Credit Scores: Understanding the Basics

In today’s world, credit scores play a significant role in our financial lives. Whether you’re applying for a loan, renting an apartment, or even getting a job, your credit score can have a profound impact on the opportunities available to you. In this post, we will provide an overview of credit scores and explain why they matter.

So what exactly is a credit score? Simply put, it is a three-digit number that represents your creditworthiness. It is calculated based on various factors such as your payment history, outstanding debts, length of credit history, types of credit used, and new credit applications. The most commonly used scoring model is the FICO score developed by Fair Isaac Corporation.

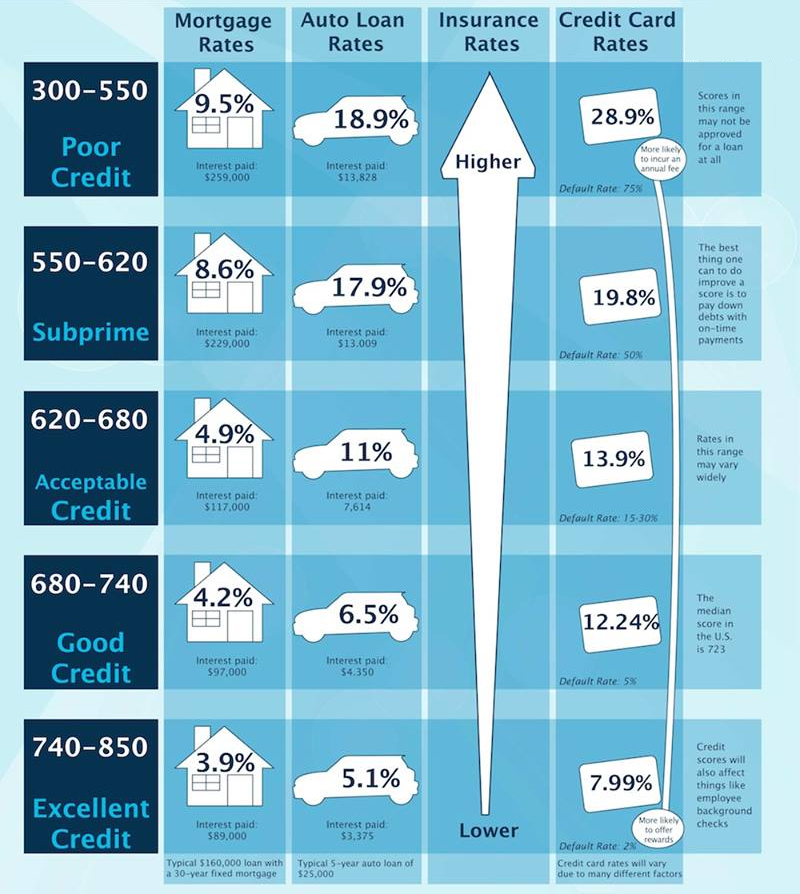

A good credit score typically falls within the range of 670-850 (FICO scale), while anything below 580 is considered poor. Lenders and creditors use these scores to determine whether you are likely to repay your debts responsibly or pose a higher risk.

Why does it matter? A good credit score opens doors to better financial opportunities. With a high score, you are more likely to secure loans at favorable interest rates and terms. On the other hand, a low score may result in higher interest rates or even denials when seeking loans or financing options.

Building and maintaining good credit takes time and effort. Here are some strategies that can help:

1. Paying bills on time: Late payments can significantly impact your score negatively.

2. Keeping debt levels low: High balances relative to your available limits can signal potential financial distress.

3. Diversifying your debt: Having different types of accounts (credit cards, mortgages) demonstrates responsible borrowing habits.

4. Regularly checking your credit report: Identifying errors or fraudulent activities early allows for prompt rectification.

5. Avoiding excessive new accounts: Opening multiple accounts within short periods may indicate financial instability.

It’s important to note that credit scores are not permanent. They can change over time based on your financial behavior and management of debts. By practicing responsible borrowing habits, you can improve your score and unlock more opportunities for financial success.

In conclusion, credit scores serve as a measure of your creditworthiness. Understanding how they are calculated and why they matter is essential for navigating the world of personal finance. By maintaining good credit habits, you can ensure better access to loans, lower interest rates, and overall financial stability.

Leave a comment