Credit Scores: Everything You Need to Know

If you’re considering taking out a loan, applying for a credit card or even renting an apartment, your credit score is one of the most important factors that will determine whether you are approved for these things. Here’s everything you need to know about credit scores.

What is a Credit Score?

A credit score is a number that represents how likely it is that someone will pay back debt on time. The higher the score, the more trustworthy and reliable a borrower appears to lenders. There are several types of credit scores, but FICO (Fair Isaac Corporation) scores are the most widely used in the United States.

How Are Credit Scores Calculated?

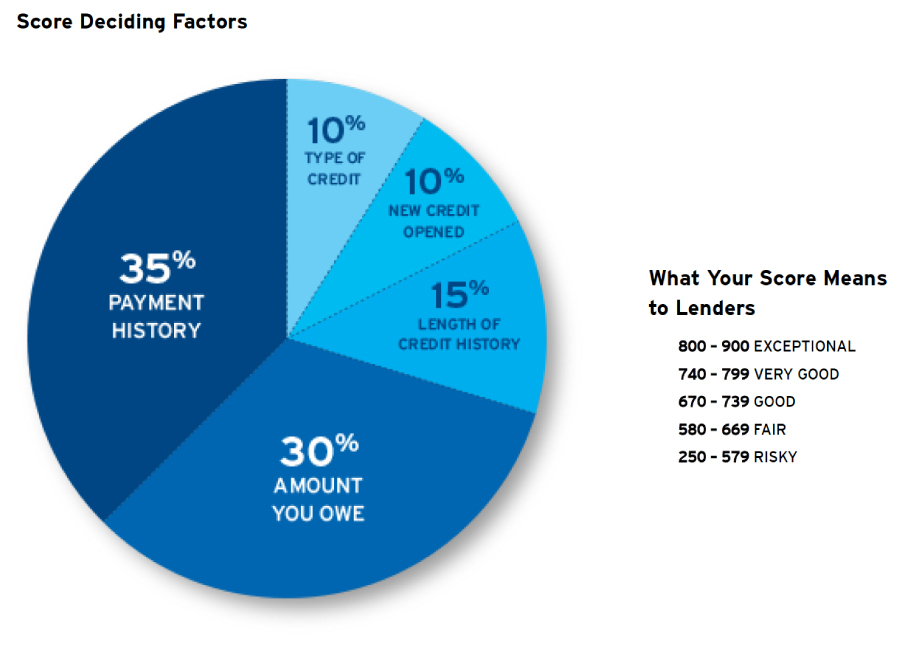

FICO scores take into account five factors:

1. Payment History (35%)

Your payment history makes up 35% of your FICO score and includes all information on past payments made on loans, credit cards, mortgages and other accounts.

2. Amounts Owed (30%)

This factor looks at how much money you owe compared to your available credit limit across all accounts.

3. Length of Credit History (15%)

The length of time you’ve been using credit contributes 15% to your overall FICO score.

4. Types of Credit Used (10%)

Having different types of accounts such as loans or lines of credits can impact this factor positively.

5. New Credit Inquiries (10%)

Whenever you apply for new lines or extensions of credits like mortgage applications or personal loans it may have some effect on your overall rating.

What Is A Good Credit Score?

Credit scores range from 300-850 with higher numbers indicating better financial health. Generally speaking, anything above 670 is considered good while anything below 580 could be problematic when seeking any sort lending agreement including car leases or rentals.

Why Do I Need A Good Score?

Having good credit opens doors to many financial opportunities including lower interest rates, higher credit limits on cards and the ability to secure loans for large expenses like a mortgage or car payment. Good credit can also help you save money in the long run as having a lower interest rate means less money paid over time.

How Can I Improve My Credit Score?

Improving your score takes time and effort but there are steps you can take:

1. Pay bills on time

2. Keep credit card balances low

3. Don’t close old accounts (unless necessary)

4. Limit new applications for credit

5. Monitor your score regularly

In conclusion, understanding your credit score is crucial to making smart financial decisions- it’s important to remember that building good habits takes time but is worth it in the end!

Leave a comment