When it comes to financial planning, it’s never too early or too late to start. Whether you’re a student, parent, or educator in the alternative schooling and education community, having a solid financial plan is essential for securing your future.

One of the first steps in financial planning is setting goals. Identify what you want to achieve financially, whether it’s saving for college tuition fees, paying off student loans, or building an emergency fund. Once you have clear objectives in mind, break them down into smaller milestones and create a timeline for each.

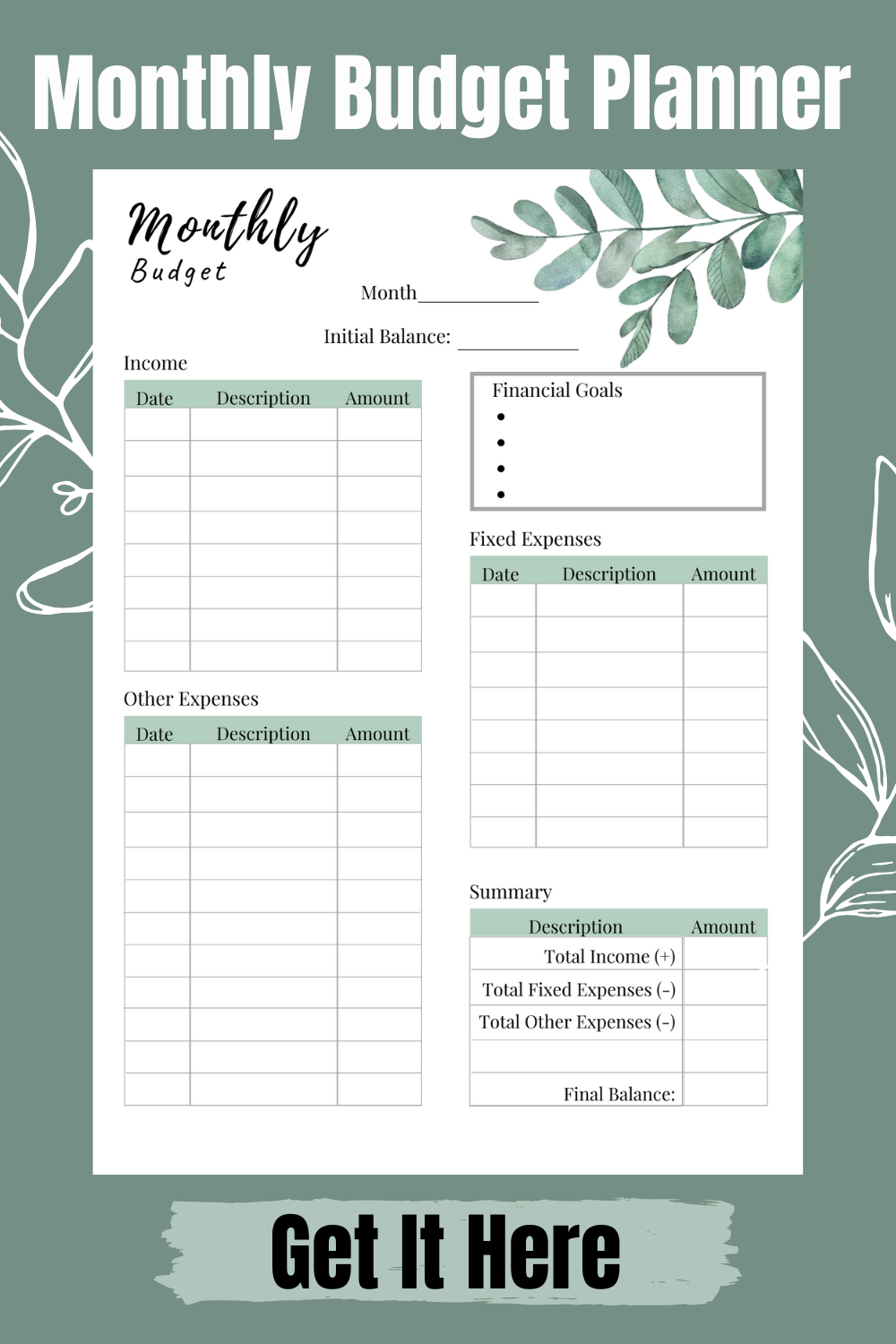

Budgeting is another crucial aspect of financial planning. Track your income and expenses diligently to understand where your money goes each month. This will help identify areas where you can cut back on unnecessary spending and allocate more towards savings or debt repayment.

Saving should be a priority regardless of your age or income level. Start by establishing an emergency fund that covers at least three to six months’ worth of living expenses. Afterward, focus on long-term savings such as retirement accounts or investment portfolios.

It’s also important to educate yourself about personal finance and investing. Take advantage of online resources and courses specifically tailored for alternative schoolers and educators seeking knowledge about managing their finances effectively.

Lastly, consider seeking professional advice from a certified financial planner who understands the unique needs and challenges faced by individuals in alternative schooling communities.

Financial planning may seem overwhelming initially but taking small steps consistently will lead to significant progress over time. By implementing these strategies into your life now, you’ll be better equipped to achieve your financial goals while securing a brighter future for yourself and those around you within the alternative schooling community.

Leave a comment