Financial Literacy: Equipping Students for a Lifetime of Smart Money Management

Introduction

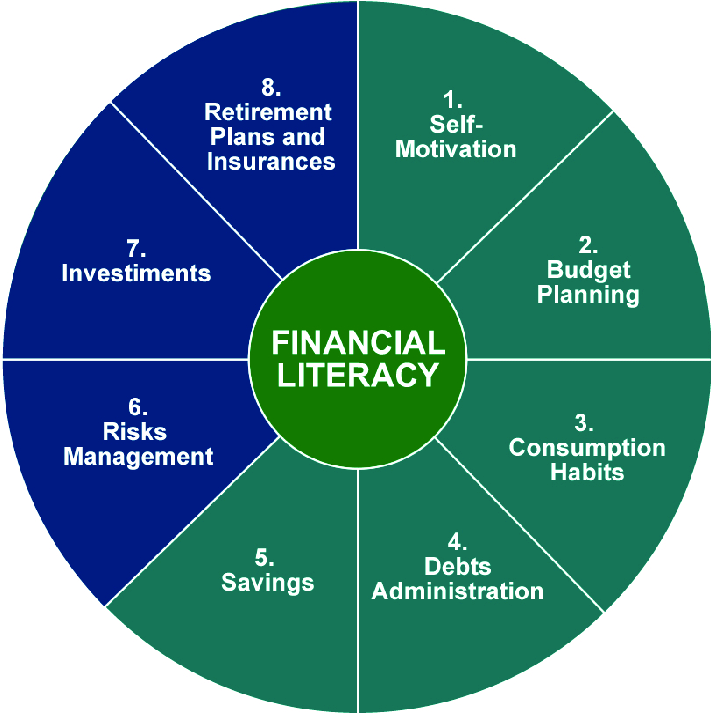

In today’s complex and ever-changing financial landscape, it is essential for individuals to possess a solid understanding of personal finance. Financial literacy is the knowledge and skills required to make informed decisions about money matters, such as budgeting, saving, investing, and managing debt. While traditional schooling often overlooks this critical aspect of education, alternative schooling and education platforms have recognized its importance in shaping students’ future success.

Why Financial Literacy Matters

1. Empowering Individuals

Financial literacy empowers individuals by equipping them with the necessary tools to navigate their financial lives successfully. It allows people to take control of their finances rather than being controlled by them. With financial literacy, individuals can set realistic goals, develop effective budgeting techniques, avoid unnecessary debt, save for emergencies and retirement effectively, invest wisely, and make informed decisions about purchasing goods or services.

2. Enhancing Economic Stability

A lack of financial literacy can contribute to economic instability on both an individual and societal level. Without understanding concepts like interest rates or credit scores, individuals may find themselves stuck in cycles of debt or unable to access loans when needed. This leads to financial stress that impacts mental health and overall well-being.

On a broader scale, low levels of financial literacy among citizens can hinder economic growth as people struggle with basic money management skills. By promoting financial literacy early on through alternative schooling methods, we can help create more financially stable communities while fostering economic growth.

3. Fostering Entrepreneurship

Financial literacy plays a vital role in fostering entrepreneurship by providing aspiring entrepreneurs with the necessary tools to succeed in business ventures. Understanding how to manage cash flow effectively is crucial for startups’ survival during challenging times when revenue might be limited initially.

Moreover, entrepreneurial ventures require careful planning regarding investment decisions and risk assessment – both concepts rooted in financial literacy fundamentals. By instilling these principles early on, alternative schooling and education platforms can contribute to a thriving entrepreneurial ecosystem.

4. Bridging the Wealth Gap

The wealth gap remains a significant issue in society, with certain groups facing disproportionate challenges when it comes to financial stability. Financial literacy can help bridge this gap by providing individuals with the knowledge and skills necessary to make sound financial decisions regardless of their socioeconomic background.

Alternative schools and education platforms have an opportunity to address this disparity by offering comprehensive financial literacy programs that cater specifically to underserved communities. By equipping students from all backgrounds with these essential skills, we can work towards creating a more equitable society.

Integrating Financial Literacy into Alternative Education

1. Early Introduction

Financial literacy should be introduced early on in alternative education settings. By incorporating age-appropriate curriculum at each educational stage, students develop a solid foundation for understanding money matters as they progress through their academic journey.

For example, at the elementary level, basic concepts like earning money through chores or allowances and saving for desired items can be taught through interactive activities or games. As students transition into middle school, topics such as budgeting, credit cards, and banking services could be covered more comprehensively.

2. Real-World Applications

To make financial literacy engaging and applicable to daily life, alternative schools should emphasize real-world applications of theoretical concepts. This could include practical exercises such as creating personal budgets based on hypothetical income scenarios or exploring investment options using virtual trading platforms.

Furthermore, guest speakers from various professions within the finance industry – such as financial advisors or bankers – can provide valuable insights into how financial literacy relates directly to career paths and professional success.

3. Experiential Learning Opportunities

Experiential learning opportunities are invaluable when it comes to developing financial acumen among students. Alternative schooling programs can organize field trips to local banks or invite professionals from different industries for workshops on topics like investing or starting one’s own business.

Additionally, encouraging students to participate in financial literacy competitions or simulations can help them apply their knowledge in real-world scenarios. These hands-on experiences solidify understanding and build confidence in managing personal finances.

4. Parental Involvement

Incorporating parents into the financial literacy education process is crucial for maximizing its impact. Alternative schools should encourage parental involvement through workshops, seminars, or online resources that provide strategies for teaching and reinforcing financial concepts at home.

By fostering a partnership between alternative education platforms, students, and parents, we create a holistic approach to financial literacy that extends beyond the classroom walls.

Conclusion

Financial literacy is an essential life skill that empowers individuals to make informed decisions about money matters throughout their lives. By integrating comprehensive financial education into alternative schooling and education platforms, we equip students with the tools they need to navigate the complexities of personal finance successfully.

Alternative schools have a unique opportunity to bridge the gap where traditional educational systems fall short by prioritizing this critical aspect of education. Through early introduction, real-world applications, experiential learning opportunities, and parental involvement, alternative schooling can empower students from all backgrounds to achieve long-term financial stability while contributing to economic growth and societal equity.

Leave a comment