Tax Planning: A Guide to Maximizing Your Savings

Introduction:

Tax planning is a crucial aspect of managing your finances effectively. By understanding the tax laws and regulations, you can strategically organize your income, expenses, and investments to minimize the amount of tax you owe. This guide aims to provide an overview of tax planning strategies that can help individuals and families save money and achieve their financial goals.

Understanding Tax Planning:

Tax planning involves analyzing your financial situation from a tax perspective and making informed decisions to legally reduce your overall tax liability. It requires careful consideration of various factors such as income sources, deductions, credits, exemptions, and investment opportunities.

Effective tax planning goes beyond simply filing annual returns; it involves long-term strategies that optimize your financial position while adhering to the existing legal framework. The primary goal is to ensure that you pay only what you owe in taxes—no more, no less.

Benefits of Tax Planning:

1. Reduced Tax Liability: Proper tax planning allows you to take advantage of available deductions, exemptions, credits, and other incentives provided by the government. By minimizing taxable income through legitimate means while maximizing eligible deductions and credits, you can significantly reduce the amount of taxes owed.

2. Increased Savings: Saving on taxes means more money in your pocket. With effective tax planning strategies in place, individuals can allocate these savings towards emergency funds or investments for future growth.

3. Improved Financial Management: Tax planning encourages individuals to review their financial situations regularly. This process provides insights into spending patterns and helps identify areas where adjustments can be made for better budgeting practices.

Key Components of Tax Planning:

1. Adjusting Withholding Taxes: One critical component of effective tax planning is adjusting withholding taxes on Form W-4 (for U.S taxpayers). By carefully assessing personal circumstances such as marital status or dependent eligibility throughout the year rather than waiting until year-end when filing returns—individuals can avoid overpaying on their taxes and increase take-home pay.

2. Strategizing Deductions: Itemizing deductions can be a powerful tool for tax planning. Expenses such as mortgage interest, property taxes, medical expenses, and charitable contributions may be deductible if they exceed the standard deduction amount. Carefully tracking and documenting these expenses can help maximize your deductions.

3. Retirement Contributions: Contributing to retirement accounts like 401(k)s or IRAs not only helps secure your financial future but also provides immediate tax benefits. Contributions made to certain retirement plans are often tax-deductible or have deferred taxes on earnings until withdrawal.

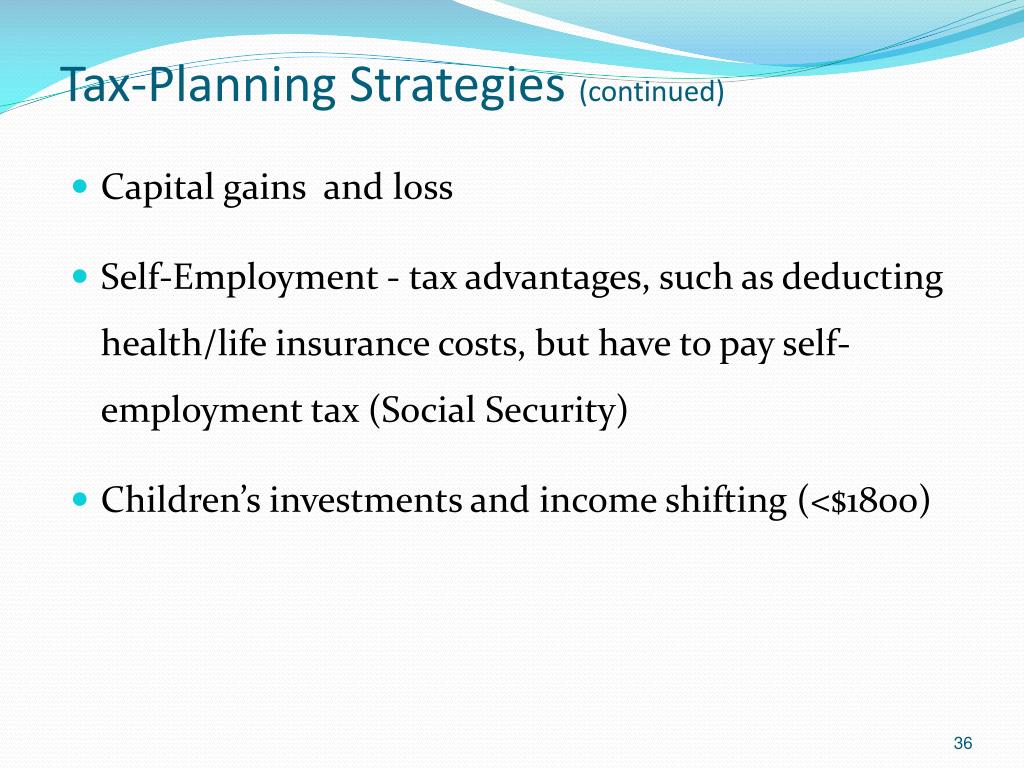

4. Capital Gains Planning: Properly managing capital gains is crucial for minimizing taxes on investment returns. By understanding different holding periods for assets (short-term vs long-term) and utilizing strategies like tax-loss harvesting or gifting appreciated securities instead of cash, individuals can significantly reduce their capital gains tax obligations.

5. Utilizing Tax-Advantaged Accounts: Taking advantage of specialized savings accounts such as Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), or Education Savings Accounts (ESAs) can provide additional opportunities for reducing taxable income while simultaneously saving for specific purposes like healthcare expenses or education costs.

6. Charitable Giving: Donating to recognized charities not only supports causes you care about but also allows you to claim deductions on your tax return. By ensuring that donations meet the criteria set by the Internal Revenue Service (IRS) and properly documenting them, individuals can lower their taxable income while making a positive impact in society.

7. Business Structure Optimization: For entrepreneurs and small business owners, choosing the right business structure—sole proprietorship, partnership, corporation—can have significant implications on taxation. Consulting with professionals who specialize in small business finance ensures that you make informed decisions regarding entity selection while considering factors such as liability protection and potential tax advantages.

Common Mistakes to Avoid:

1. Procrastination: Delaying tax planning until the last minute can lead to missed opportunities for savings. Starting early and staying organized throughout the year ensures that you have enough time to implement effective strategies.

2. Overlooking Tax Law Changes: Tax laws are subject to change, which can impact your tax planning strategies. Regularly reviewing updates and seeking professional advice is essential to stay updated on any changes that may affect your financial decisions.

3. Neglecting Record Keeping: Maintaining accurate records of income, expenses, deductions, and other relevant documents is crucial during tax planning. Poor record-keeping can result in missed deductions or potential audits by tax authorities.

4. Failing to Seek Professional Advice: While some individuals may feel confident handling their taxes independently, consulting with a qualified tax professional or financial advisor can provide valuable insights into complex tax laws and help optimize your financial strategies.

Conclusion:

Tax planning plays a significant role in achieving financial stability and security while minimizing the amount of taxes owed. By proactively strategizing deductions, contributions, investments, and taking advantage of eligible exemptions or credits, individuals can reduce their overall tax liability while increasing savings for future endeavors. Remember that each individual’s situation is unique; therefore, it is crucial to consult with professionals who specialize in taxation or finance when implementing specific strategies tailored to your circumstances. With proper knowledge and careful planning throughout the year, you will be well-prepared come tax season!

Leave a comment