Tracking Expenses: A Key Skill for Alternative Learners

In the world of alternative schooling and education, students are encouraged to take ownership of their learning journey. They have more control over what they learn, how they learn it, and when they learn it. This level of autonomy extends beyond academics and into other aspects of life, including managing personal finances.

One crucial skill that alternative learners should develop is tracking expenses. Understanding how to effectively manage money is an essential life skill that will serve them well in adulthood. By tracking expenses, students can gain a better understanding of their spending habits, make informed financial decisions, and work towards financial independence.

Why Tracking Expenses Matters

Tracking expenses provides individuals with a clear picture of where their money goes each month. Without this awareness, it’s easy for spending to spiral out of control or for money to be wasted on unnecessary purchases. By keeping tabs on every dollar spent, alternative learners can identify areas where they may be overspending or areas where adjustments can be made.

Moreover, tracking expenses helps build discipline and accountability. It forces individuals to confront the reality of their financial situation and encourages responsible decision-making regarding future expenditures.

How to Start Tracking Expenses

1. Create a Budget: Before diving into expense tracking, start by creating a budget that outlines income sources (if any) and anticipated monthly expenses such as rent/mortgage payments, utilities, groceries, transportation costs etc. A budget serves as a roadmap for spending within one’s means while also setting aside funds for savings or investments.

