Building Credit History as a Student/Young Adult: Tips and Guidelines

Credit history is an important aspect of personal finance. It’s a record of your past borrowing and repayment activities, which lenders use to determine your creditworthiness. A good credit score can open doors to financial opportunities, such as getting approved for loans or credit cards with better terms and lower interest rates. As a student or young adult, building credit history may not be at the top of your priority list but starting early can put you in a strong position in the future.

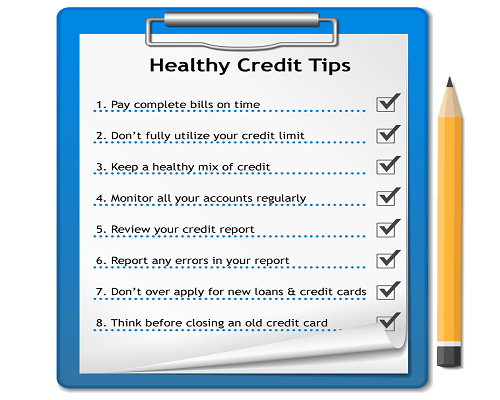

Here are some tips on how to build your credit history as a student or young adult:

1. Open a Credit Card Account

One way to start building your credit is by opening a credit card account under your name. However, this doesn’t mean that you should go out and apply for every card available just because you’re eligible for it.

Choose one that suits your lifestyle and spending habits, preferably one with no annual fees and low-interest rates (if possible). You can also look for cards that offer rewards programs like cashback or points towards travel expenses.

When using a credit card, make sure to pay off the balance in full each month before the due date to avoid paying interest charges while establishing good payment habits.

2. Get Added as an Authorized User

If you’re not yet ready to open up an account yourself but still want to start building your credit history, ask someone close – maybe parents or guardians if they would add you as an authorized user on their existing accounts.

Being added as an authorized user means that the primary account holder has granted permission for you to make purchases using their account without any legal responsibility of making payments back since it’s not technically yours. However, once they allow this privilege, both parties will have access and use rights over the same funds so communication about what’s being charged is key between all parties involved.

Make sure whoever adds you has excellent credit to ensure that the account’s good payment history will reflect positively on your credit.

3. Make Timely Payments

Your payment history is a significant factor in determining your credit score. Late or missed payments can negatively impact your score and stay on your record for up to seven years.

To avoid this, always make sure to pay bills or any money borrowed back on time or even earlier than expected if possible. Set up automatic payments so you don’t miss a due date but also be aware of the account balance so that enough funds are available when it’s time to withdraw.

4. Monitor Your Credit Report Regularly

It’s important to check your credit report regularly – ideally once every year- as mistakes and errors can occur which may negatively affect your score. These could include accounts opened without authorization, incorrect balances, late payments recorded erroneously, among others.

By checking regularly, you can catch these issues early and fix them before they cause significant damage to your score. There are many websites where you can access free copies of your credit reports like Annualcreditreport.com which offers one free report from each major bureau per year.

5. Keep Your Credit Utilization Low

Credit utilization refers to the amount of available credit you’ve used compared with the total limit granted by lenders (i.e., how much debt you have compared with how much debt you could have). It’s recommended that this number should not exceed 30% of total limits across all accounts since exceeding that threshold indicates over-reliance on borrowing money which might begin showing signs of financial instability.

A lower percentage utilization ratio reflects positively on someone’s ability and willingness to manage their finances responsibly – something creditors look out for when considering lending decisions in their favor.

6. Apply for Credit Responsibly

When applying for credits like loans or additional cards, be careful not to do too many at once as each application generates an inquiry into one’s current standing financially which shows up on reports and can indicate over-reliance. This will have a negative impact on your score.

It’s best to apply for credit only when needed, so don’t just open accounts impulsively or because you want the rewards offered without understanding all the terms and requirements upfront.

7. Be Patient

Building credit history takes time, especially if you’re starting from scratch. Don’t expect it to happen overnight but instead work on making consistent good choices that positively affect your score over time.

You can also try getting a loan with low-interest rates to help start building this credit history slowly while working towards paying off debts regularly rather than living beyond means or using more than necessary in one go unless absolutely required which could lead to financial challenges down the line.

8. Seek Professional Advice

If you find yourself struggling with debt, payments or any other financial issues, consider seeking professional advice from accountants, financial planners or even consumer protection centers that offer free counseling. They may be able to provide guidance on how best to handle situations like these as well as tips for managing finances better in general.

In conclusion,

Building credit history is an essential part of personal finance management for students and young adults alike – it helps establish trustworthiness among creditors who make lending decisions based on these records showing responsible borrowing habits over time through things like timely repayments etc..

To build a solid foundation of good credit standing requires discipline over spending habits coupled with regular checks for errors in reports which could negatively impact scores significantly if not corrected early before they become too large enough problems later down the road- So stay proactive!

Leave a comment