Managing Student Expenses: Top 10 Tips for Financial Success

As a student, managing your expenses can be a challenging task. Balancing the costs of tuition, textbooks, housing, and other necessities can quickly drain your bank account if not handled wisely. However, with proper planning and smart financial decisions, you can successfully navigate these challenges and minimize your financial stress. In this article, we will explore ten essential tips to help you manage your student expenses effectively.

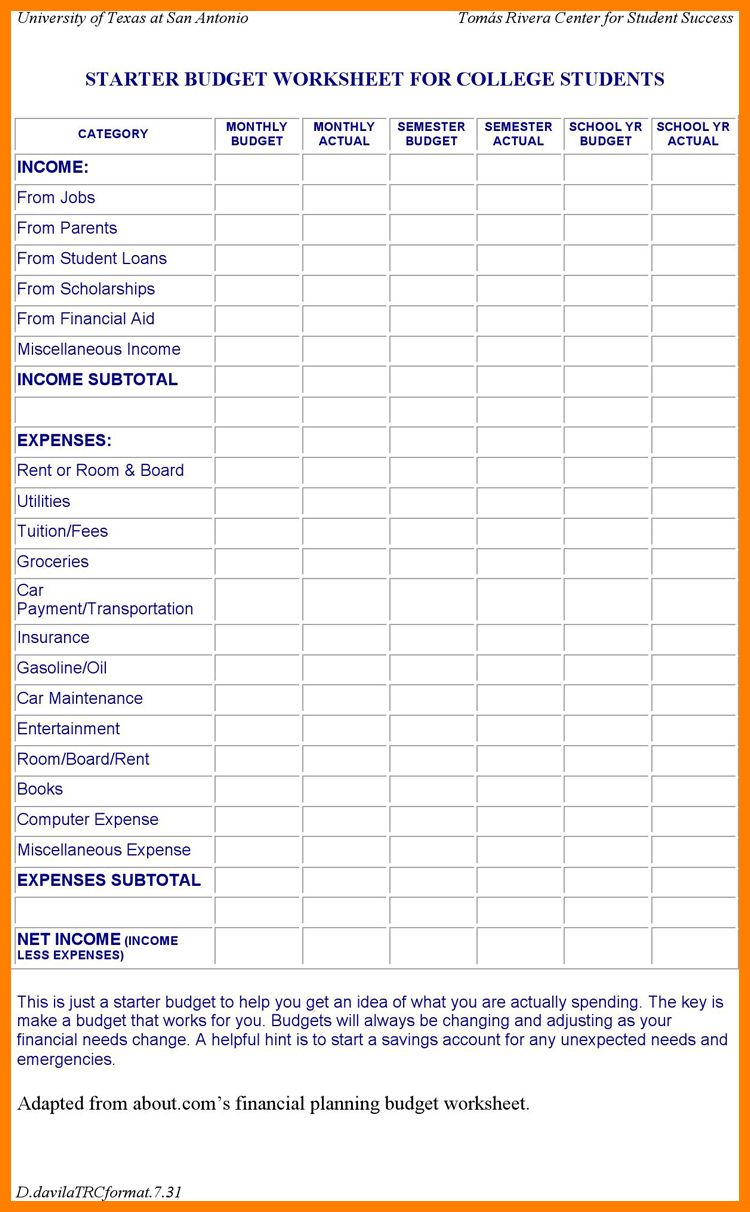

1. Create a Budget:

The first step towards managing your student expenses is creating a budget. Start by listing all sources of income (such as scholarships, part-time jobs) and subtracting essential expenses like tuition fees and rent. Allocate funds for groceries, transportation costs, utilities, books/supplies, entertainment/socializing activities while keeping some money aside for emergencies or unexpected expenses.

2. Track Your Spending:

To gain control over your finances effectively, it is crucial to track every penny you spend. Use smartphone apps or simple spreadsheets to record each transaction accurately. Regularly review these records to identify areas where you may be overspending or areas that require adjustments.

3. Minimize Textbook Costs:

Textbooks are often an expensive necessity for students; however several strategies can help reduce the burden on your wallet:

a) Opt for used textbooks: Look for second-hand books online or at local bookstores.

b) Rent textbooks: Many websites offer textbook rentals at significantly lower prices than buying new ones.

c) Utilize e-books: Electronic versions are often cheaper than physical copies.

d) Borrow from libraries: Some universities have libraries where you can borrow textbooks.

4. Save on Housing Costs:

Housing is typically one of the most significant expenses for students; hence finding ways to save money in this area is crucial:

a) Consider roommates: Sharing accommodation with roommates allows you to split rent and utility bills.

b) Live off-campus: Off-campus housing options can often be cheaper than on-campus alternatives.

c) Explore student housing options: Some colleges offer low-cost dormitories or apartments specifically for students.

5. Cook at Home:

Eating out regularly can significantly impact your budget. Cooking meals at home not only saves money but also allows you to eat healthier:

a) Plan meals in advance: Create a weekly meal plan and shop accordingly, reducing food waste.

b) Pack lunches: Prepare your lunch and snacks instead of buying them on campus.

c) Take advantage of discounts and sales: Look for deals, coupons, or student discounts when grocery shopping.

6. Use Public Transportation:

Transportation costs can quickly add up, especially if you rely on taxis or ride-sharing services. Consider using public transportation options like buses, trains, or subways as they are generally more affordable:

a) Purchase monthly passes: Many cities offer discounted monthly passes that save money in the long run.

b) Walk or bike whenever possible: Opting for physical modes of transportation is not only cost-effective but also beneficial for your health.

7. Seek Part-Time Employment:

A part-time job can help offset some of your expenses while providing valuable work experience:

a) Work-study programs: Many universities provide on-campus job opportunities exclusively for students.

b) Flexible jobs: Look for positions that allow you to balance work hours with your academic responsibilities.

c) Online freelancing gigs: Explore online platforms where you can find freelance work suitable to your skills and schedule.

8. Utilize Student Discounts:

Take advantage of the numerous discounts available exclusively to students:

a) Technology products/services: Companies like Apple and Microsoft offer special pricing for students.

b) Entertainment venues/events: Many movie theaters, museums, concerts, and theme parks have discounted rates for students upon presentation of a valid ID card.

9. Avoid Impulse Buying:

Impulse buying is one common pitfall that affects many individuals’ budgets. Before making a purchase, take some time to evaluate if it is truly necessary:

a) Implement the 24-hour rule: Wait for 24 hours before buying something non-essential to determine if you still want or need it.

b) Make a shopping list: Stick to your list when shopping and avoid unnecessary temptations.

10. Prioritize Financial Literacy:

Investing time in understanding personal finance can significantly impact your financial success in the long run:

a) Read books and blogs on personal finance: Educate yourself about budgeting, saving, investing, and managing debt.

b) Attend workshops or seminars: Many universities offer free financial literacy programs or workshops where experts share valuable insights.

c) Seek professional advice: If you find managing your finances overwhelming, consider consulting with a certified financial planner who specializes in working with students.

In conclusion, managing student expenses requires discipline, planning, and smart decision-making. By creating a budget, tracking your spending habits diligently, minimizing costs whenever possible, utilizing discounts and student perks wisely, seeking part-time employment opportunities strategically while prioritizing financial literacy; you can successfully navigate through these challenges while ensuring that your educational journey remains financially sustainable.

Leave a comment