Understanding Interest Rates and Compound Interest

Introduction

Interest rates and compound interest are important concepts that play a significant role in our financial lives. Whether you’re taking out a loan, investing in stocks or bonds, or saving money in a bank account, understanding how interest rates work is crucial. In this article, we will delve into the intricacies of interest rates and compound interest to help you gain a better understanding of these fundamental aspects of personal finance.

What Are Interest Rates?

Interest rates represent the cost of borrowing money or the return on investment for lending money. These rates are typically expressed as a percentage over a certain period, such as annually or monthly. When you borrow money from someone or an institution (such as a bank), they charge you an interest rate for using their funds. On the other hand, when you deposit your money into savings accounts or invest it in various instruments, you earn interest.

Types of Interest Rates

There are two main types of interest rates: fixed and variable.

1. Fixed Interest Rate: A fixed-interest rate remains constant throughout the loan tenure or investment period. This means that your monthly payments (if borrowing) or earnings (if investing) remain stable over time.

2. Variable Interest Rate: A variable-interest rate fluctuates based on changes in market conditions, economic factors, or benchmark rates set by central banks. If your loan has a variable rate, your monthly payments may increase or decrease depending on these variables.

Compound Interest Explained

Compound interest refers to earning additional income on both the initial principal amount and any accumulated interest from previous periods. Unlike simple interest where only the principal earns returns each period, compound interest allows investors to benefit from exponential growth over time.

The Formula for Compound Interest

The formula for calculating compound interest is:

A = P(1 + r/n)^(nt)

Where:

– A represents the total amount after compounding

– P is the principal amount initially invested or borrowed

– r is the annual interest rate (expressed as a decimal)

– n represents the number of times compounding occurs per year

– t is the duration in years

To better understand compound interest, let’s consider an example:

Suppose you deposit $10,000 into a savings account that offers an annual interest rate of 5%. The bank compounds the interest quarterly (n = 4), and you plan to leave your money untouched for five years.

Using the formula mentioned above, we can calculate the future value of our investment:

A = $10,000(1 + 0.05/4)^(4*5)

A = $12,763.57

This means that after five years at a compounding interest rate of 5%, your initial $10,000 investment will grow to approximately $12,763.57.

The Power of Compound Interest

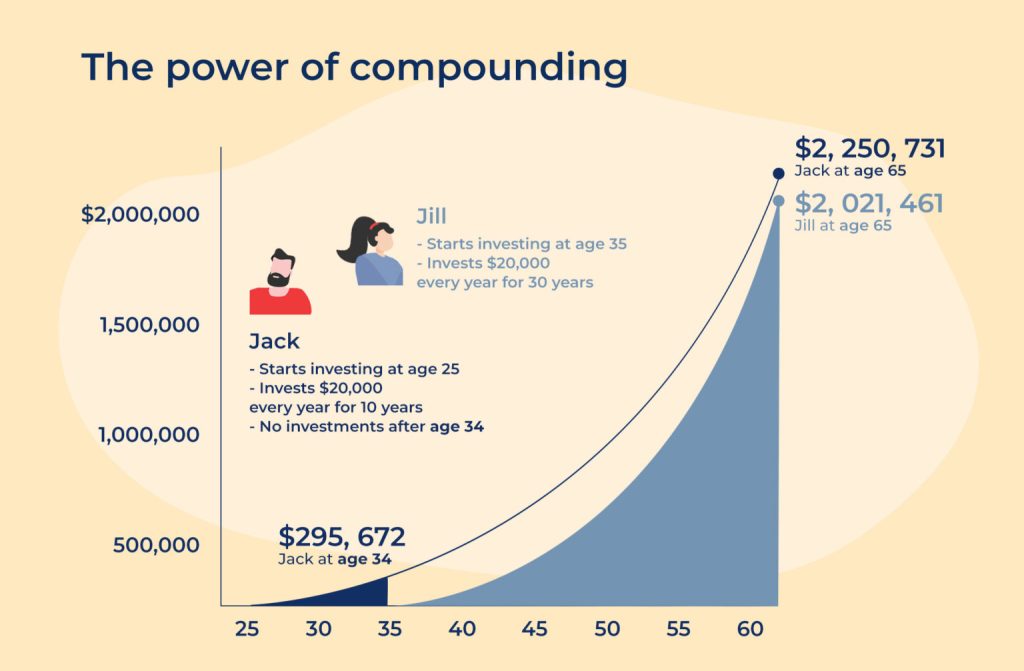

Compound interest has been famously referred to as “the eighth wonder of the world” by renowned physicist Albert Einstein. Its power lies in its ability to generate wealth over time through exponential growth.

The longer you invest or save with compound interest working in your favor, the greater your returns will be. This concept is particularly crucial when it comes to retirement planning since starting early can significantly impact the size of your nest egg due to compound growth.

However, compound interest can also work against you if you’re carrying debt with high-interest rates. Credit card debts or loans with compounding interests can quickly accumulate and become overwhelming if not managed properly.

Factors Affecting Interest Rates

Several factors influence both borrowing and lending rates:

1. Inflation: When prices rise consistently over time due to inflationary pressures, central banks may increase their benchmark rates to curb inflation. Higher inflation often leads to higher borrowing costs for consumers and businesses alike.

2. Central Bank Policies: Central banks play a vital role in setting monetary policies that influence interest rates. By adjusting these rates, central banks can control the money supply and stimulate or slow down economic growth.

3. Creditworthiness: Individual borrowers’ credit scores, financial history, and overall creditworthiness impact the interest rates offered to them by lenders. Those with excellent credit profiles typically receive lower interest rates compared to individuals with poor credit scores.

Conclusion

Understanding interest rates and compound interest is essential for making informed financial decisions. Whether you’re saving for retirement, investing in stocks or bonds, or taking out a loan, knowing how these concepts work will help you maximize your gains while minimizing your costs. By harnessing the power of compound growth and staying informed about market conditions and central bank policies, you can navigate the world of personal finance more effectively and achieve your long-term goals.

Leave a comment