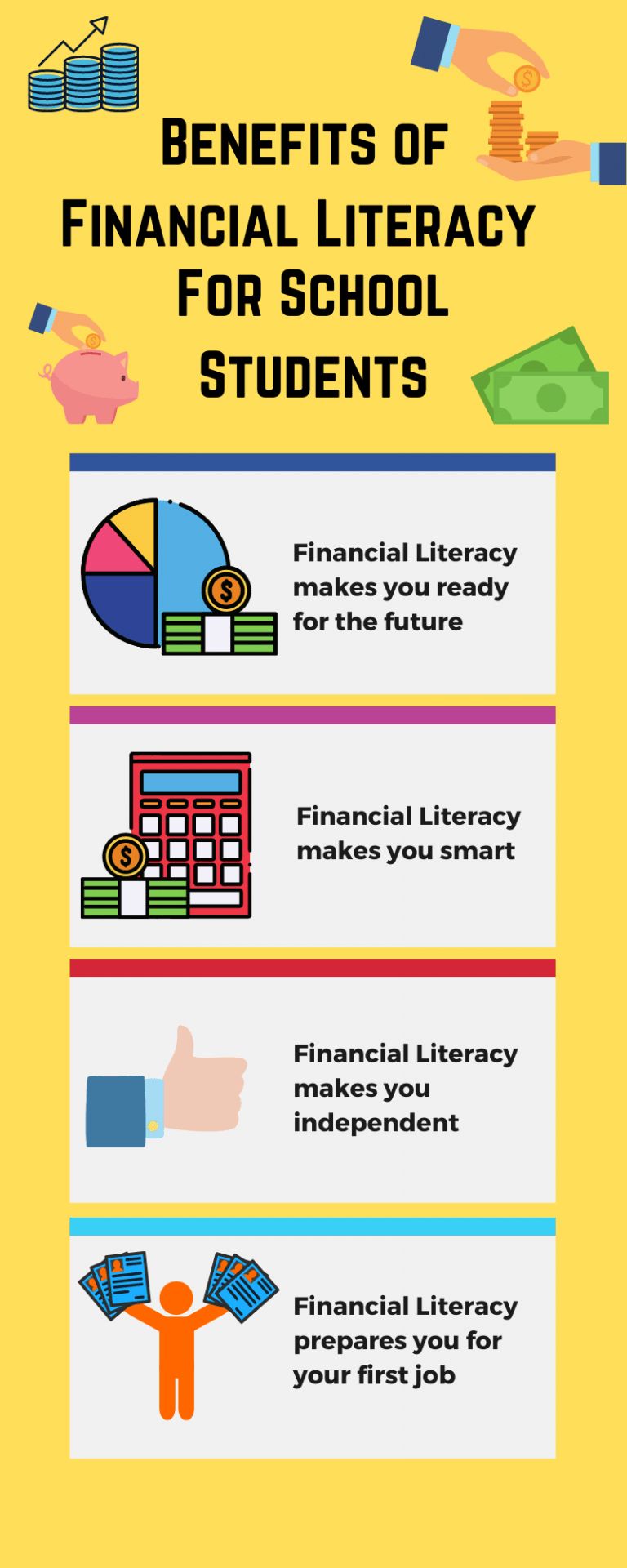

Financial literacy is an essential life skill that should be taught to individuals from a young age. It refers to the ability to understand and effectively manage personal finances, including budgeting, saving, investing, and making informed financial decisions. Unfortunately, traditional education systems often lack comprehensive financial literacy programs. This has led to a growing interest in alternative schooling and education methods that prioritize teaching practical skills like financial literacy.

One of the key reasons why financial literacy should be emphasized in education is its impact on individual well-being. When people are equipped with the knowledge and skills to make sound financial decisions, they are more likely to achieve financial stability and security throughout their lives. Financially literate individuals can create budgets, manage debt responsibly, save for emergencies or future goals, and invest wisely.

Moreover, financial literacy plays a crucial role in promoting economic growth at both individual and societal levels. A financially literate population contributes to a healthier economy by making informed consumer choices that drive demand for goods and services while also fostering responsible borrowing practices that reduce the risk of economic downturns caused by excessive debt.

Alternative schooling models have recognized the importance of incorporating financial literacy into their curricula. These models often provide experiential learning opportunities where students can apply their knowledge practically through activities such as managing mock bank accounts or participating in simulated investment games. By engaging students actively in real-world scenarios, these alternative approaches help develop practical money management skills early on.

In addition to traditional classroom settings, online platforms have emerged as valuable resources for teaching financial literacy outside of formal education systems. These platforms offer interactive modules tailored for different age groups or specific topics within finance such as credit card management or retirement planning. They allow learners to progress at their own pace while providing access to up-to-date information relevant to today’s rapidly changing economic landscape.

Financial institutions also play a role in promoting financial literacy through partnerships with schools or community organizations. These collaborations involve providing workshops or seminars on various aspects of personal finance, such as budgeting, saving for college, or understanding credit scores. By leveraging their expertise and resources, financial institutions can contribute to building a financially literate society.

In summary, financial literacy is an essential skill that should be incorporated into education systems to empower individuals with the knowledge and skills necessary to make informed financial decisions. Alternative schooling methods have recognized this need and are actively incorporating financial literacy into their curricula through experiential learning opportunities. Online platforms and collaborations with financial institutions further enhance access to financial education outside of traditional classroom settings. By prioritizing the teaching of practical skills like financial literacy, we can equip individuals with the tools they need to achieve long-term financial well-being and contribute positively to economic growth.

Leave a comment