Credit Scores: A Retrospective Look

In today’s society, credit scores have become an essential part of our financial lives. It is a three-digit number that summarizes our creditworthiness and determines whether we can get loans or credit cards, rent an apartment, or even get a job.

But what exactly are credit scores? How did they come to be? And how have they evolved over time?

The History of Credit Scores

The concept of credit scoring dates back to the early 1900s when department stores started offering their customers installment plans for purchases. To determine who was eligible for these payment plans, retailers would check their payment history and employment status before deciding whether to approve them.

However, it wasn’t until the 1950s that credit bureaus began collecting information on consumers’ borrowing habits from banks and other lenders. These records were then used to create a system that assigned a numerical value to each individual’s ability to repay debt – the first iteration of what we now know as the FICO score.

The FICO Score

Today, most lenders use FICO scores which range from 300-850. The higher your score, the better your chances of getting approved for loans with favorable terms and lower interest rates.

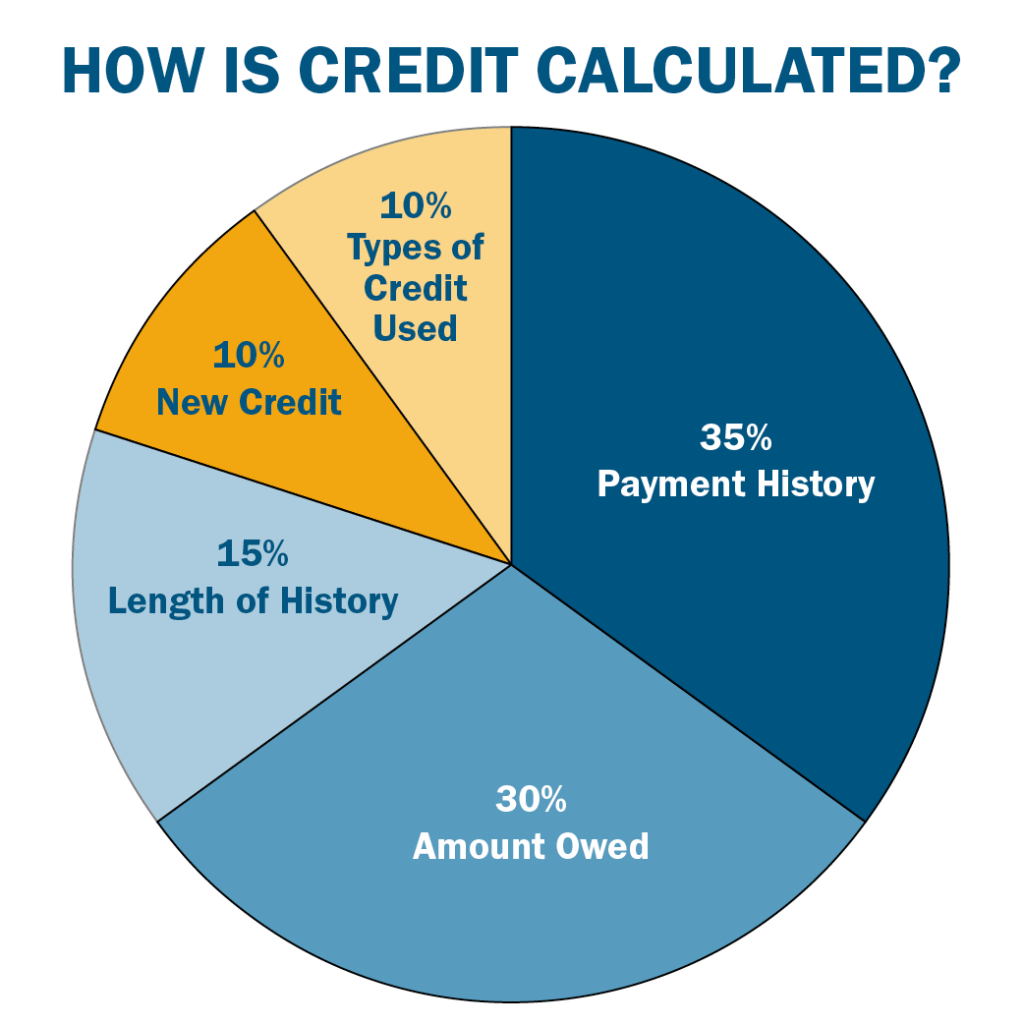

Your FICO score takes into account five factors:

1. Payment history (35%)

2. Amount owed (30%)

3. Length of credit history (15%)

4. New credit accounts (10%)

5. Types of accounts (10%)

Payment History

Payment history is one of the most important factors in determining your FICO score because it reflects how reliable you are at making payments on time every month. Late payments or missed payments will negatively affect your score.

Amount Owed

Amount owed refers to how much debt you currently have compared to your available credit limits across all your accounts such as loans and revolving lines like credits cards or home equity line-of-credit. This factor also takes into account your credit utilization ratio, which is the percentage of available credit you are currently using.

Length of Credit History

The length of your credit history refers to how long you’ve had a credit account in good standing. Generally, the longer your history, the better it is for your score.

New Credit Accounts

Opening too many new accounts or applying for multiple loans in a short period can negatively impact your FICO score. Lenders may see this as a sign that you are overextending yourself financially and may have trouble paying back debt.

Types of Accounts

Having different types of accounts such as installment loans (e.g., car loans) and revolving lines (e.g., credit cards) can positively impact your FICO score if managed well.

Evolution of Credit Scores

Since its inception, the FICO scoring model has undergone several changes to reflect changes in consumer behavior and lending practices. In 1989, FICO introduced its first version – which was based on data from Equifax – followed by versions two through four until we reached today’s version nine.

Additionally, there are other scores like VantageScore developed jointly by Experian TransUnion and Equifax that use similar but different criteria to evaluate borrowers’ financial health.

Furthermore, with evolving technology and data processing capabilities alongside rising concern about fairness across diverse groups including minorities, many fintech companies now offer alternative ways to evaluate consumers’ ability to pay their debts without relying solely on traditional measures like income or payment records alone.

Conclusion

Credit scores have come a long way since their early days when they were only used by department stores to determine who could qualify for an installment plan. Today’s lenders rely heavily on these three-digit numbers when determining whether someone qualifies for a loan or not.

It’s important for individuals to understand what factors go into calculating their scores so they can take steps towards improving them if needed. While the FICO model remains dominant, there are other alternatives that might serve some consumers better. Nevertheless, credit scoring will continue to play a significant role in the world of finance and banking for years to come.

Leave a comment