Are you tired of your kids asking for money every time they see something they want? Do you wish they had a better understanding of the value of money and how to manage it? Well, fret no more! Teaching kids about money doesn’t have to be boring or complicated. In fact, with a little creativity and humor, you can turn this important life lesson into a fun and engaging experience. So gather your little ones around and get ready for some financial wisdom disguised as hilarious adventures!

1. The Money Tree

Start by introducing the concept of earning money through work. You can set up a mini “job board” at home where children can choose tasks that match their age level and abilities. Assign different dollar amounts to each job, encouraging them to pick tasks that challenge them while also enabling them to earn enough for their desired purchases.

To make things even more amusing, bring in the “money tree.” This whimsical prop will grow fake dollar bills instead of leaves when your child completes various tasks or chores successfully. It’s an entertaining way to visually demonstrate the connection between effort and reward.

2. Budgeting With Play Money

Once your kids have earned some cash, it’s time to teach them about budgeting. Set up a mock store using old toys or household items priced with play money. Give each child a fixed amount of play cash and let them go shopping.

Encourage them to think critically about what they truly need versus what they merely want by offering tempting but unnecessary items on sale (e.g., toy robots disguised as vegetables). Help guide their choices by discussing needs versus wants and explaining the importance of sticking within their budget.

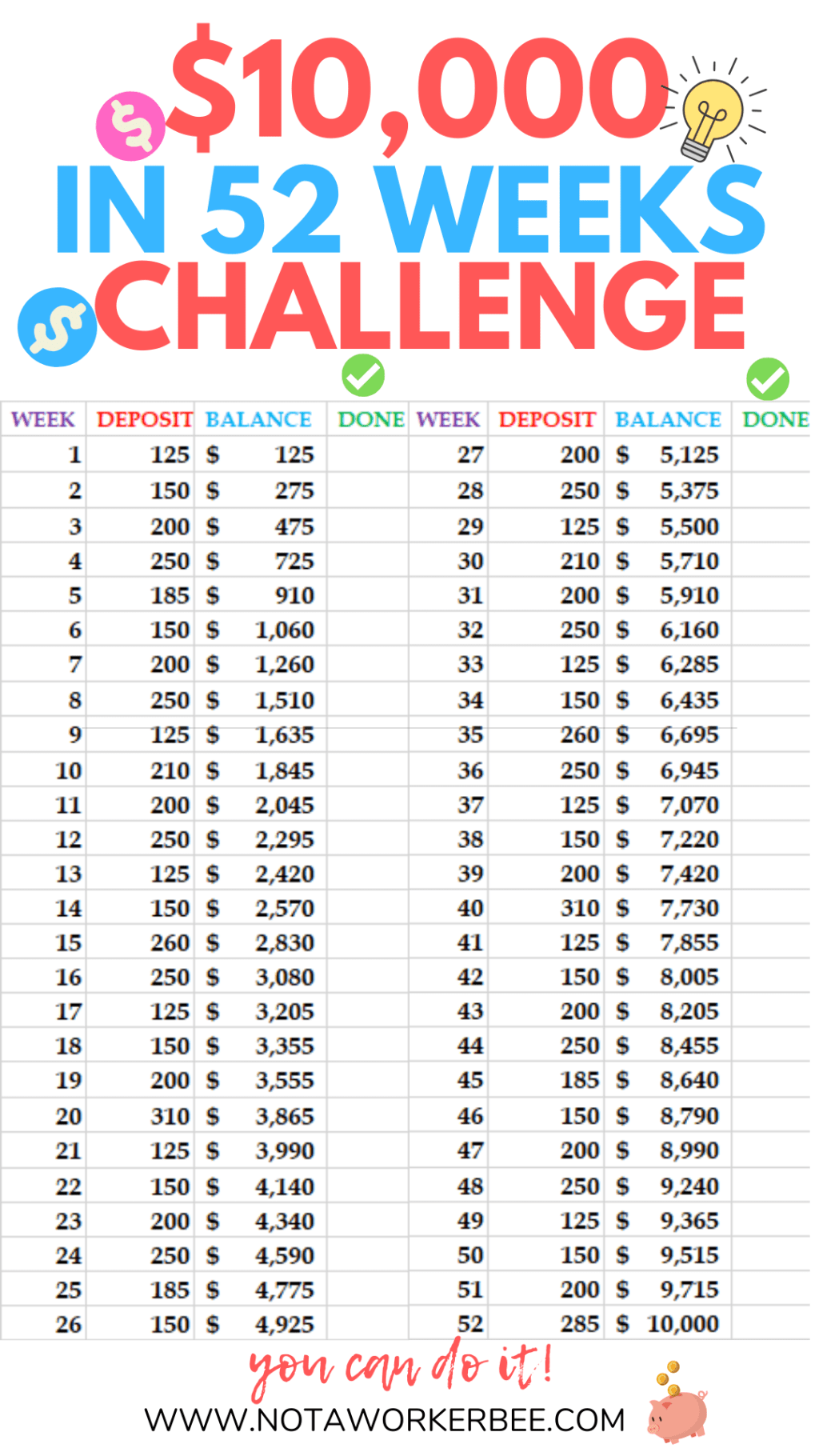

3. The Savings Challenge

Saving money is an essential skill that should be ingrained early on in life. To make it exciting, create a savings challenge game with milestones along the way.

For example, if your child wants to buy a new video game console worth $100, break it down into smaller, achievable goals. Each time they save $10, they unlock a reward like an ice cream outing or a movie night at home. This way, your child gets to enjoy the journey of saving money while learning patience and delayed gratification.

4. The Great Lemonade Stand Adventure

Ah, the classic lemonade stand! It’s not only a nostalgic childhood activity but also an excellent opportunity to teach kids about entrepreneurship and basic financial concepts.

