Budgeting 101: A Comprehensive Guide to Mastering Your Finances

Introduction:

In today’s fast-paced world, financial stability is crucial for a stress-free life. However, many people struggle with managing their money effectively. The good news is that budgeting can help you take control of your finances and achieve your financial goals. Whether you’re a student or an adult looking to improve your financial literacy, this comprehensive guide will provide you with the tools and knowledge needed to create a successful budget.

Section 1: Understanding Budgeting

Before diving into the nitty-gritty of creating a budget, it’s essential to understand what budgeting actually means. At its core, budgeting is the process of tracking and controlling your income and expenses. It helps you allocate funds for different categories such as housing, food, transportation, entertainment, savings, debt repayment, etc.

Section 2: Setting Financial Goals

The first step in budgeting is setting clear financial goals. What do you want to achieve? Are you saving for a down payment on a house? Planning for retirement? Paying off student loans? Defining these goals will give purpose to your budget and motivate you along the way.

Start by listing out all your short-term (less than one year), medium-term (one to five years), and long-term (more than five years) financial goals. Assign each goal an estimated cost and timeline for achievement. This exercise will help prioritize where your money should be allocated.

Section 3: Assess Your Income

To create an effective budget plan, it’s important to know exactly how much money is coming in each month. List all sources of income such as salary/wages from work or freelance gigs if applicable scholarships/grants if you’re a student or any other regular cash flow.

If your income fluctuates each month due to irregular work hours or commissions-based work structure make sure that while estimating average monthly earnings consider the lowest possible range.

Section 4: Track Your Expenses

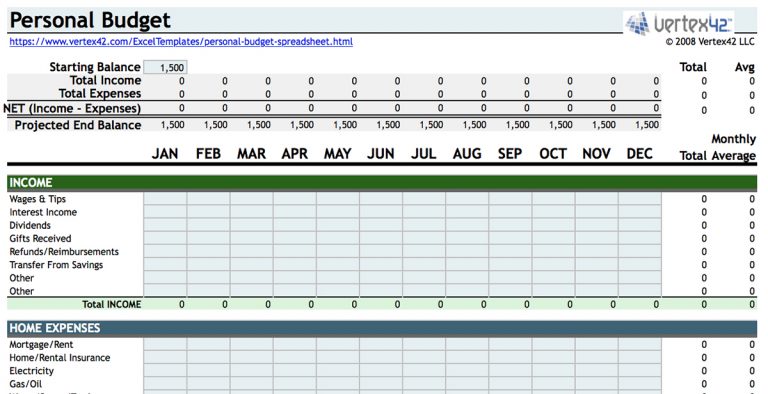

Now that you know how much money is coming in each month, it’s time to track your expenses. Start by gathering all your financial statements like bank statements, credit card bills, and receipts from the past few months.

Categorize your expenses into fixed (e.g., rent/mortgage, utilities), variable (e.g., groceries, dining out), and discretionary (e.g., entertainment, hobbies). This step will help identify areas where you may be overspending or could potentially cut back to save more money.

Section 5: Create a Budget Plan

Armed with knowledge of your income and expenses, it’s time to create a budget plan. There are several methods you can choose from based on what suits your style:

a) The 50/30/20 Rule: Allocate 50% of your income towards needs (rent/mortgage, utilities), 30% towards wants (entertainment, dining out), and dedicate the remaining 20% towards savings or debt repayment.

b) Envelope System: Divide cash into envelopes labeled for each expense category. Once an envelope is empty for the month in that particular category stop spending until next month.

c) Zero-based Budgeting: Assign every dollar a specific purpose so that at the end of each month there’s no unallocated money left over.

d) Smartphone Apps/Online Tools: Utilize budgeting apps like Mint or online tools like YNAB (You Need A Budget) that automate tracking expenses and provide visual representations of spending habits.

Choose a method that aligns with your lifestyle preferences and financial goals.

Section 6: Monitor Your Progress

Creating a budget plan is just the beginning; regularly monitoring its progress is equally important. Set aside some time at least once a week to review how you’re doing against your budget plan. Are you staying within limits? If not, why? Identifying overspending patterns will help you make necessary adjustments and stay on track with your financial goals.

Section 7: Saving Strategies

Budgeting isn’t just about managing expenses; it’s also about saving money for future needs. Here are a few strategies to boost your savings:

a) Pay Yourself First: Treat savings as an expense and allocate a fixed amount each month before spending on anything else.

b) Automate Savings: Set up automatic transfers from your checking account to a separate savings account.

c) Emergency Fund: Build an emergency fund that covers three to six months’ worth of living expenses in case of unexpected events like job loss or medical emergencies.

d) Reduce Debt: Prioritize paying off high-interest debt (e.g., credit card balances) to save on interest payments and increase available funds for saving.

Section 8: Adjusting Your Budget

Life is unpredictable, and circumstances change over time. It’s essential to regularly review and adjust your budget plan accordingly. Major life events like getting married, having children, changing jobs, or relocating might require modifications in your budget allocation. Flexibility is key to maintaining a sustainable budgeting system.

Conclusion:

Budgeting is not only about keeping track of income and expenses but also about taking control of your financial future. By setting clear goals, tracking income/expenses diligently, creating a realistic budget plan, monitoring progress regularly, implementing smart saving strategies, and adjusting as needed—financial freedom becomes attainable for anyone willing to put in the effort.

Remember that mastering personal finance takes time; be patient with yourself during the learning process. With determination and discipline, you’ll soon reap the rewards of effective budgeting – greater financial stability and peace of mind!

Leave a comment