Financial-Based Subtopics of Neurodiversity: A Comprehensive Guide

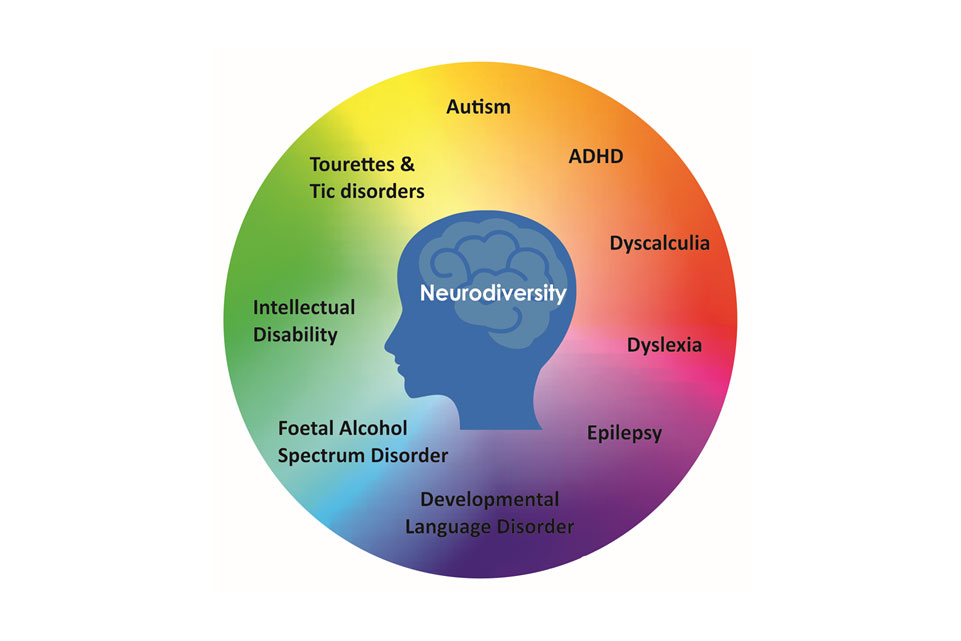

Neurodiversity is a term used to describe the natural variations in human brain function and behavior. It is an umbrella term that encompasses conditions such as autism, ADHD, dyslexia, and other developmental disabilities. While neurodivergent individuals can succeed in various aspects of life, including academics and careers, they often face unique challenges when it comes to financial management.

In this article, we will explore 28 financial-based subtopics related to neurodiversity. We will discuss the challenges faced by neurodiverse individuals and their families concerning finances while also offering strategies for managing those difficulties.

1. Financial Challenges Faced by Neurodivergent Individuals

Neurodivergent individuals often encounter additional expenses that people without disabilities do not incur. For instance, medical bills are frequent since many require regular therapy sessions or medication prescriptions. Additionally, these individuals may have difficulty finding employment leading to reduced income levels or complete reliance on government benefits programs.

2. Understanding Financial Literacy for Neurodiverse Students

Despite being capable of learning about finances just like anyone else, neurodiverse students may need more support than others due to certain cognitive differences. As a result, educators must teach them about budgeting money utilizing simple methods that cater to their specific needs.

3. The Impact of Neurodiversity on Financial Planning

When creating a financial plan for themselves or their loved ones with neurological disorders such as autism or ADHD who rely on them financially requires an understanding of the impact these conditions have on daily functioning and decision-making processes.

4.Navigating the Job Market as a Neurodivergent Individual

Job hunting poses unique difficulties for neuro-divergents because they might struggle during interviews or be unable to read social cues correctly at work leading to misunderstandings with colleagues which affect job security

5.Enterpreneurship Opportunities for Neurodiverse Individuals

Entrepreneurship can be an excellent option for neurodiverse individuals since it allows them to work independently and capitalize on their unique strengths. It also gives them control over their schedules and reduces the stresses of navigating social dynamics in traditional workplaces.

6. The Role of Assistive Technology in Managing Finances for Neurodiverse Individuals

Assistive technology eases the daily financial management challenges that many neurodivergent individuals face with tasks such as paying bills, budgeting, and tracking expenses. Examples include text-to-speech software or voice-activated banking apps.

7.Financial Management Strategies for Parents of Neurodivergent Children

Parents must prepare themselves financially to meet the needs of their child with a neurological disorder, which often includes additional costs related to treatment, therapy sessions, or specialized education programs like IEPs (Individualized Education Plans).

8.The Importance of Financial Education in Special Education Programs

Educating children about finances should start early since they need these skills throughout life. This is especially important for those with disabilities because they may not have access to mainstream schools that offer financial literacy programs.

9.Addressing the Unique Financial Needs of Autistic Individuals

Autistic individuals may require assistance managing money due to difficulties with executive functioning skills such as planning ahead or maintaining focus on tasks leading some autistic people to benefit from developing coping mechanisms through behavioural therapies

10.Supporting Financial Independence for People with ADHD

ADHD individuals often struggle when it comes to making long-term plans, prioritizing goals or organizing finances due to difficulty sustaining attention span but setting up systems that break down financial management into smaller pieces can help ensure success

11. Overcoming Financial Barriers To Higher Education For Neurodiverse Students

Many students who are neuro-divergent are at risk of dropping out before completing post-secondary education due to lack of adequate support services needed along the way like tutoring centers or accommodations allowing extra time during exams.