Help your children set up their own lemonade stand in the neighborhood or at local events. Let them decide on pricing, advertising strategies (cue catchy slogans), and even expenses such as purchasing ingredients and materials.

Encourage them to track their earnings versus expenses, teaching them about profit margins and the importance of reinvesting in their business. Plus, this venture will undoubtedly provide countless hilarious memories for years to come!

5. Investing with Monopoly Money

As your children grow older, introduce them to the world of investing by playing a modified version of Monopoly using play money.

Explain how buying properties can generate rental income over time while also providing opportunities for selling at a higher price later on. Discuss stocks and bonds using simplified terms appropriate for their age level.

This game helps develop critical thinking skills as they strategize which investments are wise choices versus risky ones. Who knows? They may end up becoming young financial wizards ready to take on Wall Street someday!

6. DIY Piggy Banks

Why settle for ordinary piggy banks when you can make personalized ones together? Gather some empty containers like jars or shoeboxes and let your kids unleash their creativity by decorating them however they want.

Label each container according to its purpose: “Savings,” “Spending,” “Donations.” Explain that these different compartments represent different ways we allocate our money wisely—saving for future goals, spending responsibly on things we need or truly value, and giving back to others less fortunate.

This hands-on activity allows children to actively engage with the concept of money management while also expressing their artistic side.

7. Money Talks

Lastly, don’t forget to involve your kids in everyday financial discussions. Talk openly about budgeting, saving for big-ticket items, and the importance of making informed purchasing decisions.

While it might initially seem daunting, discussing money matters will help demystify finances and teach your children practical skills they can carry into adulthood. Who knows? They may even offer you some valuable insights or hilarious suggestions along the way!

In conclusion, teaching kids about money doesn’t have to be a dull lecture or a tedious task. By infusing humor and creativity into the process, you can make it enjoyable for both you and your little ones. So grab those jars, set up that lemonade stand, and embark on a laughter-filled journey towards financial literacy!

Leave a comment