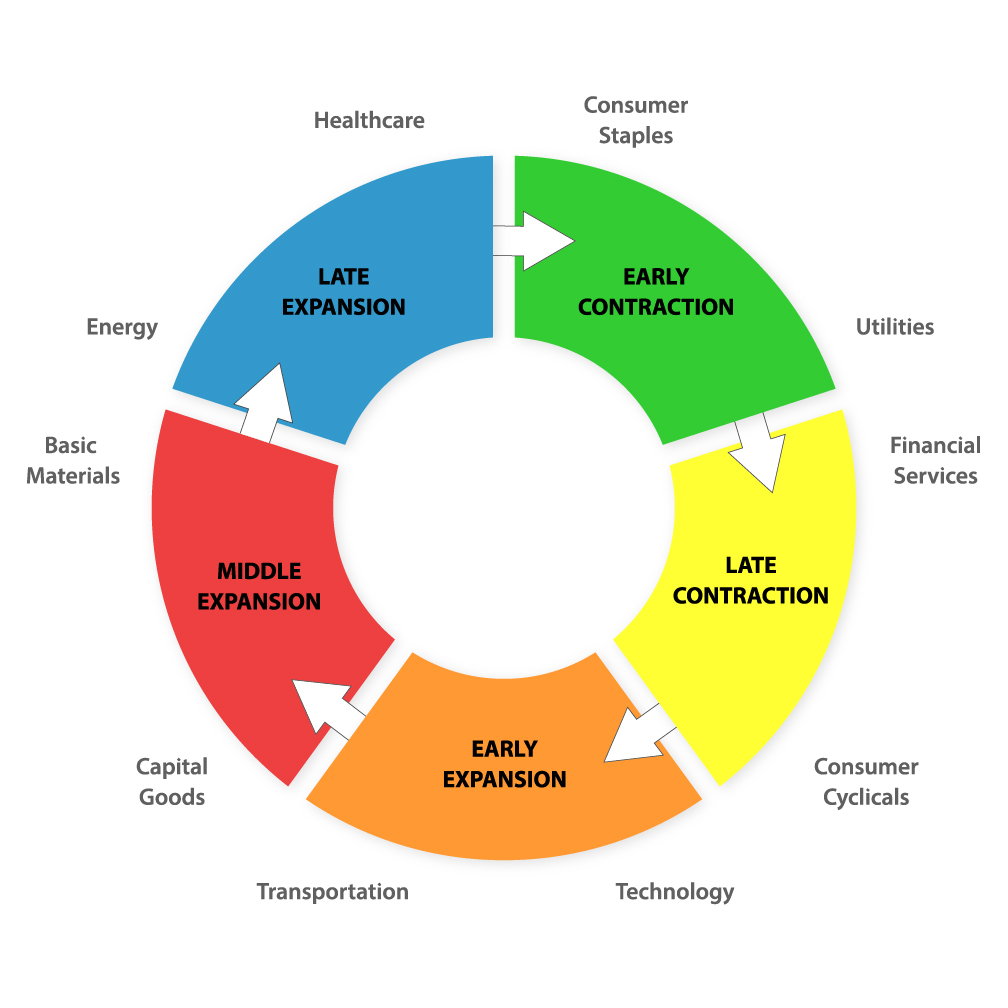

To effectively implement this strategy, investors must first understand how sectors perform in relation to economic cycles. Typically, there are four main phases: expansion, peak, contraction (also known as recession), and trough (or recovery).

During an expansion phase, sectors such as technology, consumer discretionary, and industrials tend to perform well as consumer spending increases and businesses invest in growth opportunities. These sectors benefit from higher demand for goods and services and increased business activity.

As an economy reaches its peak phase, signs of slowing growth start emerging. Sectors like utilities and consumer staples become more attractive during this period as they offer stability and consistent dividends even when overall market performance starts declining.

When an economy goes into contraction or recession mode characterized by negative GDP growth rates and rising unemployment levels, defensive sectors like healthcare and consumer staples often fare better than other industries due to their essential nature. Healthcare tends to remain relatively stable regardless of economic conditions since people still require medical services even during tough times.

Finally, during a recovery or trough phase where the economy begins showing signs of improvement after a recessionary period, cyclical industries such as financials, materials, and energy tend to outperform others. These industries typically experience strong rebounds once confidence returns among investors.

It’s important for investors not only to recognize these various phases but also identify key indicators signaling transitions between them. Economic data points such as GDP growth rates, inflation levels, job reports along with corporate earnings announcements can provide valuable insights into the current economic cycle.

One common approach to sector rotation is a top-down analysis. In this method, investors begin by analyzing the overall macroeconomic environment and then select sectors that are expected to outperform based on economic indicators, industry trends, and market sentiment. This analysis can help determine which sectors are likely to benefit from prevailing conditions.

Another popular approach is a bottom-up analysis where investors focus on individual companies within each sector. This method involves identifying undervalued or high-quality stocks regardless of their respective sectors. By carefully selecting stocks with strong fundamentals and growth potential, investors aim to generate positive returns irrespective of broader market conditions.

It’s worth noting that sector rotation strategies require active management as they involve frequent adjustments in portfolio allocations. Investors must continuously monitor economic data and market trends to identify when it’s appropriate to shift investments from one sector to another.

While sector rotation has the potential for enhanced returns, it also carries risks. Accurately predicting economic cycles can be challenging as unforeseen events like recessions or global crises may disrupt traditional patterns. Additionally, sudden shifts in investor sentiment can lead to rapid changes in sector performance, making it difficult for investors to react quickly enough.

To mitigate these risks, diversification across different sectors is crucial. A well-diversified portfolio reduces exposure to any single sector’s performance and helps smooth out volatility during changing market conditions.

Exchange-traded funds (ETFs) provide an efficient way for investors to implement a sector rotation strategy without having to invest directly in individual stocks within each industry. ETFs allow investors access to a basket of securities within a particular sector while providing liquidity and cost-effective investment options.

In conclusion, implementing a well-informed sector rotation strategy requires careful analysis of economic cycles along with an understanding of how different industries perform during various phases. By actively reallocating investments between sectors based on prevailing conditions, investors have the potential for enhanced returns while managing risk through diversification. However, it’s essential to recognize the inherent challenges and uncertainties associated with predicting economic cycles accurately.

Leave a comment