Stocks and Bonds: A Beginner’s Guide to Investing

Introduction:

👉 Check it out: Shop Wellness Journal on Amazon

Investing in stocks and bonds can be an excellent way to grow your wealth over time. Whether you are a seasoned investor or just starting out, understanding the basics of stocks and bonds is crucial. In this guide, we will provide you with an overview of these investment options, explaining what they are, how they work, and what factors to consider before investing.

👉 Check it out: Shop Essential Oils Set on Amazon

What are Stocks?

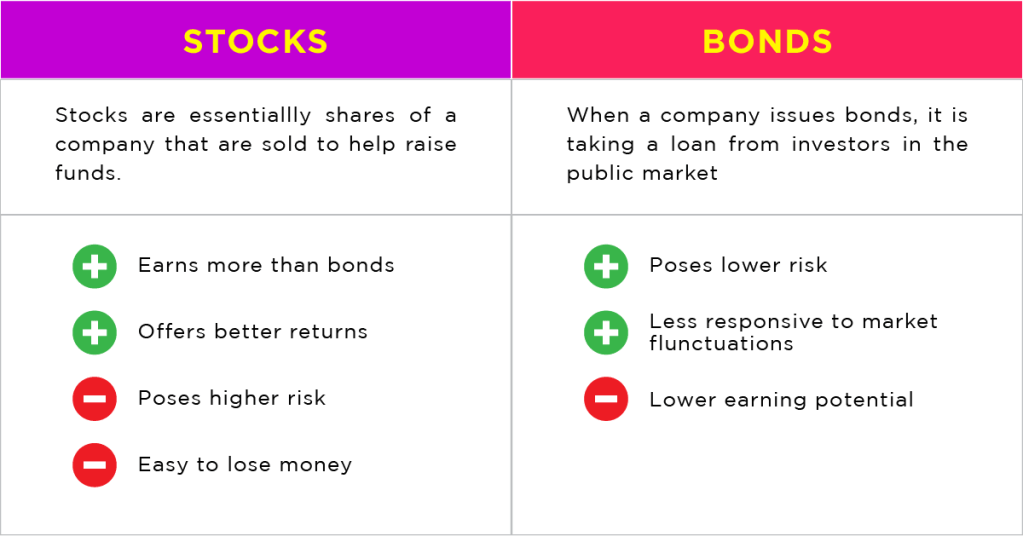

Stocks represent ownership shares in a company. When you buy a stock, you become a shareholder and have the right to participate in the company’s profits through dividends and potential capital appreciation. Companies issue stocks as a means of raising funds for their operations or expansion plans.

There are two types of stocks: common stock and preferred stock. Common stockholders have voting rights within the company but hold lower priority if the company goes bankrupt. Preferred stockholders have no voting rights but receive higher priority when it comes to receiving dividends or assets during liquidation.

Stock prices fluctuate based on various factors such as market conditions, economic performance, industry trends, political events, and company-specific news. Investors can buy individual stocks or invest in mutual funds or exchange-traded funds (ETFs) that pool money from multiple investors to invest in diversified portfolios.

What are Bonds?

Bonds are debt securities issued by governments, municipalities, corporations, or other entities looking to raise capital. When you purchase a bond, you lend money to the issuer for a specified period at an agreed-upon interest rate called coupon rate. The issuer promises to repay the principal amount upon maturity.

Bonds offer fixed-income payments (coupons) at regular intervals until maturity when the principal is repaid in full. They are generally considered safer than stocks because they have more predictable returns over time.

Types of bonds include government bonds (issued by national governments), municipal bonds (issued by local governments), corporate bonds (issued by companies), and convertible bonds (that can be converted into a specific number of company shares).

Bond prices fluctuate based on changes in interest rates. When interest rates rise, bond prices fall, and vice versa. This is because existing bonds with lower coupon rates become less attractive compared to newly issued bonds with higher coupon rates.

Diversification and Risk:

One essential aspect of investing is diversification. Diversifying your investment portfolio helps reduce risk by spreading it across different assets or asset classes. Stocks and bonds have different risk profiles.

Stocks are generally more volatile than bonds due to their exposure to market fluctuations. While stocks offer the potential for higher returns, they also carry a higher level of risk. It’s important to research individual companies, analyze financial statements, understand industry trends, and stay updated with relevant news before investing in stocks.

Bonds are considered safer investments as they provide fixed-income payments over time. However, not all bonds are risk-free; some issuers may default on their debt obligations. Credit ratings assigned by rating agencies such as Standard & Poor’s (S&P) or Moody’s can help assess the creditworthiness of bond issuers.

Understanding Investment Goals and Time Horizon:

Before venturing into stocks or bonds or any other investment vehicle, it’s crucial to determine your investment goals and time horizon.

Investment goals: Are you investing for retirement? Saving for a down payment on a house? Funding your child’s education? Your investment goals will shape your strategy when choosing between stocks and bonds. Stocks tend to generate higher returns over the long term but come with increased volatility, while bonds offer stability but lower potential returns.

Time horizon: How long do you plan on keeping your investments before needing access to the funds? If you have a longer time horizon (10+ years), you may consider allocating more funds towards stocks which can potentially weather short-term market fluctuations better than bonds. For shorter time horizons (less than 5 years), bonds or other fixed-income investments are generally more suitable.

Conclusion:

Stocks and bonds are two primary investment options available to investors. Stocks represent ownership in a company and offer the potential for higher returns but carry more risk. Bonds, on the other hand, provide fixed-income payments with lower volatility but have a lower potential for growth.

By diversifying your portfolio and considering your investment goals and time horizon, you can create a balanced investment strategy that aligns with your financial objectives. Remember, investing should be approached with patience, discipline, and careful consideration of all relevant factors.

🛒 Recommended Products

As an Amazon Associate, we earn from qualifying purchases.

Disclosure: This post contains Amazon affiliate links. As an Amazon Associate, we earn from qualifying purchases at no additional cost to you.

Leave a comment