When it comes to investing, there are a variety of options available. Two popular choices are mutual funds and exchange-traded funds (ETFs). Both allow investors to diversify their portfolios by investing in a wide range of assets, such as stocks, bonds, and commodities.

But what exactly are mutual funds and ETFs? How do they work? And how can you decide which one is right for you? In this post, we’ll take a closer look at these investment vehicles.

Mutual Funds

A mutual fund is an investment vehicle that pools money from multiple investors to purchase securities such as stocks, bonds or other assets. The fund is managed by an investment professional who makes decisions on behalf of all the fund’s investors.

Investors pay fees to the fund manager in exchange for their expertise in selecting investments and managing the portfolio. These fees are generally referred to as expense ratios and can vary widely depending on the type of fund.

One advantage of mutual funds is that they offer diversification across many different companies or asset classes. This helps reduce risk because if one company or industry performs poorly, it won’t have as big an impact on your overall portfolio.

Another advantage of mutual funds is that they’re easy to buy and sell. You can purchase shares directly from the fund company or through a brokerage account like any other stock.

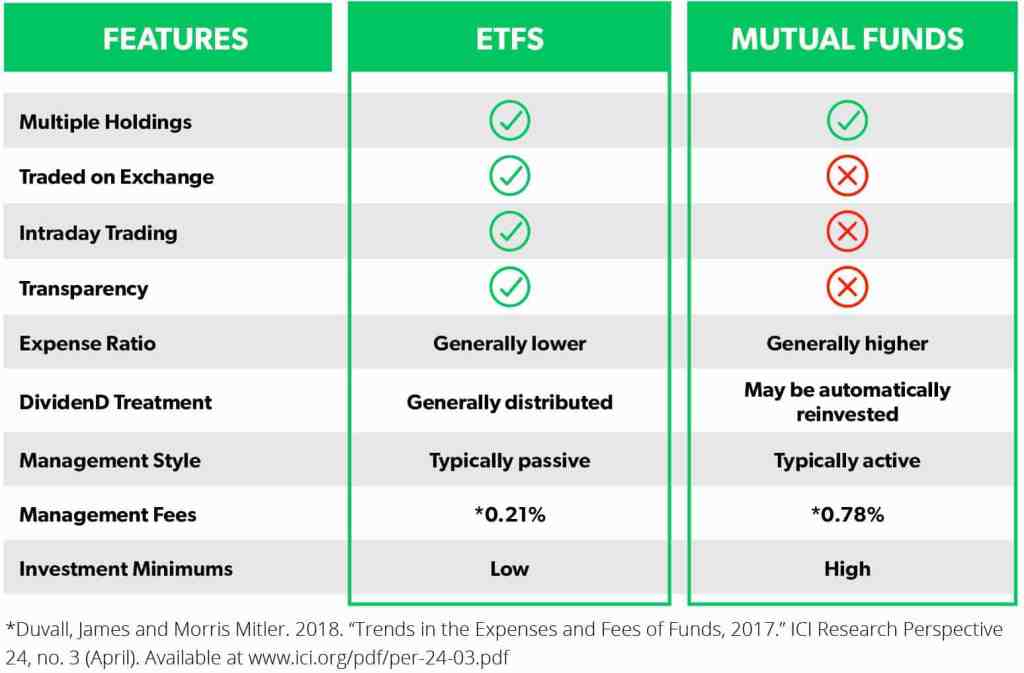

However, there are also some drawbacks to mutual funds. One downside is that they often carry high fees compared to other types of investments like ETFs. Additionally, since they’re actively managed by a professional investor who selects individual securities for the portfolio based on his/her judgment about future performance rather than following an index strategy; this could lead to higher costs due to trading expenses incurred during buying/selling those securities frequently.

Exchange-Traded Funds (ETFs)

An exchange-traded fund (ETF) is similar to a mutual fund in that it allows investors access to various asset classes without having to purchase individual securities. However, there are some key differences between the two.

First, ETFs typically have lower fees compared to mutual funds because they’re passively managed and simply replicate an index like the S&P 500 or Dow Jones Industrial Average. This means that instead of paying a professional fund manager to make investment decisions for you, you pay a lower fee for a computer program that follows the market.

Another advantage of ETFs is that they trade like stocks throughout the day on stock exchanges. This means that investors can buy and sell shares at any time during trading hours rather than waiting until the end of the day (like with mutual funds).

However, one disadvantage of ETFs is that they may not offer as much diversification as mutual funds since many focus on a specific sector or asset class. Additionally, if an investor wants to invest in more than one sector or asset class using only ETFs; he/she would need to purchase multiple ETFs which could lead to higher transaction costs.

Which One Is Right For You?

Deciding whether to invest in mutual funds or ETFs ultimately depends on your investment goals and personal preferences. If you’re looking for diversification across multiple companies and industries without having to do much research, then mutual funds might be right up your alley!

On the other hand, if you’re someone who likes taking control over their investments by investing in specific sectors or assets classes then perhaps ETF’s would be better suited for your needs.

That being said; it’s important not just look at fees alone when deciding between these two options but also consider factors such as risk tolerance level before making any final decisions about what type(s) of investments will work best given your unique circumstances.

Final Thoughts

Both mutual funds and ETFs offer investors diversified portfolios with exposure across various asset classes – each has its own benefits and drawbacks depending on what type(s) of investments suit your needs best. Ultimately it comes down to your personal preferences and investment goals.

Regardless of which option you choose, it’s important to do your research before making any decisions. It’s also a good idea to consult with a financial advisor who can help guide you towards the right choice based on your individual circumstances and risk tolerance level.

Leave a comment