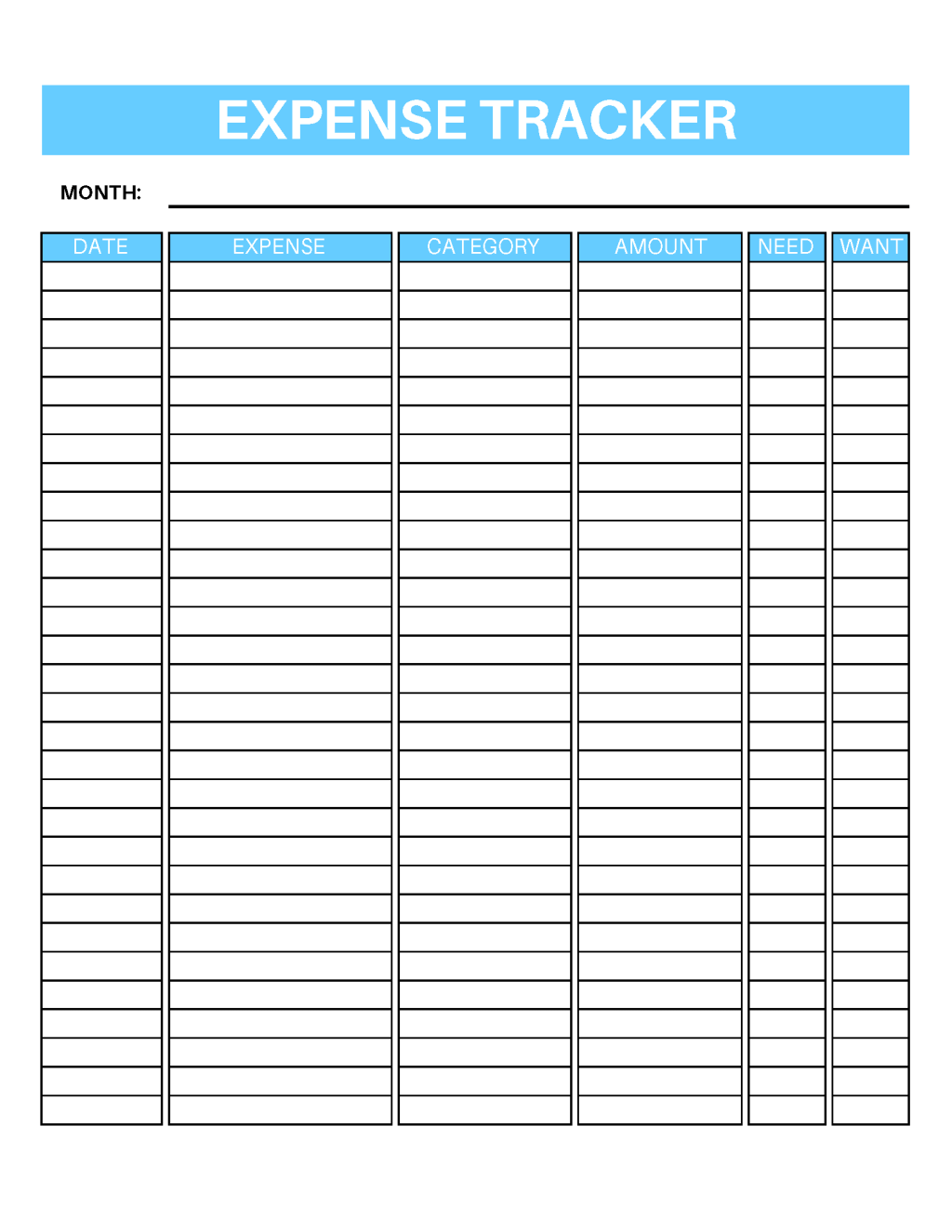

2. Choose the Right Tools: There are several tools available that can assist in expense tracking; some popular options include mobile apps like Mint or PocketGuard which sync with bank accounts automatically categorizing transactions; spreadsheets like Microsoft Excel or Google Sheets offer customizable templates designed specifically for expense tracking; traditional pen-and-paper methods work equally well if technology isn’t preferred.

3. Track Every Expense: To get an accurate representation of spending habits, it’s important to track every single expense, no matter how small. This includes the daily cup of coffee or the occasional movie ticket. Consistency is key for effective tracking.

4. Categorize Expenses: After recording each expense, categorize them accordingly. Common categories include food, transportation, entertainment, utilities etc. This step helps identify patterns and areas where adjustments can be made.

5. Review Regularly: Set aside time each week or month to review expenses against the budget created earlier. Analyze spending patterns and evaluate whether they align with personal goals and priorities outlined in the budget.

Benefits of Tracking Expenses

1. Financial Awareness: By tracking expenses diligently, alternative learners become more conscious of their financial decisions and habits. They gain a deeper understanding of what they spend money on and can make informed choices about where to allocate funds.

2. Improved Budgeting Skills: Expense tracking provides real-time data that enables students to refine their budget over time as they learn more about their needs and wants versus fixed costs.

3. Encourages Saving: With expense tracking comes an inherent motivation to save money by identifying areas where unnecessary expenditures occur regularly or opportunities for cost-cutting arise.

4. Identifying Problematic Spending Habits: For some individuals, excessive spending may be a result of emotional triggers or impulse buying tendencies that go unnoticed without proper tracking mechanisms in place. Recognizing these behaviors allows for corrective action before they escalate into significant financial challenges.

5. Goal Setting and Achievement: Tracking expenses empowers alternative learners to set tangible financial goals such as saving a specific amount within a given period or reducing debt gradually over time.

6 Strategies for Effective Expense Tracking

1. Be Consistent: Make it a habit to record all expenses immediately after making any purchase – this ensures accuracy and prevents forgetfulness from skewing data analysis later on.

2.Use Technology Effectively (if preferred): Explore mobile apps designed specifically for expense tracking. These apps can automate the process by linking to bank accounts and credit cards, making it easier to categorize expenses.

3. Set Realistic Goals: Start with small, achievable goals that align with personal financial aspirations. Gradually increase savings targets or reduce spending in specific categories as confidence and discipline grow.

4. Be Honest: It’s essential to be honest with oneself while tracking expenses. Sometimes, we tend to hide or underestimate certain expenditures, which can skew the overall analysis.

5. Seek Support and Accountability: Consider involving a trusted friend or family member in the expense tracking process for added accountability and motivation.

6. Reflect on Progress: Take time periodically (monthly or quarterly) to assess progress made towards financial goals and evaluate if any adjustments are needed in spending habits or budget allocation.

Conclusion

Tracking expenses is an invaluable skill that alternative learners should prioritize developing alongside their academic pursuits. By understanding where their money goes, students can make informed decisions about how they allocate funds and work towards financial independence. With diligence and consistency, expense tracking becomes second nature, leading individuals down a path of improved financial awareness, responsible decision-making, and long-term success in managing personal finances.

Leave a comment