Budgeting: An Essential Skill for Alternative Schooling and Education

Introduction

In today’s fast-paced and ever-changing world, alternative schooling and education options have gained popularity due to their flexible and personalized approach. However, amidst the excitement of exploring non-traditional educational paths, it is crucial not to overlook an essential life skill – budgeting. Whether you’re a student or a parent considering alternative education for your child, understanding how to manage finances effectively is vital for long-term success. This article aims to provide a detailed analysis of budgeting within the context of alternative schooling and education.

Why Budgeting Matters in Alternative Schooling

Alternative schooling often offers more freedom in terms of curriculum choices and learning environments. These advantages can lead to increased expenses compared to traditional schools that provide everything under one roof. By incorporating budgeting into alternative education plans, students and parents gain control over their financial resources while pursuing academic goals.

1. Financial Responsibility

Teaching students about budgeting helps instill financial responsibility early on in their lives. It encourages them to make informed decisions about spending money on educational materials, extracurricular activities, or other resources needed for their unique learning experiences.

2. Empowering Decision-Making Skills

Budgeting enables individuals within alternative schooling systems to develop decision-making skills by weighing costs against benefits before making any purchases or investments related to their education journey. It fosters critical thinking abilities as they learn how different choices affect their overall financial situation.

3. Long-Term Planning

Budgets act as roadmaps that outline short-term goals aligned with long-term aspirations within the realm of alternative schooling and education. By setting realistic targets based on available funds, individuals can plan ahead for various milestones such as enrollment fees, tuition payments, field trips, or specialized equipment necessary for specific subjects or projects.

4. Financial Flexibility

Alternative school programs often allow flexibility in terms of scheduling classes or participating in co-curricular activities. Budgeting ensures individuals have the financial freedom to seize these opportunities without burdening themselves with unexpected expenses or relying on financial aid.

Budgeting Strategies for Alternative Schooling

Now that we understand the importance of budgeting within alternative schooling and education, let’s explore some effective strategies for implementing this crucial skill:

1. Assess Your Income and Expenses

Begin by evaluating your income sources, whether it be a regular job, freelance work, or scholarships/grants available through your alternative education program. Then identify all potential expenses related to your educational journey – tuition fees, books, supplies, transportation costs, technology needs (e.g., laptops), and any extracurricular activities. This comprehensive assessment will provide a clear picture of your financial situation.

2. Set Realistic Goals

Based on your income and expenses assessment, set realistic financial goals aligned with both short-term objectives and long-term aspirations within alternative schooling. Prioritize essential expenses while allocating funds for non-essential items as well.

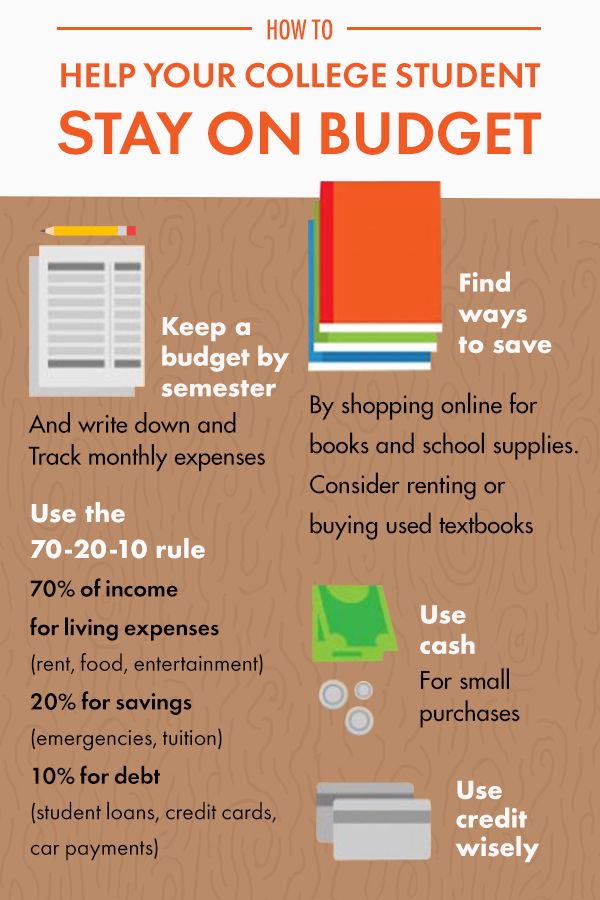

3. Create a Budget Plan

Develop a monthly budget plan that outlines how you intend to allocate your income across different expense categories such as tuition fees/supplies, housing/transportation costs (if applicable), personal development resources (books/subscriptions), and recreational activities. Ensure you leave room for unforeseen circumstances or emergencies in case additional funds are required.

4. Track and Review Regularly

Maintaining discipline is key when it comes to budgeting effectively in alternative schooling scenarios. Keep track of all expenditures diligently; this can be done manually using spreadsheets or utilizing various online tools designed specifically for tracking budgets like Mint or You Need A Budget (YNAB). Regularly reviewing your spending habits will help identify areas where adjustments can be made if necessary.

5. Seek Cost-Saving Opportunities

Alternative schooling often encourages self-directed learning through various means such as online courses, open educational resources (OERs), or community-based initiatives. Exploit these cost-saving opportunities to reduce educational expenses without compromising the quality of your learning experience.

6. Foster Financial Literacy

Incorporate financial literacy into your alternative education journey by educating yourself about personal finance, investment strategies, and money management techniques. Explore books, online resources, or seek guidance from financial advisors who specialize in alternative education pathways.

Conclusion

Budgeting is a vital skill that students and parents alike must prioritize within the realm of alternative schooling and education. By understanding the importance of financial responsibility, empowering decision-making skills, facilitating long-term planning, and ensuring financial flexibility through effective budgeting strategies – individuals can make the most of their educational experiences while maintaining control over their finances. Embracing budgeting as an integral part of alternative schooling will not only promote lifelong financial well-being but also empower individuals to take charge of their academic journeys with confidence.

Leave a comment