Managing Student Debt: A Comprehensive Guide

Obtaining a higher education can open doors to countless opportunities and pave the way for a successful future. However, with rising tuition costs, many students find themselves burdened with significant amounts of debt upon graduation. Managing student debt effectively is crucial to ensure financial stability and prevent it from becoming overwhelming. In this comprehensive guide, we will explore various strategies and resources that can help individuals navigate their student loans.

1. Understand Your Loans:

The first step in managing student debt is understanding the details of your loans. Take the time to review each loan individually, noting the interest rates, repayment terms, and any potential perks or forgiveness programs associated with them.

2. Create a Budget:

Creating a budget is essential to manage any type of debt effectively. Track your income and expenses monthly, allowing you to allocate funds towards loan payments while still covering other necessary expenses.

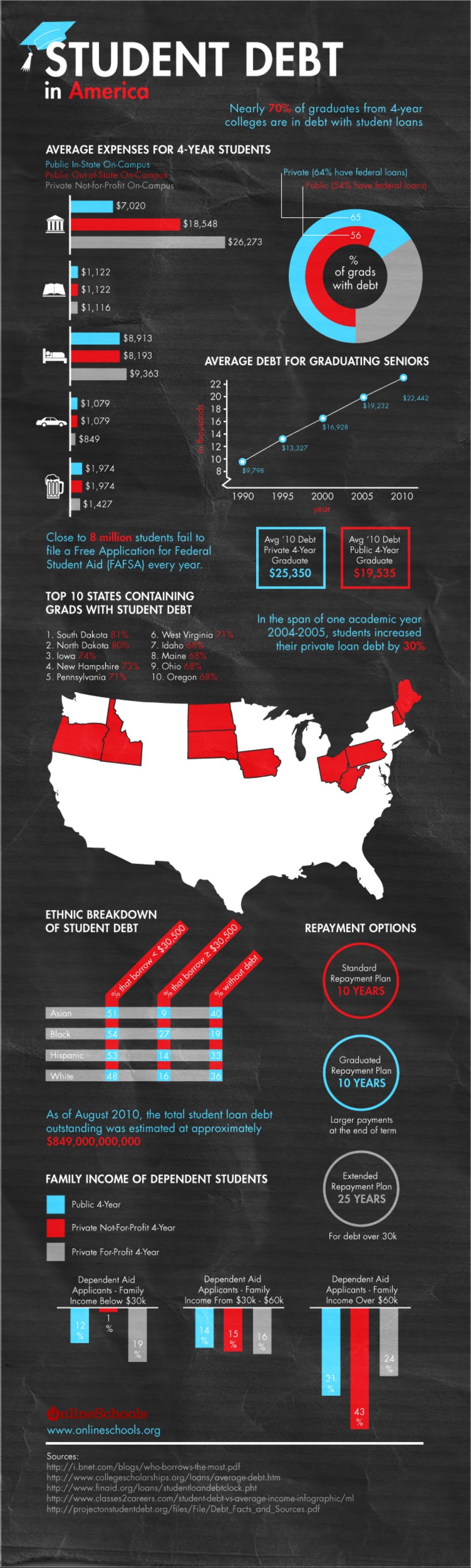

3. Explore Repayment Options:

Federal student loans offer several repayment options tailored to different financial situations. Standard repayment plans typically involve fixed monthly payments over ten years; however, there are alternatives like income-driven repayment plans that adjust payments based on your income level.

4. Consider Loan Consolidation or Refinancing:

Consolidating multiple federal loans into one direct consolidation loan simplifies repayments by combining all debts into a single monthly payment at a potentially lower interest rate.

Refinancing involves obtaining a new private loan at better terms than your current ones—an option worth considering if you have good credit and want to take advantage of lower interest rates or shorter repayment periods.

5. Utilize Loan Forgiveness Programs:

Certain professions may qualify for loan forgiveness programs such as Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness (TLF). These initiatives forgive part or all of an individual’s remaining balance after meeting specific criteria such as working in qualifying public service jobs for a certain period.

6.Implement Strategies for Early Repayment:

If possible, consider making extra payments towards your loans to reduce the principal amount and save on interest charges. By allocating additional funds, you can shorten the repayment period significantly.

7. Seek Professional Guidance:

Managing student debt can be challenging, especially if you’re juggling multiple loans or struggling financially. Seeking advice from a financial advisor specializing in student loans can provide personalized insights and strategies for effective management.

8. Explore Loan Assistance Programs:

Many employers offer loan assistance programs as an employee benefit. Research companies that provide this perk to potentially secure a job with added financial support for repaying your student loans.

9. Stay Informed About Changes in Legislation:

Stay updated on any changes in legislation regarding student loan forgiveness or repayment options. Keeping informed about policy updates ensures that you are aware of any opportunities that may arise.

Remember, managing student debt is a marathon, not a sprint. It requires careful planning and perseverance over an extended period. By understanding your loans, creating a budget, exploring repayment options, and utilizing available resources like loan forgiveness programs or refinancing opportunities, you can take control of your debt and build a strong financial foundation for the future.

Leave a comment