12.Teaching Money Management Skills to Students With Learning Disabilities

Learning disabilities such as dyslexia or dyscalculia can make it challenging for individuals to understand basic financial concepts. Breaking down complex ideas into smaller, more manageable pieces and using a range of teaching methodologies, such as visual aids and hands-on learning techniques, can help these students succeed financially

13.Strategies for Budgeting and Saving Money as a Person with Dyslexia

Dyslexic individuals might face challenges when budgeting or keeping track of expenses because they have difficulty reading numbers. Using assistive technology like speech-to-text software can be helpful in managing finances.

14.Understanding the Connection between Mental Health and Personal Finance

Mental health issues like anxiety or depression often lead to poor financial decisions leading people to spend impulsively or avoid dealing with money matters altogether. Investing in mental health treatment is essential if one wants their finances under control.

15.The Impact of Stigma on the Financial Well-being of Neurodivergent Individuals

Social stigma often leads neuro-divergents to hide their disabilities from potential employers making job searching harder than it should be while hindering opportunities that could lead to meaningful employment and independence.

16.Accessing Government Benefits And Resources For People With Disabilities

Government benefits programs are available for those who qualify; however, some may not know which ones apply best based on their specific needs. Navigating through government bureaucracy takes time but doing so will ensure access to assistance necessary for daily living expenses

17.The Role Of Vocational Training In Improving Financial Stability For People With Autism Spectrum Disorder

Vocational training programs help autistic adults acquire skills that are transferable across multiple industries reducing reliance on government benefits through gainful employment opportunities

18.Financial Planning Considerations When Caring For A Loved One With A Developmental Disability

Caring for someone with a developmental disability requires long-term planning involving medical care costs, transportation expenses, and other related expenses. Financial planning helps families manage these costs while providing their loved ones with quality care.

19.Addressing Employment Discrimination Against Neurodiverse Individuals

Discriminatory practices in hiring or employment based on neurological differences prevent neuro-divergent individuals from accessing job opportunities that could lead to financial independence.

20.Supporting Self-Employment Options For People With Intellectual Disabilities

Self-employment can be an excellent option for those with intellectual disabilities because it allows them to work at their own pace and capitalize on their unique skills and abilities. Programs like supported employment provide the necessary guidance to start a business venture.

21.Building Credit History And Accessing Loans As A Person With Down Syndrome

People with Down syndrome may have difficulty accessing loans due to cognitive differences resulting in low credit scores. Building good credit history through consistent repayment of bills or utilizing secured loan options will help them access financing when needed

22.Overcoming Challenges To Accessing Affordable Housing As A Person With ADHD

ADHD individuals might face difficulties finding affordable housing as landlords may see them as high-risk tenants due to impulsivity factors leading some people towards homelessness or unstable living conditions

23.Strategies For Managing Debt As A Person With Dyscalculia

Dyscalculic individuals struggle with basic math concepts, including calculating interest rates, which can make managing debt difficult; however, there are various tools such as calculators or spreadsheets that can assist in this area.

24.Understanding The Unique Financial Needs Of People On The Schizophrenia Spectrum

Schizophrenia is associated with higher levels of poverty, leading many affected individuals having daily financial struggles making access support services critical for coping financially

25.Addressing Barriers To Accessing Healthcare Services Due To Financial Constraints

Access health care is essential for everyone but presenting additional challenges for neurodivergents since they require specialized services adding up healthcare-related expenses contributing significantly towards overall financial burden

26.Supporting Families In Navigating Complex Healthcare Financing Systems

Navigating healthcare financing systems is often challenging. But, families of neurodivergent individuals may face even more difficulties due to their specific needs and requirements. Support in navigating these systems ensures access to essential medical care.

27.Understanding The Impact Of Poverty On Neurodivergent Individuals And Families

Poverty can have a significant impact on the financial well-being of neuro-divergents as it limits access to necessary resources for daily living expenses such as adequate food or shelter. Addressing poverty through government assistance programs such as SNAP (Supplemental Nutrition Assistance Program) or affordable housing initiatives helps alleviate this burden.

28.Strategies For Building Financial Resilience In The Face Of Economic Uncertainty

Economic uncertainty affects everyone’s finances, but it can be especially challenging for those with disabilities because they rely on support services that could be reduced during hard times. Having an emergency fund and seeking professional advice when needed are two ways to build resilience during economic uncertainty.

In conclusion, understanding and addressing the unique financial challenges faced by neurodiverse individuals is crucial for promoting their independence and overall well-being. Strategies like vocational training, entrepreneurship opportunities, financial literacy education in schools, assistive technology tools or finding mental health treatment will help mitigate some of these challenges while providing them with the necessary skills to manage money effectively.

Leave a comment