Financial Aid Options for Early College Students

As more students choose alternative paths to education, early college programs have become increasingly popular. These programs allow high school students to earn college credits while still in high school, providing them with a head start on their higher education journey. However, the cost of early college can be a concern for many families. Thankfully, there are various financial aid options available to help offset these expenses and make early college more accessible.

Scholarships are one of the most common forms of financial aid available to early college students. Scholarships can be awarded based on academic achievements, extracurricular involvement, leadership skills, or other talents and interests. Many organizations offer scholarships specifically designed for high school students participating in early college programs. Researching and applying for these scholarships can significantly reduce the financial burden associated with pursuing an early college education.

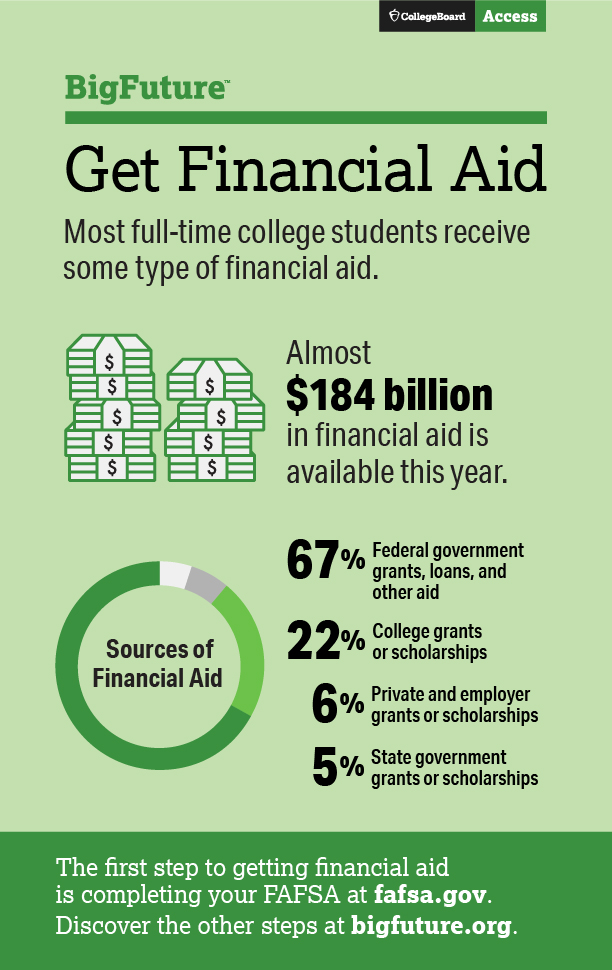

Grants are another type of financial assistance that can help cover the costs of early college. Unlike loans, grants do not need to be repaid and are typically awarded based on financial need. The federal government offers several grant programs such as the Pell Grant and Federal Supplemental Educational Opportunity Grant (FSEOG). Additionally, state governments may provide their own grant opportunities for eligible students.

Work-study programs can also be beneficial for early college students looking to fund their education. These programs allow students to work part-time while attending classes in order to earn money towards their educational expenses. Work-study positions may be available both on-campus and off-campus, providing valuable work experience along with financial support.

Another option is taking advantage of dual enrollment tuition discounts offered by some colleges or universities. Dual enrollment allows high school students enrolled in an accredited institution to take courses at a partnering higher education institution at a reduced rate or even free of charge. This arrangement enables students to save money by earning both high school and college credit simultaneously.

It’s important for early college students and their families to explore all available financial aid options. Students should start by filling out the Free Application for Federal Student Aid (FAFSA), which determines their eligibility for federal grants, loans, and work-study programs. Additionally, researching scholarships specific to early college students and reaching out to financial aid offices at colleges or universities can provide valuable information about other potential funding sources.

In conclusion, while the cost of early college may initially seem daunting, there are numerous financial aid options available to help alleviate this burden. Scholarships, grants, work-study programs, and dual enrollment tuition discounts are all avenues that can make pursuing an early college education more affordable. By taking advantage of these opportunities and being proactive in seeking financial assistance, high school students can embark on their higher education journey without excessive financial strain.

Leave a comment