Investing is a crucial skill that can empower individuals to build wealth and secure their financial future. However, the world of investing can be complex and intimidating for many people, especially those who are new to the concept. The good news is that with some basic knowledge and a willingness to learn, anyone can become a successful investor.

Before diving into the world of investing, it’s important to understand what it means. Investing refers to allocating money or resources into an asset or venture with the expectation of generating income or profit over time. This typically involves buying shares in companies (stocks), lending money (bonds), or acquiring ownership in real estate (property). The goal is to grow your investment over time, taking advantage of compound interest and capital appreciation.

One key principle of investing is diversification. Diversifying your investment portfolio means spreading your investments across different asset classes such as stocks, bonds, real estate, and even alternative investments like commodities or cryptocurrencies. By diversifying, you reduce the risk associated with putting all your eggs in one basket. A decline in one sector may be offset by gains in another.

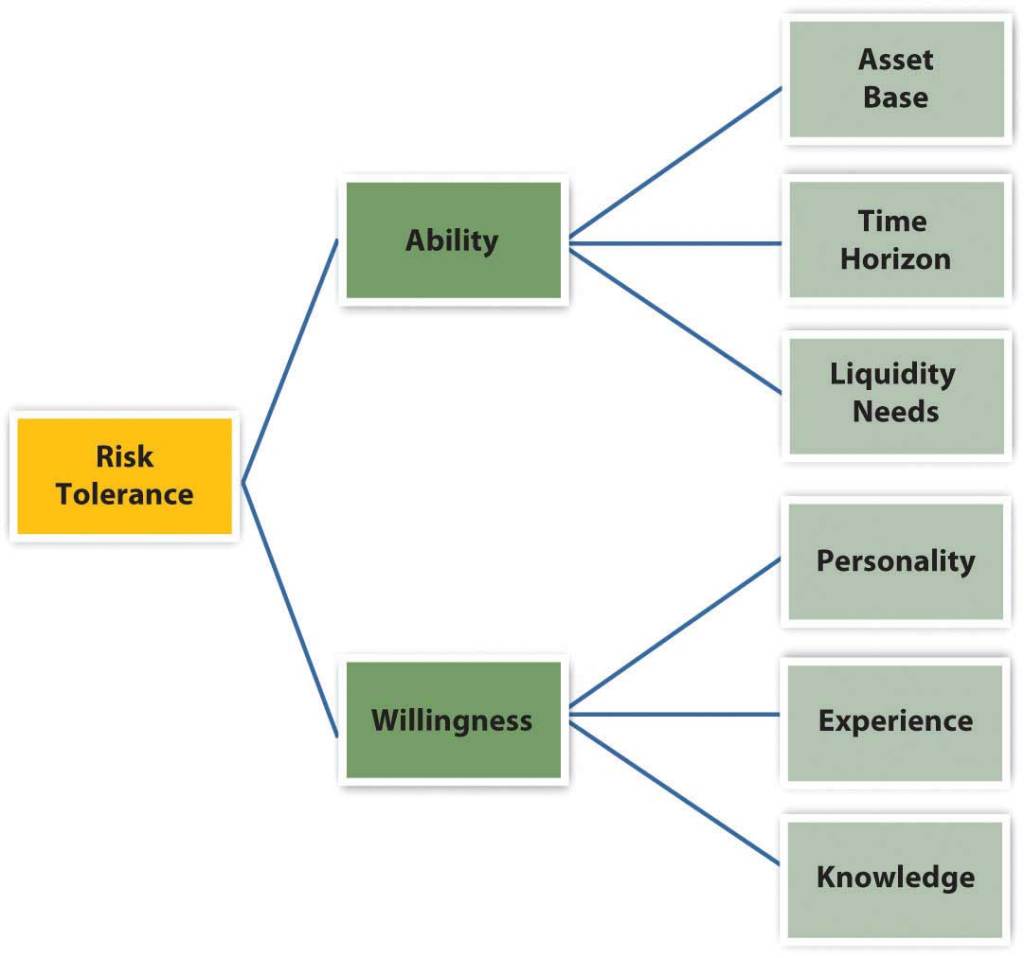

Another essential aspect of investing is understanding risk tolerance. Risk tolerance refers to how much volatility or potential loss an investor can tolerate without feeling anxious or making impulsive decisions. It’s vital to assess your risk appetite before deciding on an investment strategy because higher-risk investments may offer greater returns but also come with increased volatility.

When starting out as an investor, it’s wise to seek education and guidance from reputable sources such as books written by experienced investors or online courses provided by established institutions specializing in finance and investing education. These resources will equip you with the necessary knowledge about fundamental concepts like stock valuation methods, economic indicators that affect markets, and strategies for managing risk effectively.

It’s important not only to educate yourself but also to set clear goals for your investments. What are you trying to achieve? Are you looking for short-term gains or long-term growth? Defining your investment goals will help you make informed decisions about where to invest and how much risk to take on.

One commonly overlooked aspect of investing is the importance of patience. Successful investors understand that investing is a long-term game. They resist the temptation to make impulsive decisions based on short-term market fluctuations and maintain a disciplined approach, allowing their investments time to grow steadily over years or even decades.

Lastly, staying updated with financial news and regularly reviewing your portfolio are essential habits for successful investors. The markets are constantly evolving, influenced by various factors such as economic conditions, geopolitical events, and technological advancements. By staying informed, you can make adjustments to your investment strategy when needed.

In conclusion, investing is a skill that can be learned by anyone willing to put in the effort and learn from experienced investors. Diversification, understanding risk tolerance, seeking education and guidance from reputable sources, setting clear goals, practicing patience, and staying informed are all crucial components of becoming a successful investor. Remember that investing requires discipline and a long-term perspective – it’s not about getting rich overnight but rather building wealth steadily over time.

Leave a comment