Personal finance is an essential aspect of adult life that many people struggle with. From budgeting and saving to investing and managing debt, it can be overwhelming to keep track of your financial health. Thankfully, personal finance apps and tools have emerged as a solution to help individuals effectively manage their money.

In this article, we will explore some of the best personal finance apps and tools available today. These applications are designed to simplify financial management, provide valuable insights into spending habits, and help users achieve their long-term financial goals.

Mint:

Mint is one of the most popular personal finance apps available. It allows users to connect all their financial accounts – bank accounts, credit cards, loans – in one place for a comprehensive overview of their finances. Mint automatically categorizes transactions and provides customizable budgeting features that allow users to set spending limits for different categories such as groceries or entertainment.

One standout feature of Mint is its ability to send alerts when bills are due or if you exceed your budget in a particular category. This helps users stay on top of their bills and avoid overspending.

YNAB (You Need A Budget):

YNAB takes a unique approach to budgeting by emphasizing proactive planning rather than tracking expenses after they occur. Users assign every dollar they earn to specific categories such as rent/mortgage, groceries, utilities, etc., ensuring that every penny has a purpose. YNAB encourages users to prioritize savings goals while also addressing immediate expenses.

The app provides real-time synchronization across multiple devices so that you can access your budget from anywhere at any time. The built-in reporting feature offers detailed insights into spending patterns over time, enabling users to make informed decisions about where adjustments need to be made.

Acorns:

Acorns is an investment app that aims at making investing more accessible for everyone by automating the process through round-up savings. Whenever you make a purchase using linked debit or credit cards connected with Acorns, the app rounds up the transaction to the nearest dollar and invests the spare change into a diversified portfolio of stocks and bonds.

Acorns offers five different investment portfolios based on your risk tolerance, allowing users to start investing with as little as $5. The app also provides educational content to help users understand investing concepts better.

Personal Capital:

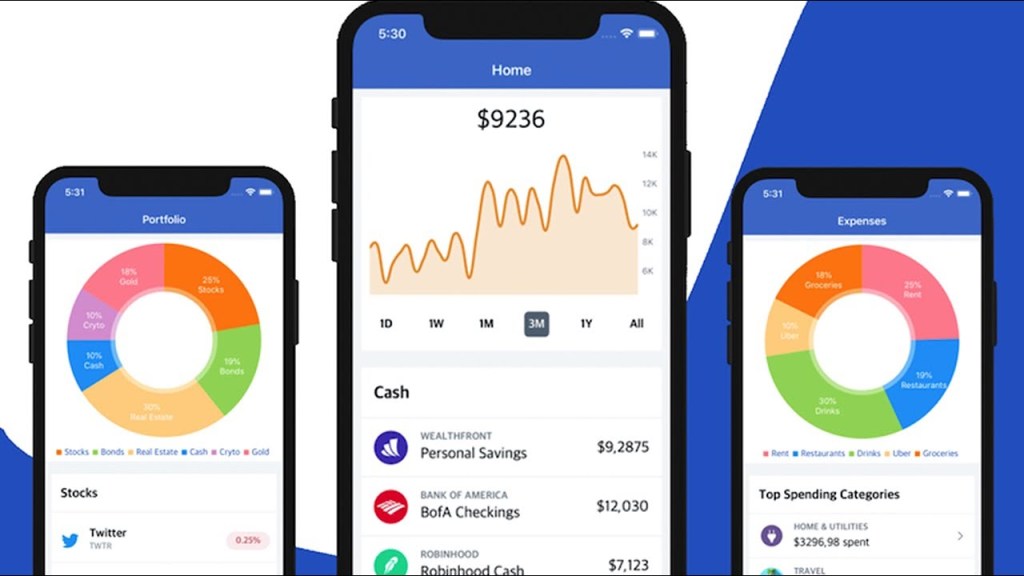

Personal Capital is an all-in-one financial management tool that combines budgeting, investment tracking, retirement planning, and wealth management services. It syncs with all your financial accounts to provide a comprehensive overview of your net worth in real-time.

One standout feature of Personal Capital is its investment tracking capabilities. It analyzes the asset allocation, fees, and performance of your investments while providing recommendations on how to optimize your portfolio. Additionally, it offers retirement planning tools that project whether you are on track for meeting your long-term financial goals.

PocketGuard:

PocketGuard focuses primarily on budgeting by giving users an easy-to-understand snapshot of their current financial situation. It connects with bank accounts and credit cards to track income and expenses automatically. Users can set custom spending limits for various categories or create savings goals within the app.

What sets PocketGuard apart is its ability to factor in recurring bills such as rent/mortgage payments or subscription services when calculating available funds for discretionary spending. This helps users avoid overspending while ensuring essential bills are covered each month.

Spendee:

Spendee is a visually appealing expense tracker that allows users to manually input their income and expenses across multiple currency wallets. It provides detailed reports on spending patterns through colorful graphs and charts.

One unique feature of Spendee is its ability to create shared wallets with family members or friends who share expenses such as rent or groceries. This makes it easier to split costs fairly without any confusion or hassle.

In conclusion, personal finance apps have revolutionized how individuals manage their money by simplifying tasks like budgeting, tracking expenses, saving money effectively, and investing wisely. Whether you’re looking for a comprehensive financial management tool or a simple expense tracker, there is an app or tool available to suit your needs. By leveraging these tools, individuals can gain better control over their finances and make informed decisions that will positively impact their long-term financial health.

Leave a comment