Are you tired of being judged by a number? Do you cringe every time someone asks you about your credit score? Well, fear not! In this article, we will take a lighthearted look at the infamous credit score and explore its relevance in our lives.

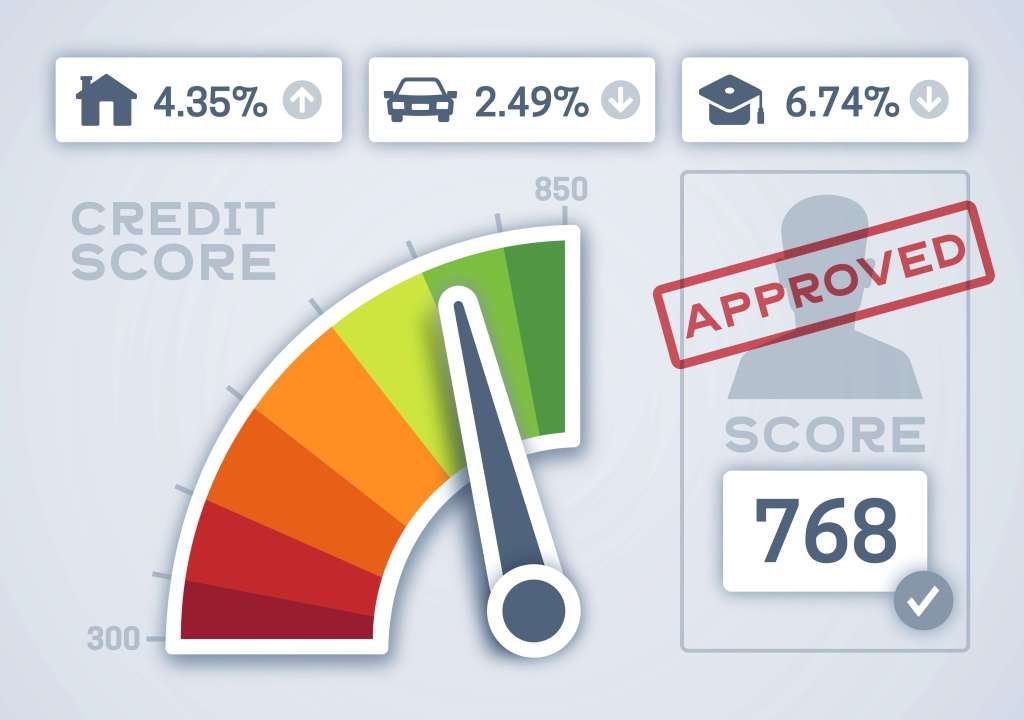

First things first – what exactly is a credit score? Essentially, it’s a numerical representation of your financial history. It ranges from 300 to 850 and is used by lenders to assess your creditworthiness. But let’s be honest, does a three-digit number really define us as individuals?

Credit scores have become such an integral part of our lives that they can determine whether we get approved for loans or mortgages. They even play a role in job applications and insurance premiums! It’s almost like living in some sort of dystopian world where numbers hold power over us.

But let’s not get too carried away with the doom and gloom. There are ways to improve your credit score if you find yourself on the lower end of the spectrum. Paying bills on time, keeping credit card balances low, and diversifying your types of credit can all contribute positively to your score.

On the other hand, there are those who obsessively monitor their credit scores as if they were checking their social media likes. They panic at any slight drop or celebrate when it inches up by a point. It’s like participating in an endless game show where winning means having an excellent credit rating.

One might argue that we should focus less on these arbitrary numbers and more on developing good financial habits overall. Instead of fixating solely on maintaining a perfect credit score, why not educate ourselves about managing money responsibly? Perhaps schools should consider adding personal finance courses to their curriculum instead of just teaching algebra equations that most people never use after graduation.

Moreover, it’s worth questioning whether relying so heavily on credit scores perpetuates societal inequalities. Those who have experienced setbacks due to financial hardship are penalized with lower scores, making it even more difficult for them to climb out of the hole they find themselves in. It’s like kicking someone when they’re already down.

In a world that values individuality and personal growth, why do we allow a single number to define our worth? Our credit score should not be the ultimate measure of our success or failure. It’s time to break free from this oppressive system and focus on what truly matters – living fulfilling lives based on our own unique values and aspirations.

So next time someone asks you about your credit score, feel free to respond with a wink and say, “Oh, I don’t let numbers dictate my happiness. I’m too busy enjoying life!” After all, isn’t that what alternative schooling and education is all about – embracing creativity, critical thinking, and personal growth beyond societal expectations?

Leave a comment